A crypto memecoin investor holding Gigachad (GIGA) tokens has lost $6.09 million in a phishing attack involving a fake Zoom meeting link.

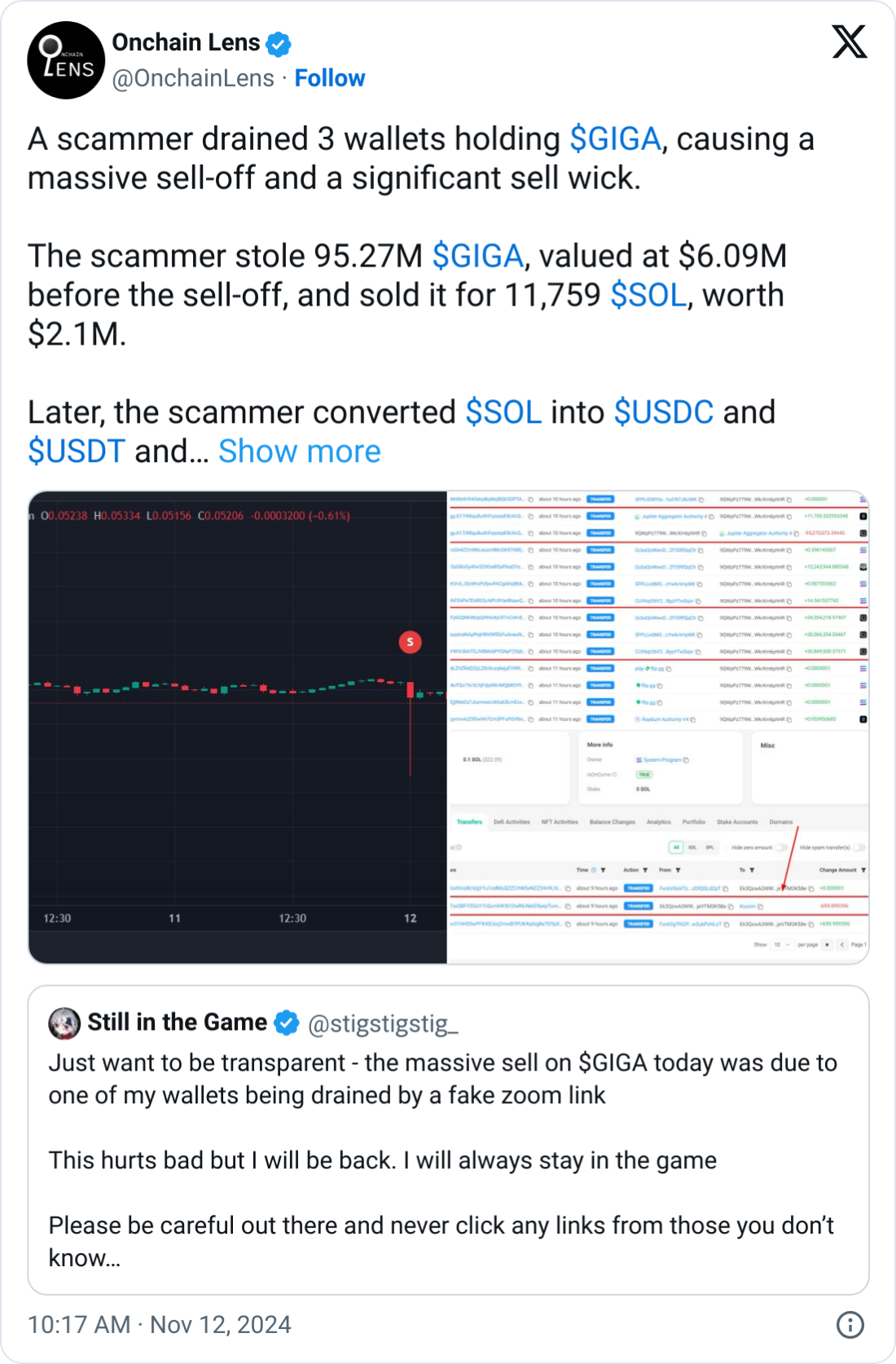

On Nov. 12, GIGA recorded an unusual price drop triggered by a massive sell-off event. Soon after, a prominent pseudonymous GIGA investor ‘Still in the Game’ proactively alerted against the involvement of a hacker:

“Just want to be transparent – the massive sell on $GIGA today was due to one of my wallets being drained by a fake Zoom link. This hurts bad but I will be back. I will always stay in the game.”

According to crypto investigation firm Scam Sniffer, the victim investor clicked on a fake Zoom call invite link, which redirected them to a deceptive website designed to harvest sensitive wallet information.

Source: Scam Sniffer

Phishing link installs crypto malware on computer

Still in the Game claimed that the phishing website installed malware into their laptop, which the hacker later used to collate funds from three crypto wallets into one before cashing out.

Onchain analytics firm Onchain Lens found that the hacker stole 95.27 million GIGA tokens from the victim, valued at $6.09 million.

The hacker exchanged the stolen GIGA tokens for 11,759 Solana (SOL) worth $2.1 million before converting them to Tether (USDT) and USD Coin (USDC) stablecoins.

Source: Onchain Lens

The hacker moved the stablecoins to a different wallet address, while an additional 700 SOL tokens were transferred indirectly to the crypto exchange KuCoin.

Law enforcement gets involved to investigate GIGA theft

The victim said they had involved the United States Federal Bureau of Investigation and a forensics team to help recover the stolen funds.

Despite the lack of surety of funds recovery, the investor remains optimistic about making up for the loss in the ongoing bull market. “I’m going to make it all back and more. Just watch me,” they added.

Related: DeltaPrime exploited for $4.8M worth of ARB and AVAX tokens

After the recent downfall of the Indian crypto exchange WazirX following a $235 million hack, its founder, Nischal Shetty, announced plans to explore building a separate decentralized exchange (DEX). He added:

“The best thing is that you’ll be able to self-custody your assets here — your assets will be completely under your control — and you can freely trade or do what you want with your assets.”

The plan includes the possible launch of a corresponding DEX token to pay for fees on the platform and provide an instrument for governance.

Magazine: Real life yield farming: How tokenization is transforming lives in Africa