In Nov. 2021, bitcoin’s market valuation managed to make it into the top ten list of assets ranked by market capitalization, as it was the eighth largest market cap last year on Nov. 9. Since then, bitcoin is 75% lower in value against the U.S. dollar and the leading crypto asset’s market capitalization has dropped down to the 26th largest position among the most valuable assets and companies worldwide.

Bitcoin’s Market Cap Is Just Below Chevron’s and Just Above the Home Depot’s Market Valuations

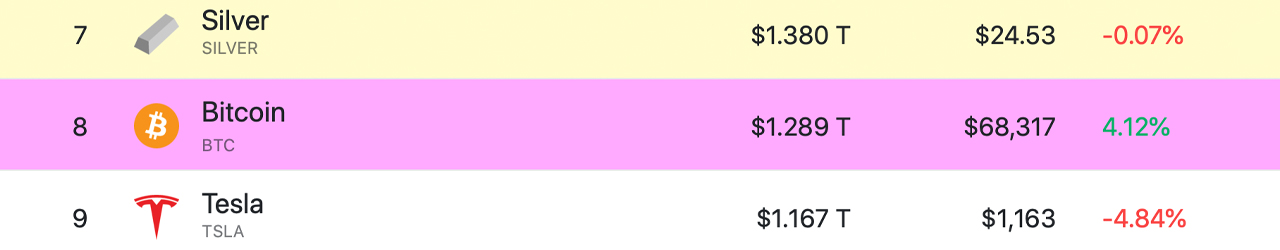

Just over a year ago in Nov. 2021, bitcoin’s (BTC) market capitalization was the eighth largest out of a myriad of companies and assets traded globally. At the time, on Nov. 9, 2021, an archive.org snapshot collected from companiesmarketcap.com shows BTC’s market valuation was $1.289 trillion as each unit was swapping for just over $68K.

On that day, BTC’s market cap was below the precious metal silver’s overall valuation, which was $1.380 trillion on Nov. 9, 2021. The leading crypto asset was just above Tesla’s $1.167 trillion market valuation recorded 395 days ago. Additionally, ethereum (ETH) was situated in the top 20 positions of assets ranked by market capitalization as ETH held the 15th largest market cap on Nov. 9, 2021.

At the time, ETH’s market valuation was around $570.45 billion as ether was swapping for $4,839 per unit. Ethereum’s market cap was below the company Tencent which had a market valuation of around $588.07 billion. The second leading crypto asset’s market cap was above JPMorgan Chase’s valuation which was $499.61 billion 395 days ago.

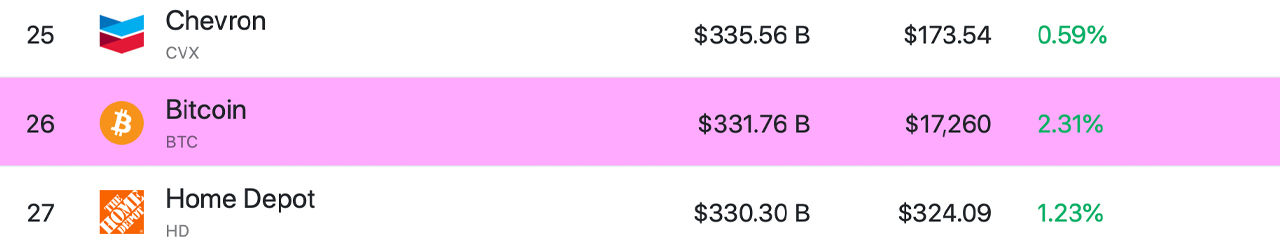

Today, on Dec. 9, 2022, the top two leading crypto assets BTC and ETH have much lower valuations than they did a year ago. Bitcoin is not represented in the top ten standings of assets ranked by market capitalization as it’s now within the top 30 positions and ranked at 26. The $331.76 billion market cap BTC holds today is just below Chevron’s market cap of around $335.56 billion.

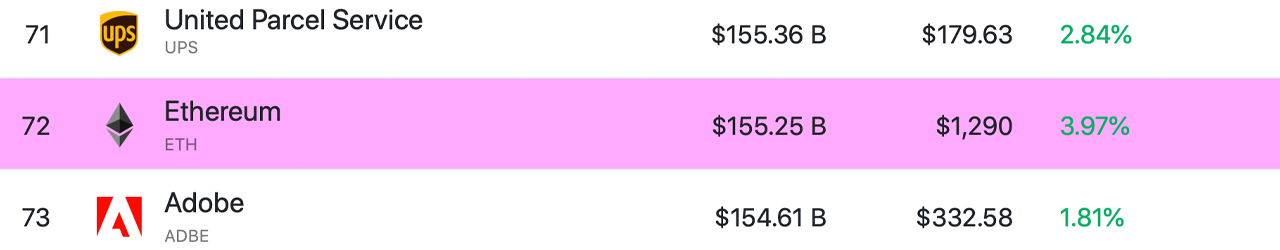

Further, bitcoin’s market capitalization is just above the overall market valuation of Home Depot, which is valued at $330.30 billion on Dec. 9. Ethereum has slid a great deal from the 15th largest position as it now holds the 72nd spot with a market cap of around $155.25 billion. Ether’s market cap is below the United Parcel Service (UPS) which is $155.36 billion, and it’s just above the valuation of Adobe ($154.61B).

Ethereum’s current market price is roughly 73.7% lower than it was 395 days ago on Nov. 9, 2021. Though BTC and ETH have seen their market caps drop lower during the last year, the same can be said for a large number of different assets and companies. Some assets, like gold’s overall market valuation, conversely recorded increases over the last 12 months. Gold’s cap in Nov. 2021 was around $11.605 trillion, and today it’s worth $11.910 trillion.

Microsoft was the second-largest asset a year ago, but it’s now in the third position as Microsoft’s valuation dropped from $2.53 trillion to today’s $1.844 trillion. Google’s or Alphabet’s market cap was around $1.98 trillion and in the fifth position 395 days ago on Nov. 9, 2021, and on Dec. 9, 2022, it’s down to $1.213 trillion. Silver’s position in the top ten list moved up from the seventh to the fifth position, but the precious metal’s market cap still dropped from $1.38 trillion to today’s $1.316 trillion.

What do you think about bitcoin’s fall from the top ten most valuable assets and companies worldwide down to the 26th position? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, editorial photo credit: companiesmarketcap.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.