The Ordinal Token (ORDI) has made history by recording a staggering $93 million trading volume within just 12 hours after its first-ever centralized exchange (CEX) listing.

The massive trading volume marks a major milestone for the first BRC-20 token on the market, leaving many in awe of the token’s performance and prompting questions.

Listing on Gate.io

Ordinals are gaining popularity in the bitcoin world as a new form of digital assets similar to NFTs.

The unique feature of Ordinals is that users are inscribing images, video games, and other content on satoshis, which are the smallest denomination of a bitcoin.

In April 2023, the number of newly created Ordinals spiked, breaking daily record inscriptions.

The popularity of Ordinals has led to the emergence of a new market for unique and collectible digital assets. This has created opportunities for creators to monetize their content in new and innovative ways.

The use of satoshis as a canvas for these digital assets also has implications for the bitcoin ecosystem as it increases the demand for the cryptocurrency and contributes to the growth of the blockchain network.

Gate.io’s listing of ORDI is a significant development for the Ordinal market.

As the first centralized exchange to support the new cryptocurrency, Gate.io’s listing will provide greater liquidity and access for investors looking to participate in this promising investment opportunity.

It also signals the growing interest and adoption of Ordinals in the broader cryptocurrency market.

The creation of Ordinals has seen a significant increase over recent weeks, resulting in a rise in both transaction fees and the average block size of the Bitcoin blockchain.

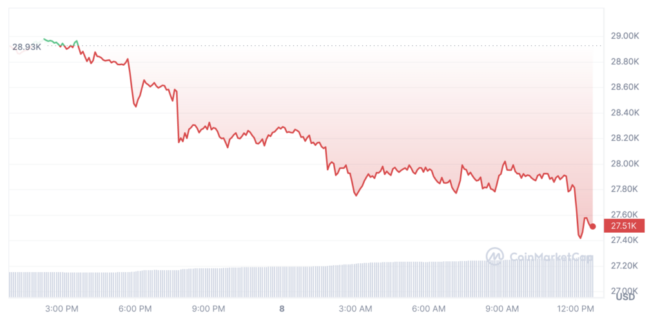

In looking at prices following the record trading volume, data reports show a 4.96% decrease in bitcoin price in the last 24 hours.

BTC to USD | Source: CoinMarketCap

Surprisingly, this decrease did not crack the top losers, according to CoinMarketCap, which includes losses of nearly 38% for other altcoins.

Top Losers | Source: CoinMarketCap