HTX (formerly known as Huobi), one of the leading cryptocurrency exchanges, has been embroiled in a new controversy as Justin Sun, Tron’s founder and BitTorrent’s CEO, faces allegations of a staggering $2.4 billion shortfall in user funds.

Adam Cochran, Managing Partner at Cinneamhain Ventures, has shed light on the intricate details of the alleged malpractice, revealing a web of “financial manipulations.”

Huobi Crisis Unveiled?

Cochran’s analysis raises concerns over Huobi’s financial stability, questioning the integrity of the exchange’s claims regarding its holdings of Ethereum (ETH) and USDT, a stablecoin pegged to the US dollar.

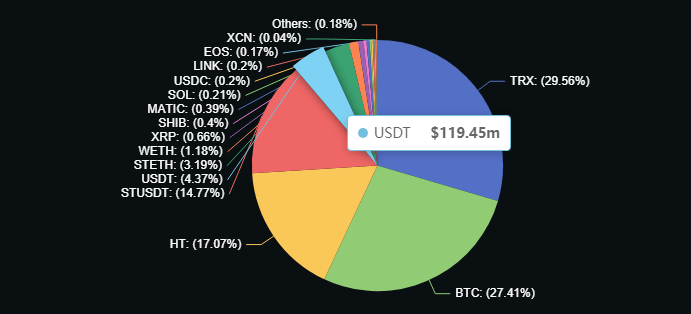

As seen in the chart above, while Huobi asserts assets worth $200 million in ETH, Cochran’s investigation, corroborated by defillama data, reveals a discrepancy, with the actual value amounting to under $113 million, even when considering wrapped ETH (WETH) and staked ETH (stETH).

The situation further unravels when examining Huobi’s purported $624 million USDT holdings. However, Cochran’s findings indicate that only $119 million of USDT resides within the exchange, while the remaining balance is in staked USDT (stUSDT).

What raises suspicion is that Justin Sun has enabled staked USDT (stUSDT) a staking feature, which allows users to stake either USDT or TUSD (TrueUSD) to earn stUSDT, as reported by NewsBTC.

Allegations Mount Against Justin Sun

Instead of following the expected protocol of burning staked assets to claim the cash and take it offline, these funds are redirected to Justin Sun’s addresses or utilized to support JustLend, a lending platform associated with the Huobi ecosystem.

Contrary to Huobi’s claim that it burns the stUSDT with Tether, Cochran’s investigation reveals that the counterparties for USDT on Huobi are the exchange’s deposit wallets or Binance.

This suggests that Justin Sun may utilize USDT from user balances on Huobi to generate stUSDT, subsequently leveraging the underlying USDT to support JustLend or repurchase TUSD on Binance.

Cochran concludes that this complex financial arrangement, including TUSD deposits into stUSDT, effectively mints “fake assets” against an unknown equity.

As a result, Cochran estimates that Justin Sun’s alleged debt to users across the Huobi and Tron ecosystems amounts to approximately $2.4 billion, all while users remain unaware of the situation.

Featured image from Shutterstock, chart from TradingView.com