On-chain data shows Ethereum whales have sold around 12 million in the cryptocurrency within the past year and have shown no signs of slowing down.

Ethereum Whale Holdings Have Been In Constant Downtrend Since 2020

In a new post on X, analyst James V. Straten has discussed how the Bitcoin and Ethereum whales have shown some stark contrast in their behavior.

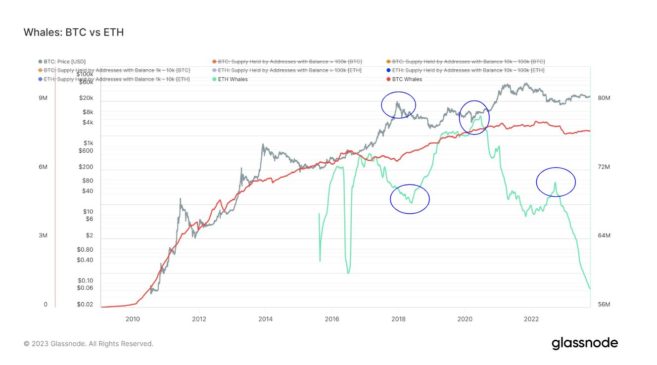

Here is the chart that the analyst has shared, which compares the trends in the holdings of these humongous holders for the two assets over their entire history:

How the holdings of the whales differ between the two cryptocurrencies | Source: @jimmyvs24 on X

For defining what a “whale” is, the analyst has chosen the 1,000 tokens cutoff for both assets. The graph shows that the holdings of the Bitcoin whales have been in an overall uptrend throughout the asset’s history.

Some deviations have been from this upward trajectory, like during the 2021 bull run, where these investors participated in some profit-taking. However, such deviations have only been temporary as the whales have eventually resumed their accumulation.

However, a deviation that is yet to be reversed fully is the drawdown observed around the FTX collapse in November 2022. Nonetheless, the whales have participated in some accumulation since the start of the year; more is needed to retrace the aforementioned plunge.

The Bitcoin whales have seen their holdings move sideways in the past couple of years. The Ethereum whales, on the other hand, have participated in a steep selloff during the same period.

Since 2020, these holders have shed 20 million ETH from their combined holdings, worth about $31.6 billion at the current exchange rate. In the past year alone, they have sold about 12 million ETH ($18.9 billion), an astonishing figure.

As highlighted in the graph, the Ethereum whales showed a temporary deviation phase when they bought at the bear market lows. Nevertheless, this accumulation was quickly reversed as the indicator resumed a sharp plunge soon after.

Something worth noting here is that the size of the whales isn’t the same between the two assets. Due to the difference in the prices of the coins, 1,000 tokens of each have vastly different weightages. Based on this cutoff, Bitcoin whales would hold at least $27.4 million worth of the asset, while the ETH whales hold just $1.58 million.

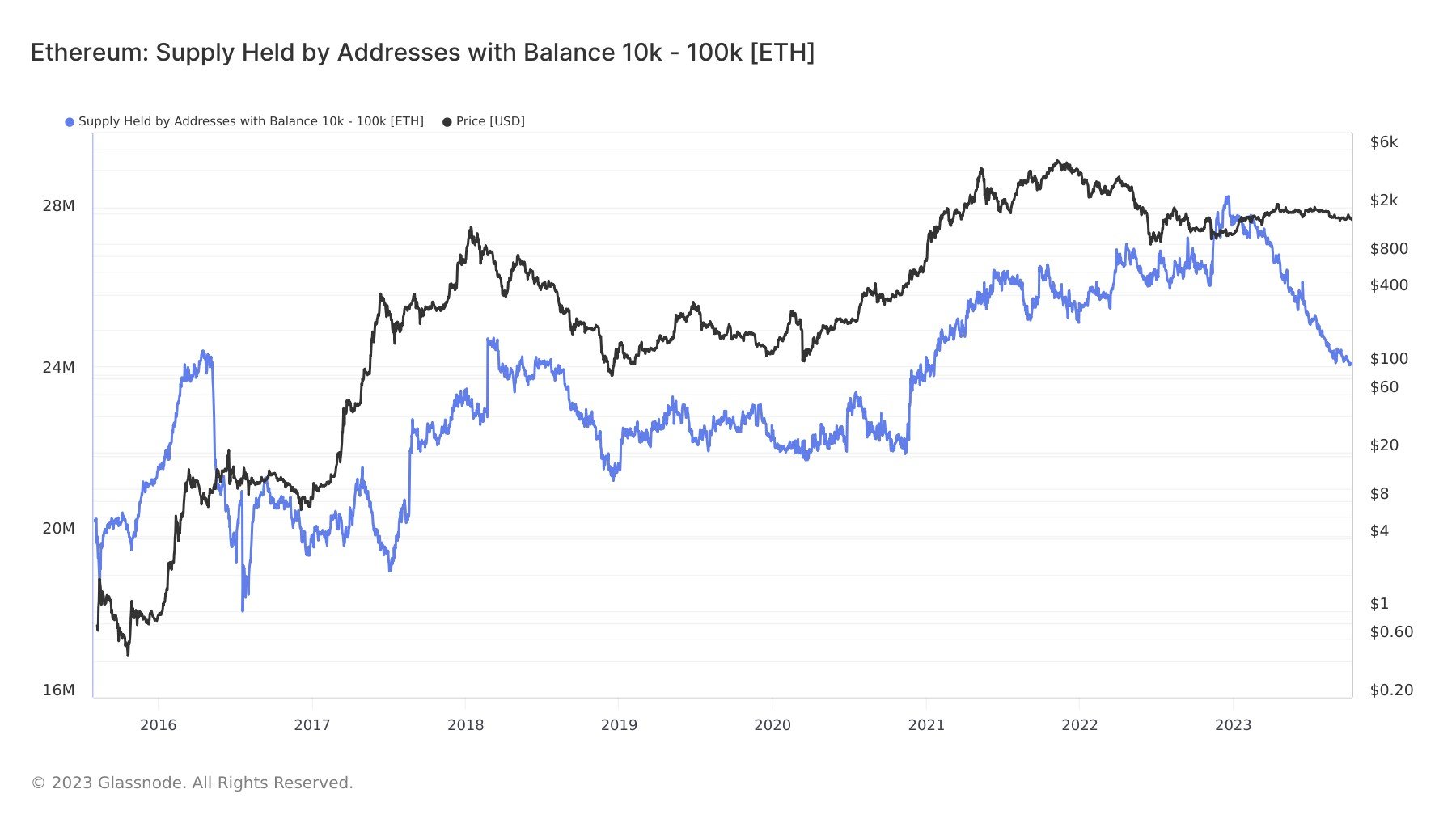

A more fair comparison may be made by looking at the holdings of the ETH entities of comparable size to the BTC whales. As displayed in the chart below, the Ethereum whales with between 10,000 to 100,000 ETH ($15.8 million to $158 million) have shown accumulation over the years. Still, this cohort has also sold massive amounts this year.

Looks like the value of the metric has sharply declined recently | Source: @jimmyvs24 on X

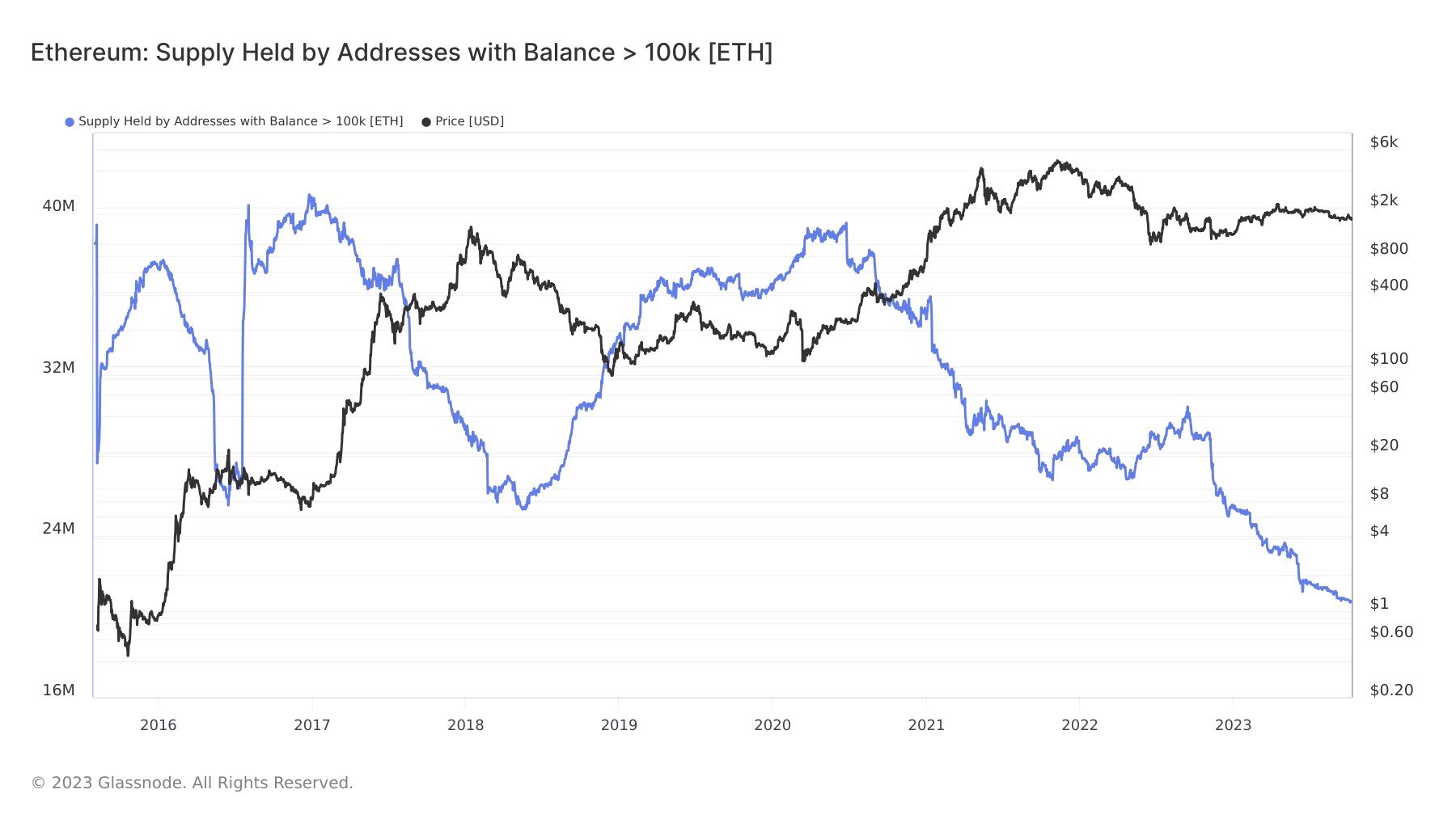

However, the mega whales on the network ($158 million+) have shown behavior more in line with the aggregate 1,000+ ETH group, as they have distributed heavily since 2020.

These whales have been selling for a few years now | Source: @jimmyvs24 on X

Ethereum’s situation looks bleak, at least in terms of the holdings of the whales. The fact that these humongous holders have shown no signs of a turnaround so far may be the most concerning, as they lack interest in accumulating the asset. This differs greatly from the sentiment around the Bitcoin whales, who have been participating in net buying this year.

ETH Price

Ethereum has registered some decline recently, as the coin’s price is now retesting the same lows as back in August.

ETH has been moving sideways over the past couple of months | Source: ETHUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, Glassnode.com