Funding rates on several exchanges have surged to an annualized 50% or more, indicating a steep premium in perpetual futures relative to spot prices, Velo Data data show. Positive rates indicate investor preference for long, or bullish, bets and reflect collective optimism that prices will likely increase.

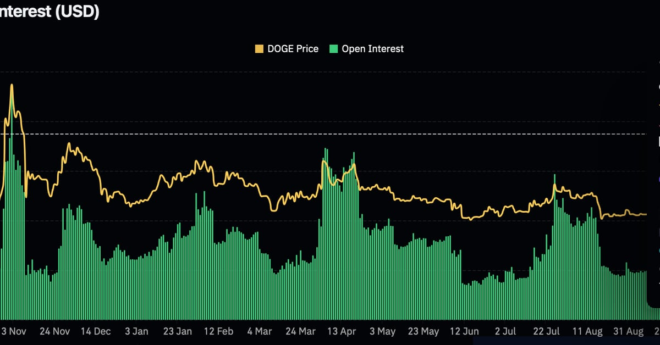

Over $600M Locked in Open Dogecoin (DOGE) Futures With Meme Coin at 8-Month High on 10th Anniversary