Stablecoins emerged as a topic during JPMorgan Chase’s fourth-quarter earnings call on Tuesday, with executives expressing support for blockchain technology while warning that certain stablecoin designs could threaten the regulated banking system.

The comments came in response to a question from Evercore analyst Glenn Schorr, who asked about stablecoins in light of recent industry lobbying by the American Bankers Association and ongoing congressional markups related to digital asset legislation.

Responding to the question, JPMorgan chief financial officer Jeremy Barnum said the bank’s position aligns with the intent of the GENIUS Act, which seeks to establish guardrails around stablecoin issuance.

Barnum warned against the use of interest-bearing stablecoins that replicate traditional banking without the equivalent oversight.

“The creation of a parallel banking system that sort of has all the features of banking, including something that looks a lot like a deposit that pays interest, without the associated prudential safeguards that have been developed over hundreds of years of bank regulation, is an obviously dangerous and undesirable thing,” he said.

Barnum added that while JPMorgan welcomes competition and innovation, it remains firmly opposed to the emergence of a parallel banking system operating outside established regulatory protections.

As Cointelegraph reported last May, the US banking lobby views yield-bearing stablecoins as a major disruption to its business model, with one industry insider describing the response as a full-blown “panic.” The concern is not without merit.

Stablecoins have grown rapidly as tools for payments, onchain settlement and dollar access, offering faster transactions and lower costs. The prospect of yield-bearing versions only sharpens the threat, particularly as banks continue to offer depositors relatively modest interest rates.

Related: Wall Street’s crypto debate is over as banks go all-in on BTC, stablecoins, tokenized cash

Stablecoin rewards draw scrutiny in Congress

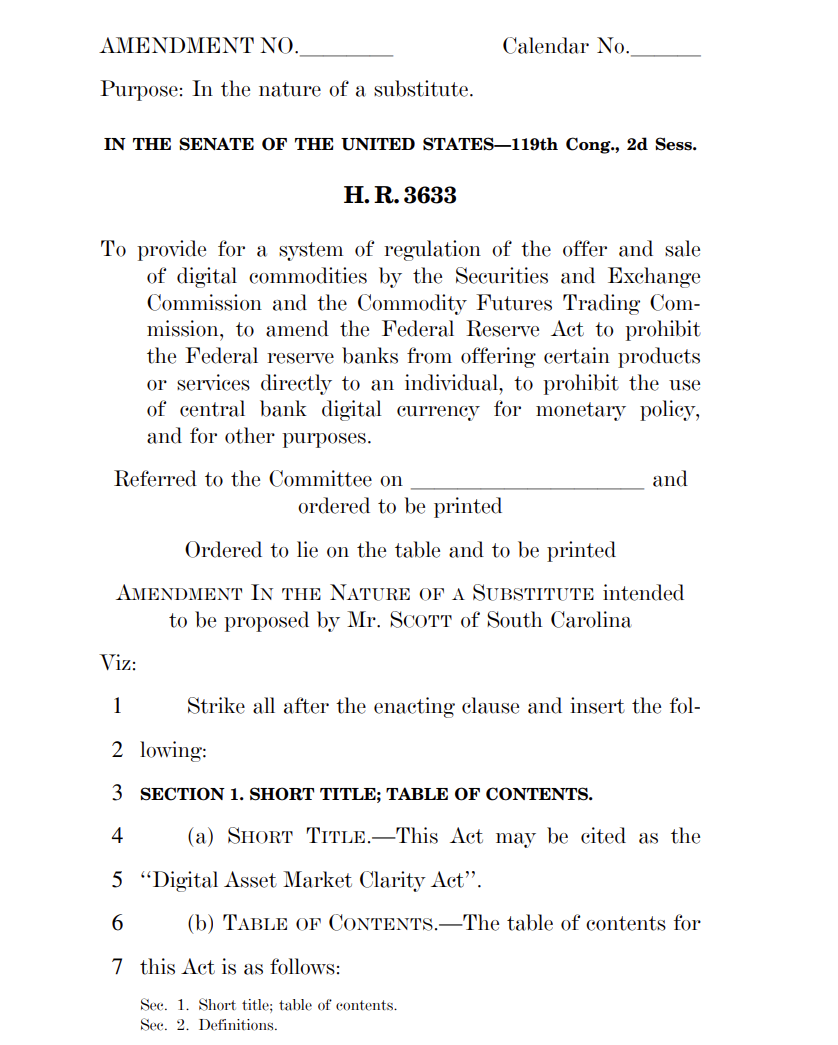

Stablecoin rewards have emerged as a key point of contention in US lawmakers’ deliberations over the Digital Asset Market Clarity Act, a sweeping proposal aimed at clarifying regulatory jurisdiction over digital assets and defining how crypto-related activities should be supervised.

According to an amended draft of the legislation released this week, digital asset service providers would be prohibited from paying interest or yield “solely in connection with the holding of a stablecoin,” signaling lawmakers’ intent to prevent stablecoins from functioning like bank deposits.

At the same time, the draft leaves room for certain incentive structures tied to broader ecosystem participation. These include rewards associated with liquidity provision, governance activities, staking and other network-related functions, rather than passive yield for holding a dollar-pegged token.

Related: Crypto’s 2026 comeback hinges on three outcomes, Wintermute says