Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

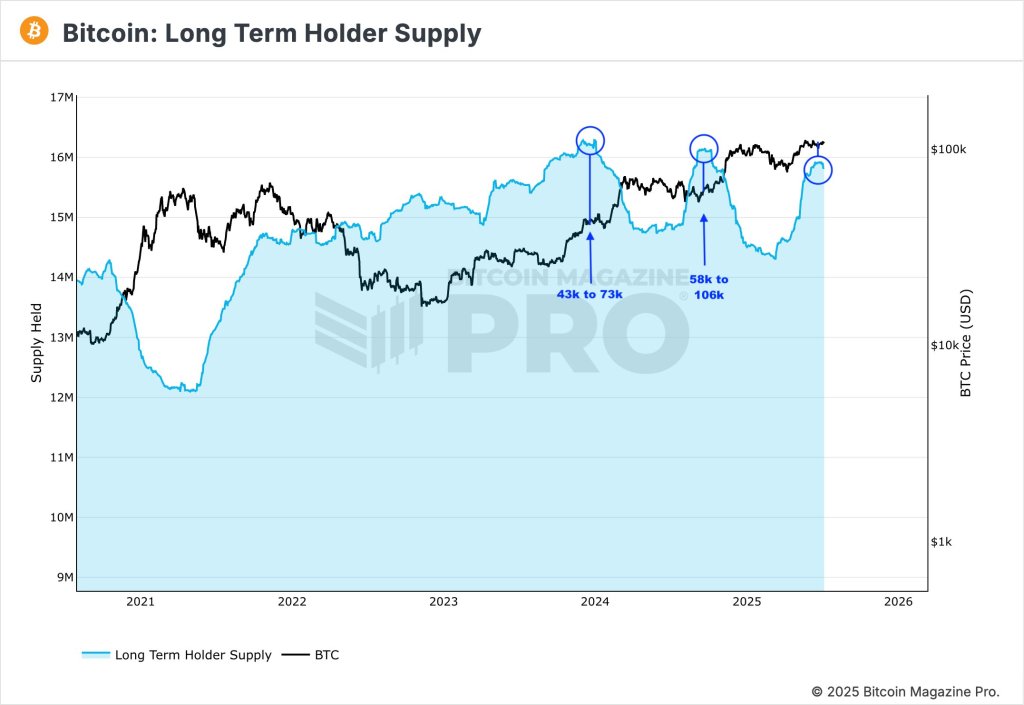

The Bitcoin market appears to be coiling for a major move, according to prominent crypto analyst CrediBull Crypto (@CredibleCrypto), who highlighted today via X that over 80% of all Bitcoin in existence is currently being held by long-term investors—levels of supply constraint previously seen only at major inflection points in Bitcoin’s price history.

Why No One’s Selling Bitcoin

In his post, CrediBull noted, “The only 2 times in Bitcoin’s 15 year history that this % was higher was at 43k before a $30,000 impulse to 73k and at 58k before a $50,000 impulse to 105k+.” Drawing on this historical precedent, he concluded that the market is poised for another massive leg up: “When the majority of $BTC total circulating supply is cornered by ‘diamond hands’, price moves up aggressively at the hint of any ‘new’ demand.”

With “excess” supply now redistributed to long-term holders and institutional entities such as Bitcoin treasury companies increasingly taking the lead, the analyst sees a clear signal: “The next impulse IS IMMINENT. This next one will also likely be even bigger than the last two ($50,000+). Who’s ready for 150k+ Bitcoin?”

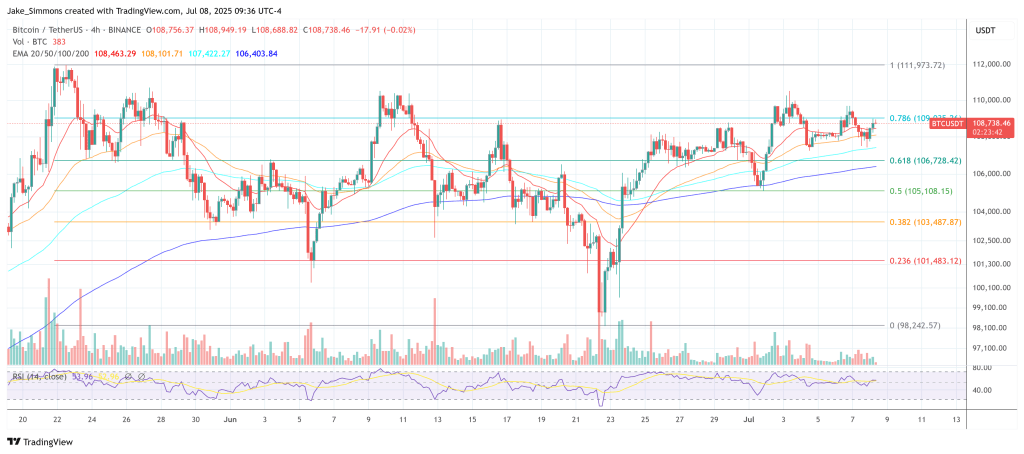

Related Reading

The optimism is not without a technical underpinning. In a previous post, CrediBull addressed the current market structure and his own Elliott Wave-based scenario planning: “My original count/idea shared a few days ago had us rejecting at range highs above 110k and seeing a pullback down to the BLUE zone at 102k-ish before moving sideways for a few more weeks before the next impulse begins.”However, the analyst acknowledged a significant alternative possibility: “I do still think this scenario is probable, I also recognize that there is a non-zero chance that the next impulse up has already begun (most bullish scenario depicted).”

Given the price action and structure, CrediBull argued that the risk-reward profile no longer favors bearish positioning. “In either case, downside is relatively limited on Bitcoin from current levels imo and so focus should be on identifying potential long opps on Bitcoin rather than looking to short clear strength.”

Related Reading

He punctuated the point with a rhetorical jab: “Why is it now illegal to short Bitcoin? Because there is a non-zero chance that the next impulse up has already begun.”

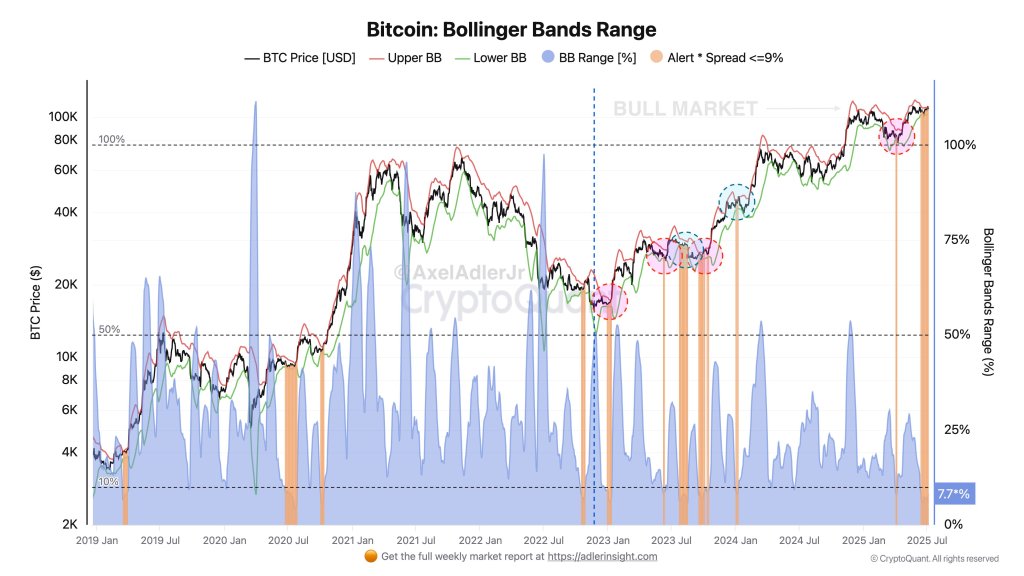

Adding a layer of technical confirmation, analyst Axel Adler Jr provided a concurrent signal from volatility metrics. Adler pointed to a significant Bollinger Bands squeeze underway, writing: “The range between the upper and lower boundaries has fallen to 7.7%—one of the lowest values throughout the entire bull cycle.”

Such compressions in volatility historically precede large directional moves. Adler explained, “The decrease in volatility indicates energy accumulation in the market; the price is ready for a rally, and in an upward trend environment, the chances of an upward breakout are significantly higher.”

In the current cycle, Adler has identified six episodes of such squeezes. Four were immediately followed by strong price appreciation, while the remaining two saw brief corrections before continuing upward. The takeaway: “Based on this experience, the current squeeze most likely foreshadows another upward impulse, although a small consolidation before the move is also not ruled out.”

With long-term holders now controlling an overwhelming share of supply, bullish technical compression in play, and institutional adoption continuing to absorb circulating coins, the environment CrediBull describes echoes past moments of explosive upside. While nothing is guaranteed, the combination of on-chain metrics and technical indicators suggest Bitcoin’s next chapter may already be beginning—quietly, beneath the surface.

At press time, BTC traded at $108,738.

Featured image created with DALL.E, chart from TradingView.com