The average commission on the Bitcoin (BTC) network exceeded $37, reaching a yearly high.

The increase in blockchain fees was caused by another wave of activity in the Ordinals segment. This has led to increased demand for block space.

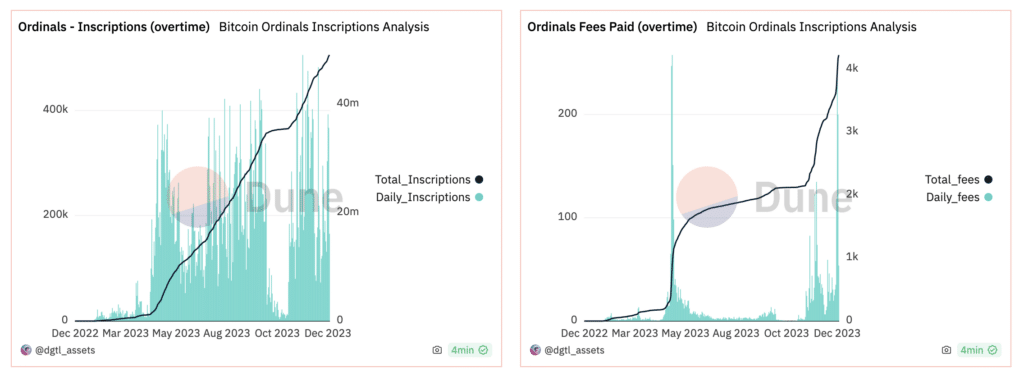

A similar situation happened in April-May 2023. At that time, after the popularization of inscriptions — notes that can be inscribed onto the Ordinals blockchain — the average commission reached $19. Then, the demand for Bitcoin NFTs fell, but grew again in Q3 2023.

Commission increases occurred due to the high demand for inscriptions on the Ordinals network.

The number of these tokens and the volume of commissions show a steady upward trend.

The beneficiaries were miners whose income jumped to the levels of Bitcoin quotes at historical highs of around $69,000.

Some users noted that this network fee level makes mass cryptocurrency adoption problematic.

However, according to popular influencer hodlonaut, the network of the first cryptocurrency is not intended for this, and high commissions are its protection from attack. The expert believes that second-layer solutions like Liquid Network or Lightning Network, which are specifically designed for mass use, should be used for accessible transactions.

He is confident that the structure of the Bitcoin network allows for a constant increase in value by the design of the Proof-of-Work consensus algorithm. The expert believes it is impossible to maintain low commissions in this situation, as failed forks like Bitcoin Cash showed, the analyst claimed.

At the same time, commissions have also increased in other blockchains on which analogs of Ordinals are issued. On Dec. 16, gas consumption for operations with “inscriptions” in EVM networks jumped to $8.37 million. Avalanche accounted for $5.6 million of the total amount, while Aribitrum One’s figure was $2.1 million.