At yesterday’s hearing, she was asking the deputy treasurer questions about if a validator is in Iran, somehow that means Iran is making millions of dollars. Now, you and I and everybody reading this knows that a validator could be anywhere. It could be in Iran, it could be anywhere else in the world. That’s what’s a decentralized distributed ledger system is. But a validator doesn’t get cash. If anything, a validator could get paid in the native asset of the network, whether it’s Bitcoin or Ethereum, but then you have to have an off-ramp. And the off-ramps and on-ramps are the exchanges, and they already comply with AML/KYC.

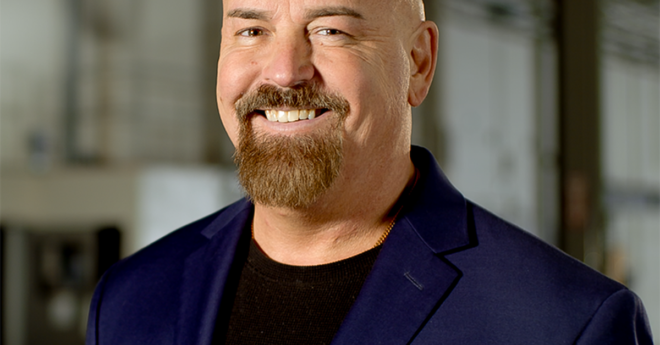

John Deaton on his Senate Race With Elizabeth Warren