Bitcoin, the largest cryptocurrency by market cap appears to have “bottomed out” and is now poised to surge above $150,000, according to prominent crypto analyst Captain Faibik.

This insight from the analyst comes as Bitcoin currently sees a sign of rebound, reclaiming the $60,000 mark following its recent plunge below $59,000.

A $150,000 Surge On The Horizon

In his recent post on X, Captain Faibik disclosed a distinct pattern known as the Descending Broadening Wedge found on the BTC chart. This technical pattern typically indicates bullish potential, suggesting that an upward breakout is highly probable after a period of price declines and increasing volatility.

Faibik elaborates that we are currently in what he describes as the “Accumulation phase,” which historically precedes significant bullish rallies.

This phase is characterized by investors purchasing the asset at lower prices, gearing up for anticipated future gains. The sentiment is supported by the severe price drops in altcoins, with a 60-70% decline since March 2024.

Since the March 2024 high, the Markets have been moving in a Descending Broadening Wedge Pattern.

We are currently in the Accumulation phase, just before the Next Massive Bullish Rally.

Most altcoins are down 60-70% since the March high, and I know Altcoin holders are… pic.twitter.com/ttWsBwMbOJ

— Captain Faibik (@CryptoFaibik) August 11, 2024

Captain Faibik is optimistic about Bitcoin’s price trajectory, drawing parallels to previous cycles. He recalls the period around August-September 2023 when BTC traded between $17,000 and $18,000. According to Faibik, those who heeded his advice to buy during that time saw Bitcoin’s value soar to $74,000.

Revealing the current outlook, Faibik noted:

Now, I’m telling you again to Accumulate. Bitcoin will likely surpass $150k this time. Keep accumulating the dips and Building your Portfolio for the 2024-25 bullrun.

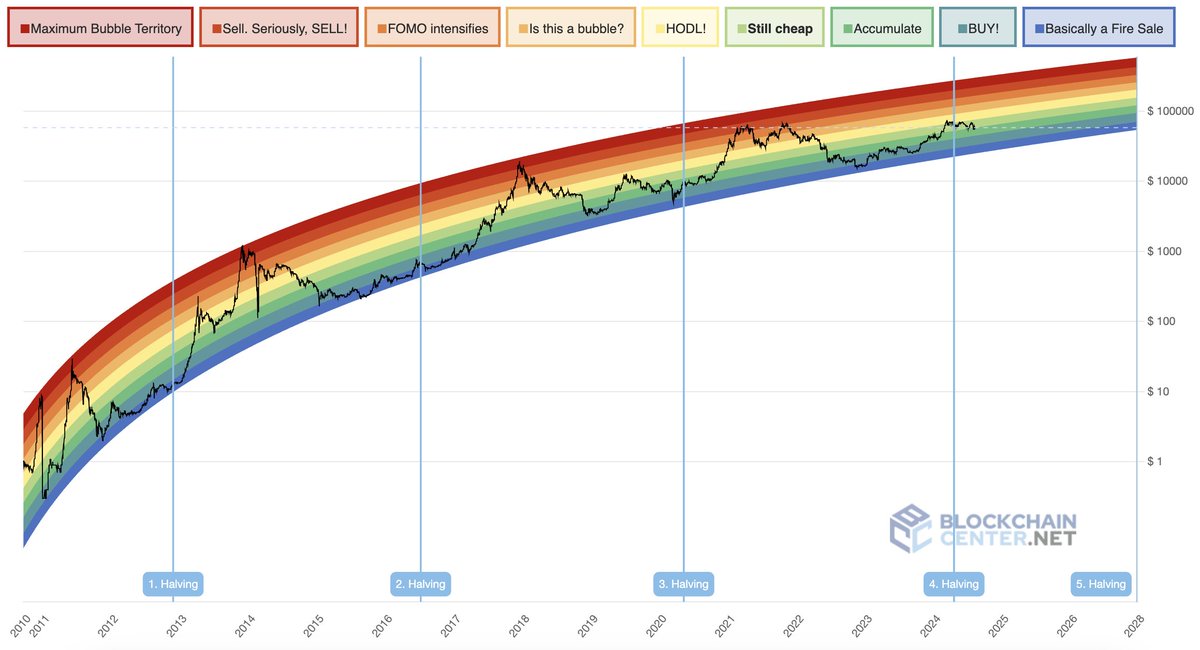

Bitcoin Rainbow Chart Outlook

Echoing Fabric’s analysis, another analyst, Lark Davis, points to the Bitcoin Rainbow chart, which currently shows Bitcoin in the “accumulation zone.”

Based on historical data, investors use this tool to gauge market sentiment and potential price movements. According to Davis, if BTC reaches the “FOMO Intensifies” zone, as it did in the last cycle, it could skyrocket to between $150,000 and $190,000.

Davis advises investors to consider accumulating BTC during these dips, suggesting that we are in an optimal phase for building positions in anticipation of the next market surge.

The Bitcoin Rainbow chart shows that $BTC is currently in the accumulation zone.

Last cycle, we topped in the “FOMO Intensifies” zone.

If we reach that zone this cycle, $BTC could go anywhere between $150K–$190K.

Where do you think we top this cycle? pic.twitter.com/STuOwmoN68

— Lark Davis (@TheCryptoLark) August 12, 2024

Featured image created with DALL-E, Chart from TradingView