Bitcoin (BTC) is still in a bullish reversal when looking at this year’s price chart. The BTC price has gained 70% after bottoming out at around $16,800 in November 2022, defying rate hike fears while riding on growing exchange-traded fund approval optimism.

However, in recent months, Bitcoin bulls have failed to sustain the BTC price above $30,000. Therefore, with the “bullish” halving still over 200 days away, many traders wonder if the Bitcoin price will crash again in the coming months.

Cointelegraph looks at the possible scenarios as Q3 draws to a close.

Fibonacci fractal hints at Bitcoin crash to $21,500

From a technical standpoint, the Bitcoin price has stabilized around the 0.236 Fib line of its Fibonacci retracement graph drawn from the $69,000 swing high (the market top) to the $15,900 swing low (the local market bottom).

This flat BTC price action looks very similar to the one witnessed during the 2018 BTC price correction.

In 2018, the BTC/USD pair stabilized around its 0.236 Fib line at around $6,790 for months before dropping toward $3,000 in December. The $3,000 level coincided with what is now multiyear ascending trendline support (marked as bear market support in the chart above).

Bitcoin is now halfway repeating 2018 already with price flatlining at the 0.236 Fib line. A breakdown from this level means BTC price will see $21,500 as the next major support level, down 17.75% from current levels.

Strong dollar adds to Bitcoin’s downside risks

Meanwhile, the U.S. Dollar Index (DXY), which measures the greenback’s strength against a pool of top foreign currencies, has reached its highest level since November 2022.

The index has been negatively correlated with Bitcoin throughout 2023, as shown below.

The dollar’s advance has accelerated after the United States Federal Reserve’s rate decision on Sept. 20, and the DXY is currently painting its 11th consecutive green weekly candle.

In other words, Bitcoin’s upside prospects could be limited if the dollar continues to climb following the DXY golden cross.

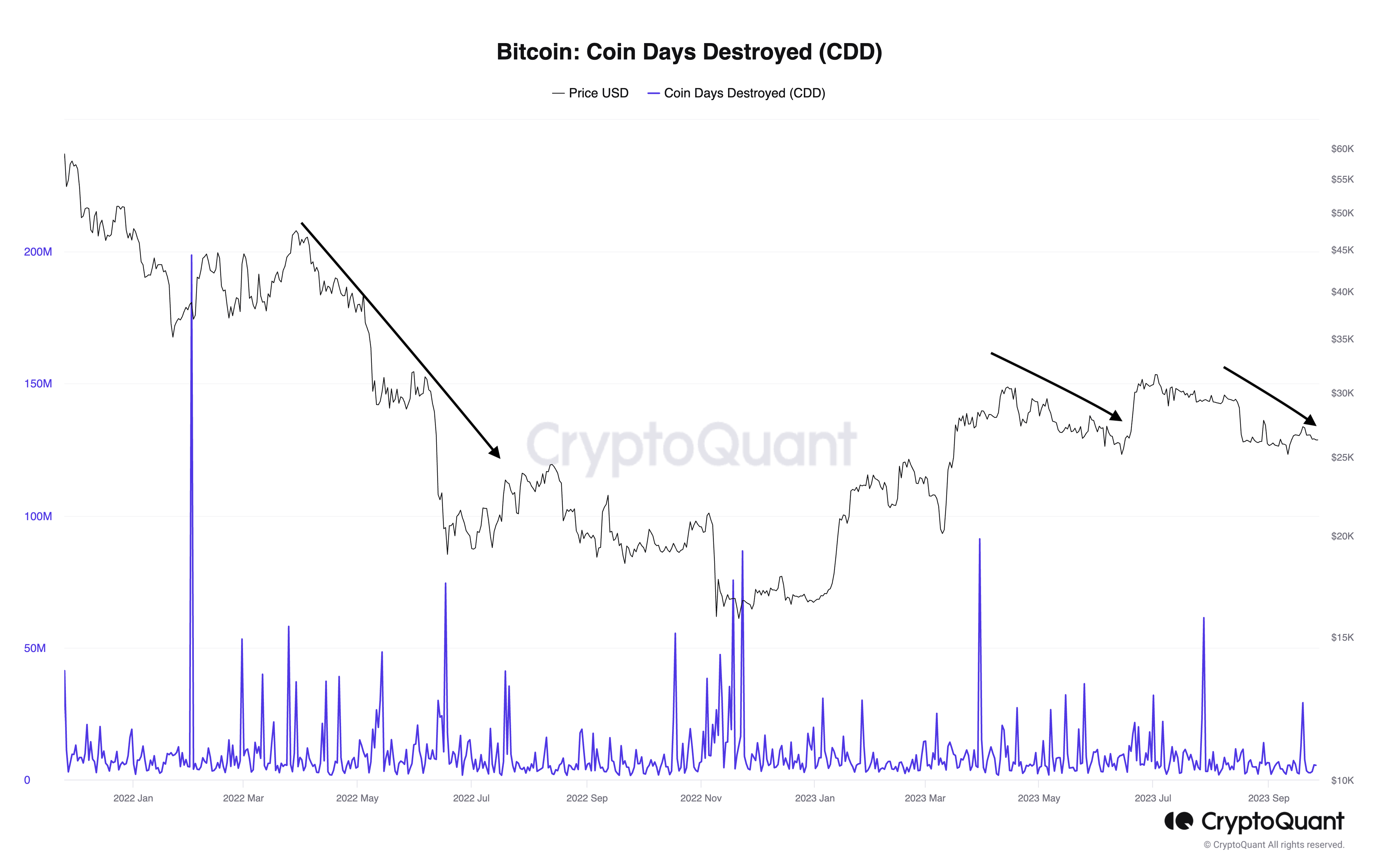

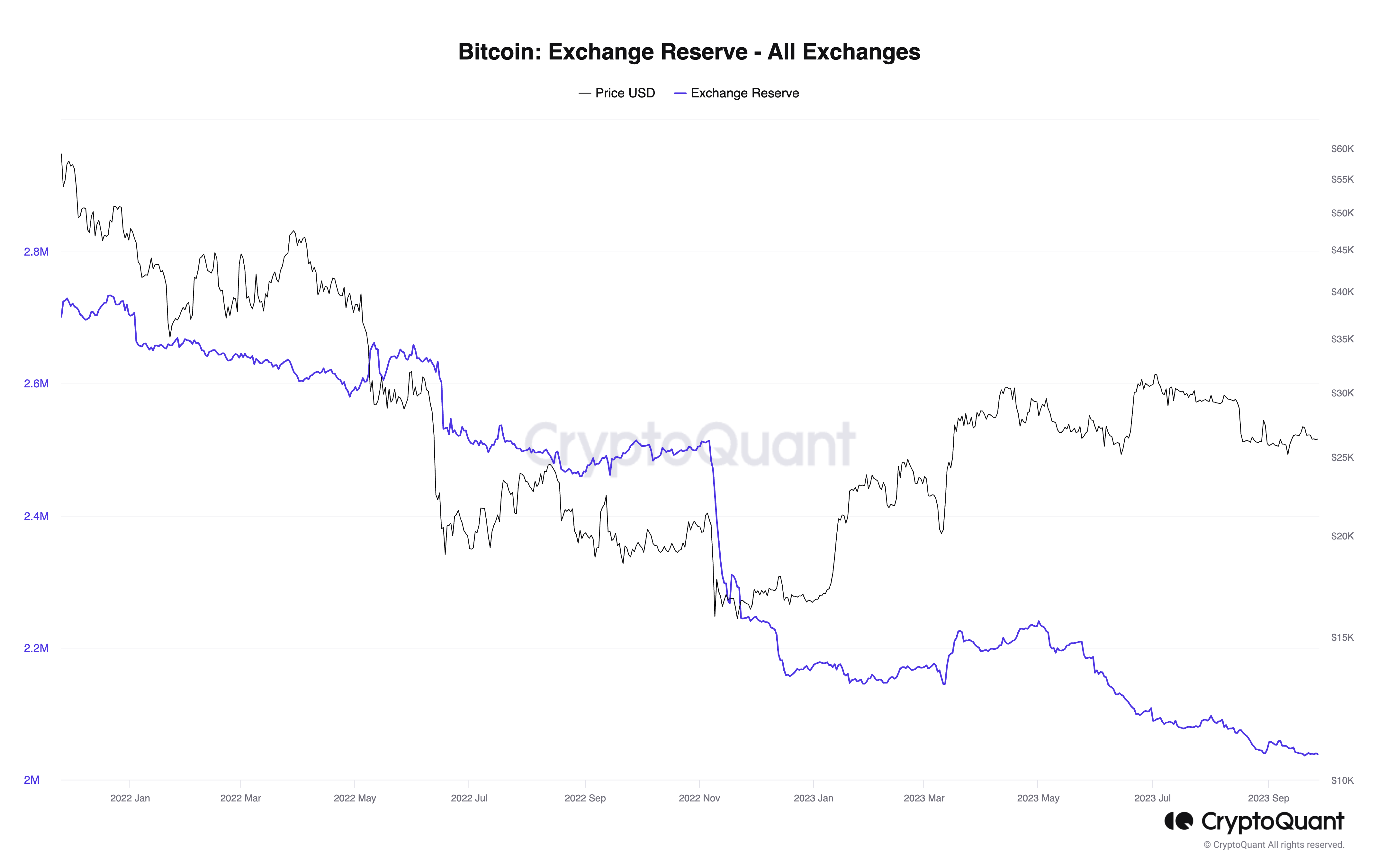

“Old” Bitcoin being sold?

Bitcoin’s on-chain metrics are painting a mixed outlook.

Bitcoin’s coin days destroyed (CDD) metric, measuring long-term investors’ actions, spiked on Sept. 19, indicating that some long-term BTC holders moved their coins, suggesting possible profit-taking or repositioning.

Traders should take caution here as most CDD spikes have historically preceded price declines.

On the other hand, Bitcoin reserves across all crypto exchanges continue declining, which hints at increasing hodling behavior among investors.

What Bitcoin trading analysts are saying

Bitcoin analysts are also divided over where BTC price may be headed in the months ahead.

Popular trader Skew argues that the BTC price can hit $30,000 by October, citing thin ask liquidity near $27,000, possibly leading to a breakout.

Related: Bitcoin fails to recoup post-Fed losses as $20K BTC price returns to radar

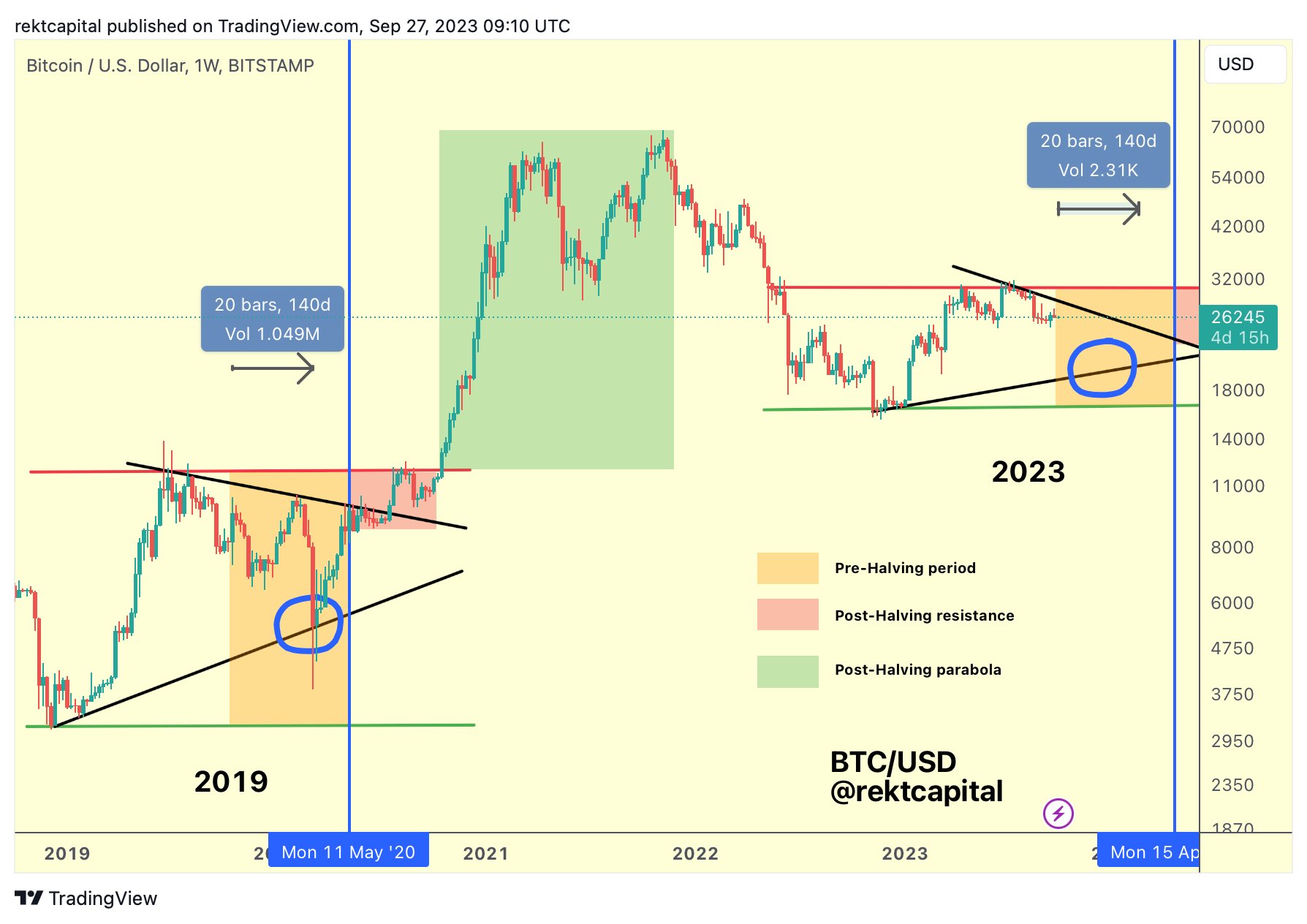

Fellow analyst Rekt Capital, however, doesn’t rule out a price correction toward $18,000 based on a pre-halving fractal shown below.

“History suggests that the next 140 days will be crucial for dollar-cost-averaging in preparation for the Post-Halving parabolic rally,” said Rekt Capital, adding:

“If Bitcoin is going to retrace from [the current price levels], it will most likely be during this current 140 day period.“

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.