Bitcoin (BTC) has new short-term BTC price targets as consolidation mixes with bouts of volatility.

After a classic “short squeeze” took the largest cryptocurrency to near $36,000, Bitcoin market participants are highlighting key levels to look for from Nov. 8 onward.

Bitcoin buy liquidity inches down to $34,000

Bitcoin is facing hurdles overcoming resistance at the $36,000 mark, and several attempts to clear it have quickly faded data from Cointelegraph Markets Pro and TradingView shows.

Now, sellers are becoming active on intraday timeframes, and data from exchange order books shows the buy side getting cautious.

In an X post on the day, on-chain monitoring resource Material Indicators highlighted support liquidity heading lower — from $34,500 to $34,000.

“The Bitcoin Gameboard is Changing,” it wrote in part of accompanying commentary.

A snapshot of the BTC/USDT order book on Binance also confirmed $36,000 receiving additional sell liquidity after declining during the prior day’s tap of $35,900. $40,000 remained the crunch psychological barrier.

With $34,000 now a potential battleground should sell-side pressure push the market lower, popular trader Daan Crypto Trades eyed lines in the sand to the upside.

These came in the form of $35,000 and $35,000 — the site of liquidity which could serve to replicate the short squeeze should bulls gain the upper hand.

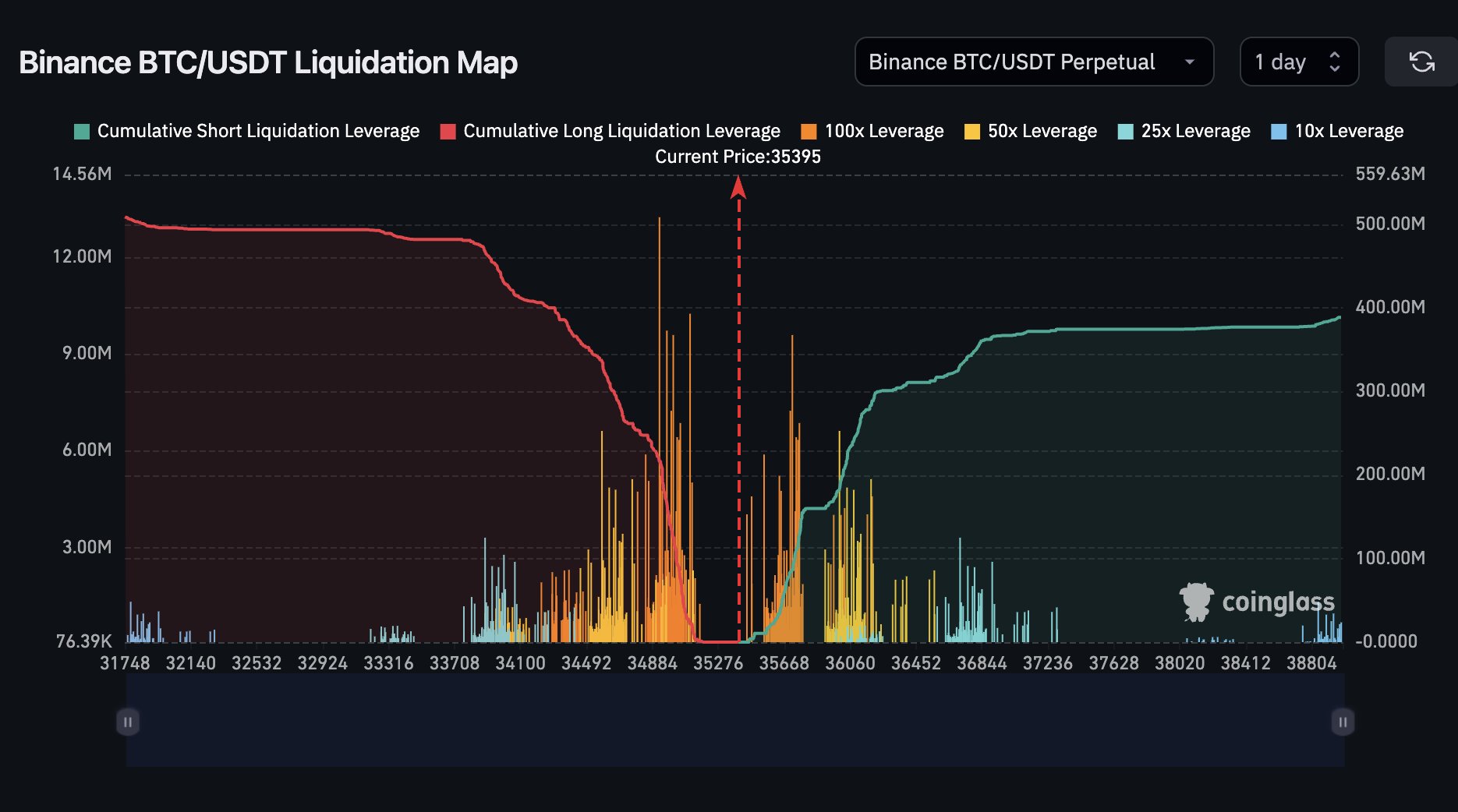

“Clear liquidation clusters located around $35K & $35.7K,” he wrote about Binance BTC/USDT perpetual swaps.

“Expect a bit of a squeeze to occur if either of these levels are tagged.”

Summarizing the spot and perp status quo, fellow trader Skew concluded that spot bidders were needed to give the market a chance of further upside.

$BTC Market Data thread

Binance Spot orderbook

Clear quoted range from liquidity perspective after high volume spot buying yesterday

note lack of spot volume currently

Binance Futures orderbook

very thick bid depth & high short float led to the short squeeze yesterday as… pic.twitter.com/OUzfdRdl9q

— Skew Δ (@52kskew) November 8, 2023

Analysis: $33,700 “most bearish” BTC price scenario

In a characteristically optimistic take, meanwhile, trader and analyst Credible Crypto stated that Bitcoin returning below $33,700 was unlikely.

Related: Exchange flow gap hits 10K BTC — 5 things to know in Bitcoin this week

Updating X subscribers on two BTC price scenarios, he suggested that $34,500 would in fact hold as support.

“In my ‘most bearish’ low timeframe scenario, I don’t expect we see below 33.7k,” he wrote.

“In other words- no matter how this plays out in the coming days I think downside is extremely limited.”

Credible Crypto added that hints as to the outcome of current conditions should be expected within “the next day or two.”

As Cointelegraph reported, longer-term TBC price perspectives give bulls cause for celebration. Even year-end targets include $45,000 or more, with the upcoming block subsidy halving a source of optimism in itself.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.