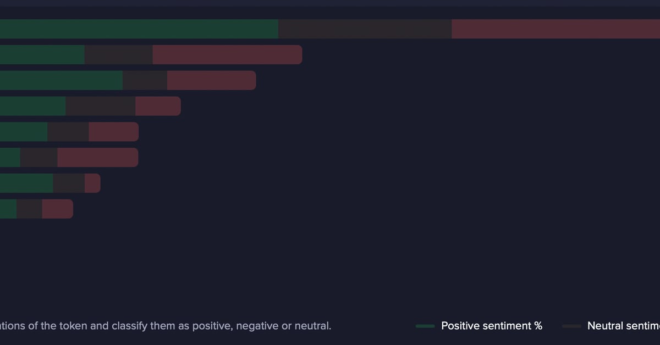

Bitcoin’s near-vertical rise continues, with the cryptocurrency scaling the $59,000 mark early Wednesday. Ether (ETH) topped $3,300, and the CoinDesk 20 Index, a measure of the broader market, jumped 3.5% to $2,177. The bears, if any, have been put on notice as bitcoin (BTC) is now just 16% short of challenging the record high of $69,000. The distance could be covered easily before April’s mining reward halving, assuming Wall Street continues pouring money into the spot exchange-traded funds, maintaining the demand-supply imbalance. That said, the market increasingly looks overheated, not only in terms of funding rates, but also because, as Santiment data show, the top trending cryptocurrency on social media in the past 24 hours is PEPE. The meme token’s market cap has skyrocketed by 153% this week, CoinDesk data show. Such frenzied action in smaller coins often presages market-wide price pullbacks. While past performance is no guarantee of future behavior, some traders have started purchasing bitcoin puts to hedge potential downside risks.

PEPE, Not BTC, Is The Top Trending Token