In an announcement today, Japanese firm Metaplanet revealed plans to increase its Bitcoin (BTC) holdings by issuing $11.3 million worth of bonds to fund the purchase.

Metaplanet To Increase BTC Holdings Through Bond Issuance

The Tokyo-listed company announced on November 18 that its Board of Directors had approved a debt sale with a guarantee worth 1.75 billion yen, or approximately $11.5 million. The bonds will have a one-year maturity period, maturing on November 17, 2025, and will carry an interest rate of 0.36% per annum.

Related Reading

The proceeds from the bond issuance will be used solely to purchase BTC. It’s worth noting that Metaplanet already holds 1,018 BTC on its balance sheet.

Often referred to as “Asia’s MicroStrategy,” Metaplanet’s latest BTC acquisition announcement comes just a week after the US-based business intelligence firm MicroStrategy purchased 27,200 BTC, worth approximately $2.03 billion at current market prices.

Metaplanet began acquiring BTC as a strategic treasury reserve asset in April. The company announced it was adopting a “Bitcoin-first, Bitcoin-only” approach, mirroring MicroStrategy’s BTC investment strategy.

Since April, the early-stage investment firm has steadily expanded its Bitcoin portfolio. For instance, the company acquired an additional 20.195 BTC in June, worth roughly $1.2 million.

It added another 38.464 BTC in September, valued at approximately $2 million. Most recently, in October, the firm announced it had purchased 156.78 BTC, bringing its total holdings to over 1,000 BTC.

Despite the announcement of the bond issuance, Metaplanet’s share price saw little movement. The firm’s share closed the day with a modest 0.81% increase on Monday.

However, since the company began its Bitcoin acquisition strategy, its stock has experienced explosive growth. On April 4, 2024, Metaplanet’s shares traded at 190 yen ($1.23). Today, they trade at 1,994 yen ($12.86), reflecting gains of nearly 950% in just over seven months.

Bitcoin Supply Scarcity To Further Propel Price?

With increasing retail, institutional, and even sovereign demand, Bitcoin’s limited supply could lead to a supply shock, potentially driving the digital asset’s price to unprecedented levels. As a reminder, BTC’s total supply is capped at 21 million by design.

Related Reading

According to a recent analysis by a CryptoQuant analyst, BTC reserves on cryptocurrency trading platforms have fallen to a five-year low. The analyst also noted that more investors hold Bitcoin long-term as a hedge against rising inflation and currency debasement.

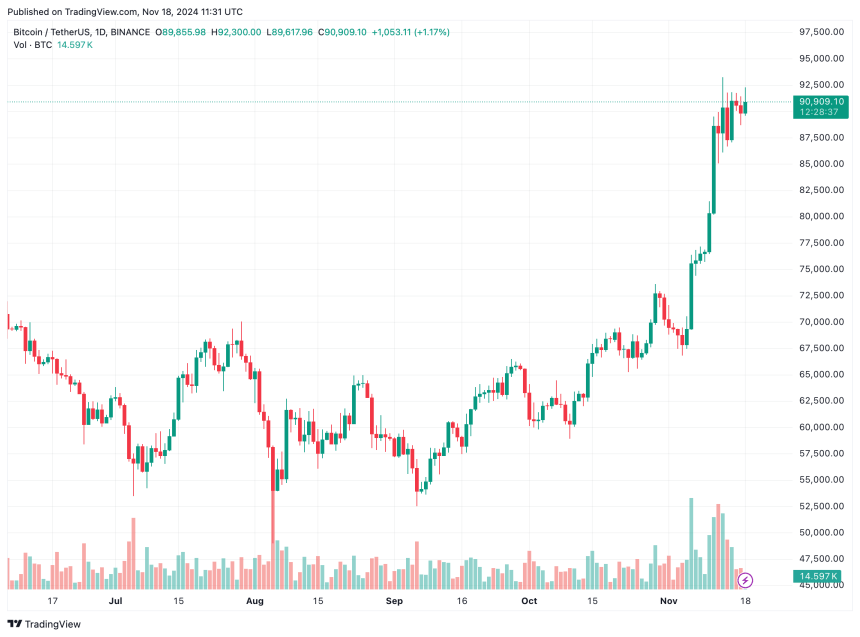

Similarly, a recent report suggests that BTC demand vastly exceeds its supply. This growing supply-demand imbalance may set the stage for Bitcoin’s next major price breakout. BTC trades at $90,909 at press time, up 0.1% in the past 24 hours.

Featured image from Unsplash, Charts from Yahoo! Finance and Tradingview.com