On-chain liquidations occur when the value of collateral added by a user borrowing an asset slumps, and the user is then required to add more margin to avoid it being liquidated. Conversely, the user will also risk liquidation if the value of the borrowed asset rises beyond borrowing capacity.

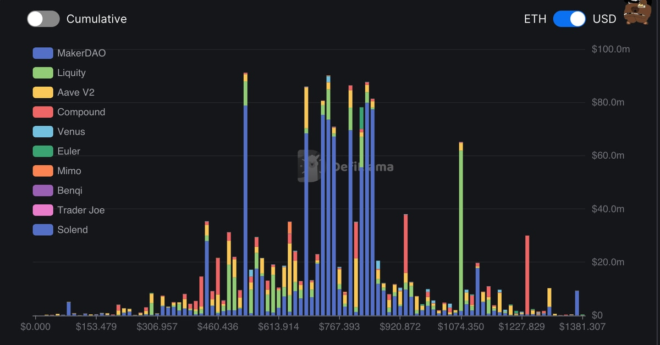

On-Chain Liquidations Beckon as Ether Slumps to 2-Month Low