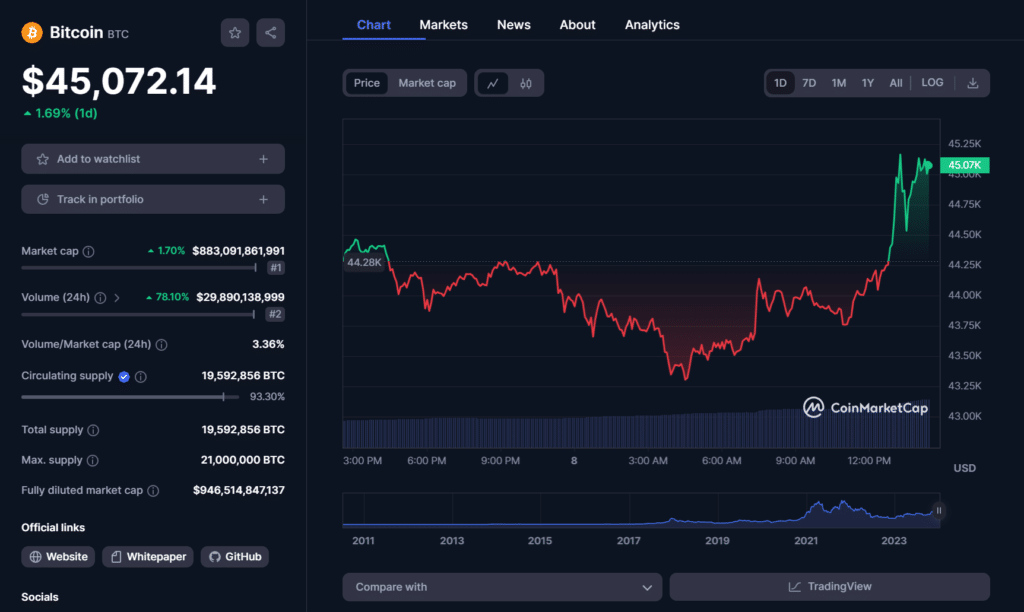

BTC broke above $45,000 as BlackRock, Grayscale, ARK 21Shares, and other firms submitted updated spot Bitcoin ETF forms leading up to the first deadline for approval.

As of 10 a.m. ET on Jan. 8, 10 spot Bitcoin ETF issuers had filed amended S-1 and S-3 forms with the United States Securities and Exchange Commission (SEC) in a final push for approval of traditional financial funds that would track the price of spot Bitcoin (BTC), the largest cryptocurrency.

Valkyria, Wisdomtree, Invesco Galaxy, BlackRock, ARK 21Shares, VanEck, Fidelity, Bitwise, and Franklin Templeton included fees for their spot Bitcoin ETFs in the SEC filings. Grayscale also submitted a fresh registration of securities for its GBTC conversion.

The forms were submitted two days before the final deadline for a decision on the ARK 21Shares Bitcoin ETF, slated for Jan. 10. Major exchanges such as the Nasdaq and NYSE already sent updated 19-b4s following a meeting with the SEC.

According to the filings seen by crypto.news, Bitwise offered the lowest fee at 0.24%, and Grayscale disclosed the most expensive fee, set at 1.5%, although not all issuers had submitted amended forms at press time. Some firms also plan to list with fee waivers.

For instance, BlackRock will list its iShares Bitcoin Trust with a 0.2% fee for its first 12 months. The fee waiver will apply for up to $5 billion in assets under management (AUM). ARK 21Shares and Bitwise also plan to charge zero fees for the first six months and up to $1 billion AUM.

Invesco Galaxy will offer its first six months with no fees and up to $5 billion AUM before reverting to a 0.59% fee.

spot Bitcoin ETF fee tussle

The spot Bitcoin ETF fee war appears underway as each issuer tabled competitive rates and moved to attract investors to their iteration of America’s first spot BTC ETF. However, remarks from Bloomberg analyst Eric Balchunas suggest that fund fees may not be a deciding factor.

One quick note on the temporary fee waivers that we’re seeing in the Bitcoin ETFs. Historically this hasn’t moved the needle much. One ETF back in the day actually paid you to invest in it until it reached a certain AUM mark but no one cared. Advisors focused on regular fees since they are long-term investors. That said, given all these ETFs do the same thing maybe it will matter all else equal, we’ll see.

Eric Balchunas, Bloomberg ETF analyst

Custodia Bank founder and CEO Caitlin Long voiced concerns over the no-fee funds. The Bitcoin proponent pointed to skepticism around securities lending, which she said could threaten investors’ safety.

Meanwhile, Bitcoin responded to the news with an uptick in market price, gaining under 2% to surge beyond $45,000 after a 10% drop last week. Opinions differ regarding the impact of a spot BTC ETF on Bitcoin, with some believing the news to be priced in already and others predicting a massive rally toward its previous $69,000 ATH.

Robert Quartly-Janeiro, chief strategy officer at crypto exchange Bitrue, shared two views on price movements to expect should the SEC approve spot Bitcoin ETFs, adding that the upturn in institutional adoption should drive BTC price up in the long term.

Sure, some buyers are there in the hope of short-term gain – that happens in so many asset classes. But at a deeper, secondary level, is the fact investors around the world feel they have something that is truly different. In their eyes, it’s already investment-grade, but now it needs to be an investment-grade product in the largest economy in the world.

Robert Quartly-Janeiro, chief strategy officer, Bitrue

It’s a final hurdle, said Quartly-Janeiro.