Pension funds are in a perpetual crisis worldwide, with low demographic rates in many countries foreshadowing a dim future for such investments, combined with young people’s lack of faith in the continued existence of social security models.

In order to stay afloat, many pension funds have strived to remain apprised of new investment opportunities, including cryptocurrencies. According to a 2022 study published by the CFA Institute, “94% of state and government-sponsored pension funds are invested in one or more cryptocurrencies.”

But pension fund interest in volatile cryptocurrencies has not come without consequences.

In April 2023, Ontario Teachers’ Pension Plan (OTPP) backed off from investing in the cryptocurrency sector after losing $95 million on its stake in FTX. The failure of OTPP may have discouraged other pension plans from getting close to crypto or other emerging assets and technologies for their investment plans.

Artificial intelligence (AI) and digital assets share a similar hype.

For better or for worse, this relationship could affect them. Cryptocurrencies offer a wide versatility, although mainstream investors may categorize them as vulgar speculative assets. AI, the new kid on the block, could offer many more use cases.

AI is not something that investors can avoid or escape, so is it safe for pension funds to adopt?

Pension funds worldwide are in jeopardy

According to the “Mercer CFA Institute Global Pension Index 2023” report, numerous countries’ pension systems have “major risks and/or shortcomings that should be addressed,” with the United States being one of them.

Many others, such as Argentina, are in real danger. Without improvements, “the efficacy and sustainability [of the pension system] are in doubt” in these countries.

Only a handful of countries, with the Netherlands taking the lead, have a “robust” and “sustainable” retirement system.

Pension funds need to avoid putting “at risk the well-being of current and future pensioners,” as stated in the 2022 “Pensions Outlook” of the Organization for Economic Cooperation and Development (OECD).

Systematic inflation isn’t helping, but the main problem future pensions will face is record-low birth rates, a phenomenon known as the “graying” of society.

This issue is primarily occurring in developed countries. For example, Japan has seen its birth rate drop to 1.25, the U.S. is currently at 1.66, and almost all European countries are breaking records, such as Italy’s rate of 1.22. A birthrate of 2.07 is generally considered necessary to maintain a stable population.

The unavoidable demographic crisis is coming, meaning new creative solutions are required for pension funds to survive. So, what about AI?

AI for investment strategies

The idea of using emerging tech such as AI for decision-making in investments shouldn’t scare people away.

Since the 1980s, programmable trading has been widely applied, with high-frequency trading changing the rules of the game.

Recent: Bitcoin maxis vs. multichains: Two opposing visions of crypto’s future

As the Mercer report notes, “Algorithmic trading now facilitates automatic trading across all asset classes and market segments.” Per the report, 60% to 73% of all U.S. equity trading in 2018 used this automated trading technique.

Pension funds could use AI tools for many different use cases, particularly to cut costs to be more cost-efficient.

The report mentions the many options AI could offer pension funds. Among them are:

- A deeper analysis of their clients’ behaviors by scraping data. This could offer optimal financial personalized products, helping against fraud along with other options.

- Double-checking the reliability of environmental, social and governance (ESG) stocks.

- Automatically narrow the differentials between passive and active investment strategies.

- Identify patterns and discover market sentiment and signals to suggest unconventional future investment opportunities.

David Knox, senior partner at Mercer and lead author of the report, pointed out the juicy possibility of pensions being able to gather higher investment returns thanks to AI:

“The ongoing expansion of AI within the operations and decisions of investment managers should lead to more efficient and better-informed decisionmaking processes, producing higher real investment returns for pension plan members.”

AI represents an ideal tool for aiding investors in making better decisions. The dilemma is whether AI could manage 100% of the decision-making, as algorithmic trading is automated nowadays.

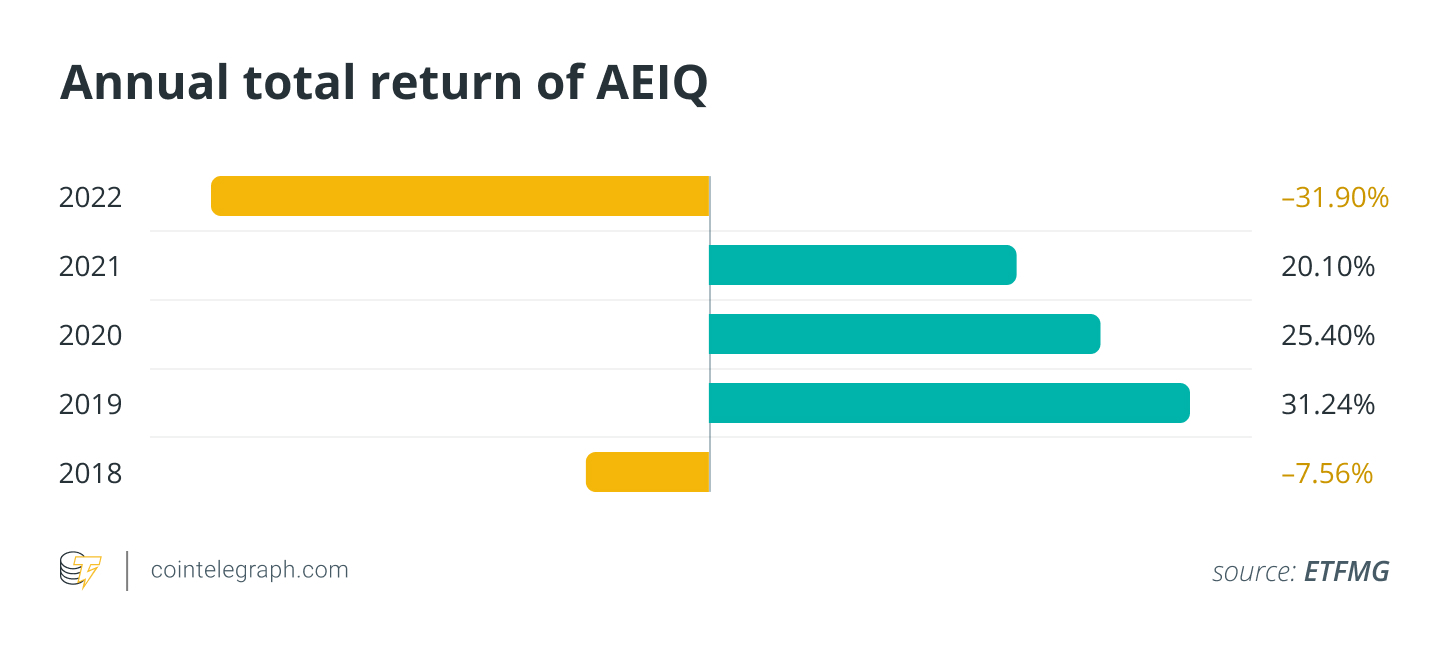

Fortunately, there is a practical example worth considering. The AI Powered Equity ETF (AIEQ) uses the AI computer system IBM Watson, which aims to match “a team of 1,000 research analysts, traders and quants working around the clock.” AIEQ has $106 million in assets under management as of Dec. 1.

For now, the historical data of the AI-driven fund has offered mixed results.

Given this data, pension funds may not be fully confident in using AI for their investment strategies, as they tend to have a more conservative approach.

This year, AEIQ has fallen into the trap of overinvesting in tech stocks. This common mistake has left investors questioning the effectiveness of AI technology in investing.

Despite the criticism from its human competitors, investors should keep in mind that AI technology is only as good as the data it is fed. Even with the outstanding advancements in recent years, this technology may not be sophisticated enough to be fully automated, just yet.

The growing pains of generative AI

The hype around artificial intelligence is driven by generative AI, the technology that powers ChatGPT.

Juan Calvo, senior data engineer/prompt engineer at AI consultancy firm Datatonic, told Cointelegraph that “while there is hype, it’s based on a wave that is here to stay.”

A 2023 Goldman Sachs report stated that if generative AI reaches widespread usage, it could boost global labor productivity by more than one percentage point a year in the next decade.

Achieving that will require a $200 billion investment globally by 2025. Google’s $2 billion investment in AI firm Anthropic earlier this year is one element of this global backing.

Markets may have to wait or learn to understand how artificial intelligence makes certain decisions. According to Ryan Pannell, chairman of the investment firm Kaiju Worldwide, which manages $600 million in assets and uses AI in its investment process:

“Artificial intelligence looks for patterns. […] So it’s not going to make thematic or fundamental research-based trading decisions the way that we think of those terms when they are decisions being made by humans.”

For example, AI could identify when a company is oversold based on patterns of mean reversion. A human could decide if a company is oversold based on earnings reports.

So, given its young age, is generative AI reliable for prediction and investment strategies at this point in time? Calvo explained:

“Large language models (LLMs) are reliable for specific questions and tasks, but they may produce incorrect or nonsensical information (hallucinate) if the task is complex. We currently address this by creating data platforms and applications where the core is an LLM. […] This enables these models to interact with a specific environment relevant to their responsibilities and goals, effectively solving complex problems with both effectiveness and accuracy.”

Calvo specified that generative AI “serves as an everyday tool rather than an autonomous entity.”

The future of pension funds and AI

The use of AI for pension fund investment strategy has been studied by the Japanese Government Pension Investment Fund (GPIF), the world’s largest pool of retirement savings.

The study found many advantages of using AI, but with a caveat:

“Widespread adoption of AI by asset management companies may lead to a Nash equilibrium in an N-player game via the market.”

GPIF simulated several investment approaches using AI and learned that the strategies would “asymptotically degenerate to index investments.”

The study reported that once a fund uses this technology with positive results, the race for first-mover advantage will be on.

Magazine: Real AI use cases in crypto: Crypto-based AI markets, and AI financial analysis

It’s hard to foresee what uses AI will be put to, so younger people may not want to invest a lot of time and energy on a matter that will take years to affect them. This might also be the reason the focus on and uses of AI in the pension system might have received less focus than it perhaps deserves, but this may change shortly.

Felix Mantz, director of investment management firm Cardano — which supports pension schemes with aggregated assets of over $490 billion — told Cointelegraph:

“Right now, younger taxpayers mainly fund pay-as-you-go state pensions. If we end up in a future where AI-driven companies and robots do all the work and all humans receive a universal income, the pension challenge disappears. However, if we end up in a future of AI relationships, the natality problem could increase!”

One way or the other, AI is a ticking time bomb. As society moves forward in using technology in education and enhancing personal skills, habits change, including investing and planning for the future.