NEO gained bullish momentum after over eight months as Bitcoin (BTC) surpassed the $30,000 mark on Oct. 19.

The asset reached $15.3 on Nov. 5, marking a 36-week high — NEO reached $15.5 in mid-February. The native crypto of the Chinese blockchain Neo, which once competed with the second-largest blockchain, Ethereum (ETH), has gained bullish momentum after eight months of constant declines.

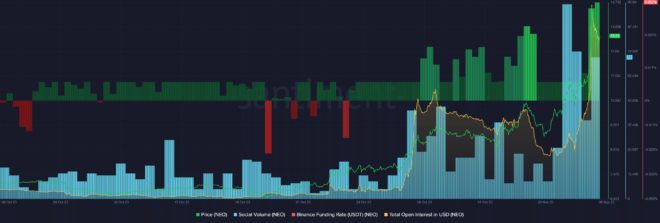

According to data from the market intelligence platform Santiment, NEO’s social volume skyrocketed over the past week — marking an 800% surge in the past seven days.

Moreover, data from Santiment shows that the Binance futures funding rate for Neo has reached 0.05%. In simple terms, this indicates that short-position holders are dominating long-position holders until major movements happen.

As the token reaches its local top, NEO’s total open interest (OI) witnessed a 68% rise in the past 24 hours. According to the market intelligence platform, Neo’s total OI in derivatives contracts has reached $44.3 million.

However, while the Binance funding rate suggests the dominance of short positions, the exact amounts of short and long positions are still not precise.

NEO is up by 17.6% in the past 24 hours and is trading at $13.66 when writing. It’s important to note that the asset registered a 91% rise over the past 30 days.

Data shows that the total market cap of NEO is currently sitting at $963 million, making it the 50th largest cryptocurrency. Neo’s 24-hour trading volume surged by 316%, reaching $613 million.