Here’s what the “Altseason Indicator” from the on-chain analytics firm Glassnode says regarding if an Altcoin season is currently going on or not.

What Altseason Indicator Says Regarding The Altcoin Season

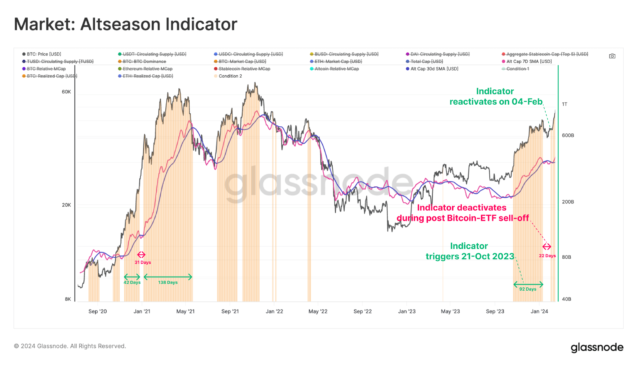

In its latest weekly report, Glassnode has discussed what the Altcoin season status for the cryptocurrency market has looked like recently. To check whether the “altseason” is on, the analytics firm has devised its Altseason Indicator.

This metric judges if the investors are in a risk-on mode based on how capital rotations are occurring in the sector. There are two conditions the indicator checks for.

First, the Altseason Indicator looks at the capital netflows involving the three major asset classes in the sector: Bitcoin (BTC), Ethereum (ETH), and stablecoins.

For the former two assets, netflows are gauged using their “realized caps.” The realized cap is a capitalization model that calculates any asset’s total valuation by assuming that the real value of any token in circulation is the price at which it was last moved rather than the current spot price.

The last transfer for any coin was likely the last point at which it changed hands, so the price at the time of that transaction would be its current cost basis. As such, the realized cap sums up the cost basis of every holder in the sector.

Put another way, the realized cap measures the actual amount of capital the investors have put into the asset. Thus, changes in the metric would reflect the amount of capital flowing into or out of the asset.

For the stablecoins, net flows can be judged based on the supply or market cap alone, as the stables’ value remains tied to $1 at every point, so the magnitude of the market cap and realizes cap would be equal (both of these would also equal the supply, except for the unit).

For the Altcoin Season to be active, all three asset classes should have positive netflows. This is because capital generally enters the cryptocurrency sector through these coins and only then rotates into altcoins as investors’ appetite for risk rises.

The other condition the Altseason Indicator checks for is the momentum in the altcoin market cap itself. In particular, the metric confirms whether or not the altcoin market cap is currently over its 30-day simple moving average (SMA).

The data of the Altseason Indicator over the past few years | Source: Glassnode's The Week Onchain - Week 8, 2024

The chart shows that the Altseason Indicator first started flashing the risk-on signal in October of last year. However, the signal turned off when the market cooled off following the launch of the Bitcoin spot ETFs.

After staying off for 22 days this month, though, the Altseason Indicator seems to have been saying that the Altcoin season is back on.

BTC Price

At the time of writing, Bitcoin is trading around the $50,900 level, down 1% in the past week.

Looks like the price of the asset has gone down over the past day | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.