Arbitrum (ARB), a Layer-2 scaling solution for Ethereum, has been on an eventful journey, with its promise of enhanced scalability and efficiency facing continuous scrutiny.

Recent downtime incidents and declining metrics have raised concerns among investors and users, challenging the network’s resilience.

This kind of downtime raises concerns about the network’s stability and the potential impact on users and DeFi protocols running on the platform.

Traders and investors, already cautious about the rapidly evolving cryptocurrency landscape, may need more time to engage with a network facing repeated disruptions.

ARB Incident Raises Eyebrows

A notable incident was reported via Twitter, where Arbitrum seemingly experienced a block production halt for approximately 15 minutes. The information surfaced through the Arbitrum scanner, but the exact cause of the disruption remained unclear. It was uncertain whether the issue originated from the scanner itself or if the network had indeed stopped producing blocks during that time.

looks like Arbitrum was down for ~15min a little bit ago?

or arbiscan rugging again idk pic.twitter.com/h1evcO6wIP

— Spreek (@spreekaway) July 25, 2023

This occurrence was not an isolated event for Arbitrum, as it had previously faced outages, including one in January that prompted a public statement from Offchain Labs, the team behind the development of Arbitrum.

Challenges In Metrics And TVL

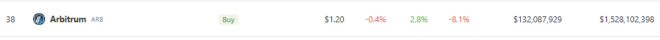

In addition to the downtime concerns, Arbitrum has been experiencing declining metrics and a recent slump in its token price. As per CoinGecko, the cost of ARB stood at $1.20, with a 24-hour rally of 2.8%. However, over the last seven days, the token declined 8.1%, reflecting the uncertainty and hesitancy among investors following the downtime incidents.

Source: Coingecko

Another crucial metric, the Total Value Locked (TVL) on Arbitrum, experienced a slight decline over the past few weeks. While it managed to stay above the significant threshold of $2 billion, the overall value has decreased.

At the time of writing, the TVL was approximately $2.10 billion, which indicates that some users may have withdrawn their assets from the platform or opted for other alternatives amidst the recent concerns.

As of today, the market cap of cryptocurrencies stood at $1.1 trillion. Chart: TradingView.com

Insights And Future Outlook

Arbitrum’s journey has been a roller-coaster ride, with ups and downs testing its capabilities and investor confidence. The recent downtime incidents highlight the challenges faced by layer 2 solutions as they work towards improving Ethereum’s scalability and user experience.

Moving forward, the team at Offchain Labs and the broader community have promised to address these concerns head-on. Moreover, continuous efforts to improve the platform’s stability, security, and performance will be paramount to ensure that Arbitrum can fulfill its promise of being a reliable and scalable solution for Ethereum.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from ZebPay