With a year-to-date gain of over 240%, MSTR has outperformed NVDA’s 192% surge by a big margin. Since MSTR adopted bitcoin as a treasury asset in August 2020, the gap has grown even bigger, with MSTR up 1,800% versus NVDA’s 1,150%, that’s probably the best evidence of MicroStrategy and its CEO Michael Saylor’s success.

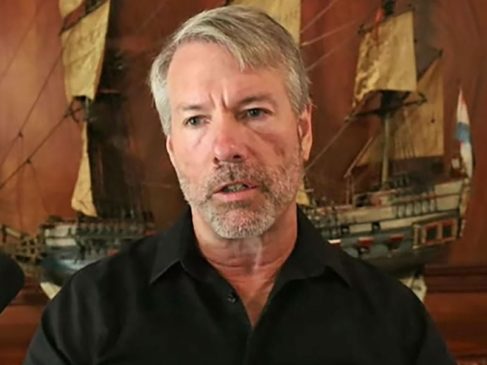

Michael Saylor’s MicroStrategy Makes New Highs as Trading Volume Relative to Nvidia Surges