“In the wake of the market collapse due to multiple [U.S. Federal Reserve interest] rate hikes, and the downfall of bad actors such as Three Arrows Capital, Celsius Network and Terra, risk management comes to the forefront of crypto, particularly in the credit markets,” Camas said.

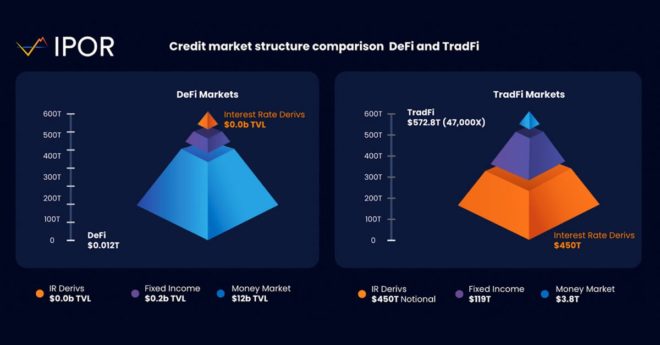

IPOR Labs Unveils Protocol to Make DeFi Credit Markets More Transparent and Stable