A leading analytics firm is revealing that blockchain scaling solution Polygon is witnessing a dramatic drop in the supply of MATIC on crypto exchanges even after the token’s explosive rally in the last few days.

In a new report, Santiment says the “crowd is piling in” on Polygon as supply on crypto exchanges plummets from over one billion MATIC tokens in mid-October to 833.03 million coins on November 4th.

“MATIC’s supply on exchanges continue to fall even as prices skyrocket, indicating that folks are pretty confident about further price rise.”

MATIC is in the midst of a blazing rally to kick off November, opening the month at $0.90 and surging to as high as $1.30 for a 44% increase in less than a week.

MATIC has retraced since and is trading at $1.17 at time of writing.

Looking at MATIC’s other on-chain metrics, Santiment says that the coin’s rally comes as Polygon sees its highest network growth in months. According to the analytics firm, network growth illustrates user adoption by tracking the amount of new addresses that transferred MATIC tokens for the first time.

“MATIC is seeing its highest network growth in months. A sustained network growth would be good but as soon as it falls and price continues to hover, forming a divergence, it tends to signal a local top as no new folks are coming in.”

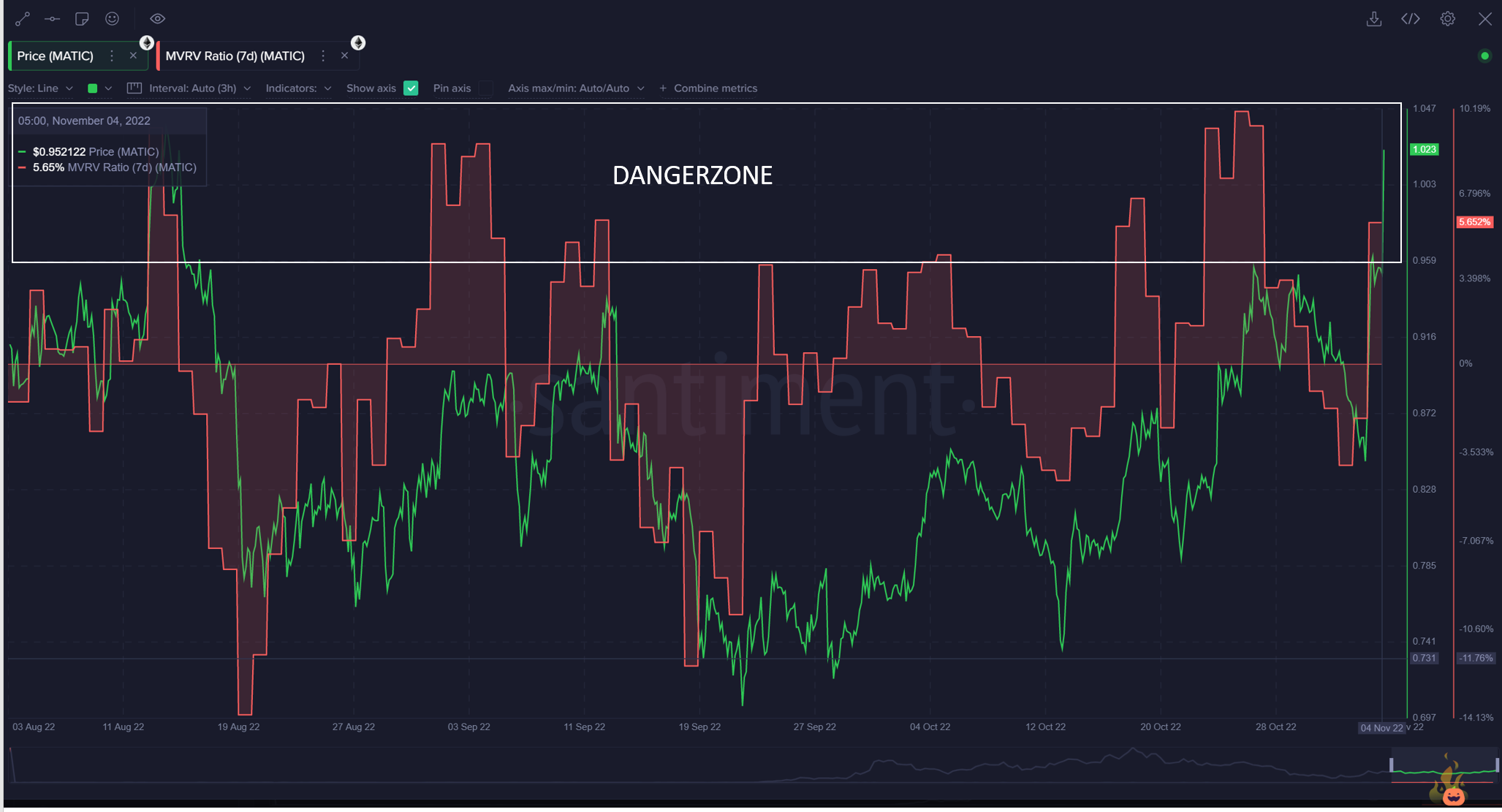

With more traders jumping in and participating in the rally, Santiment warns that one-chain metric is signaling that MATIC may be on the verge of a corrective move. According to the analytics firm, the coin’s seven-day market value to realized value (MVRV) metric shows that MATIC holders are in a good position to lock in profits.

“MATIC’s MVRV 7D, which measures the short-term profit/loss of holders, is showing that we are now in the Danger Zone, where historically saw MATIC’s price decline shortly after as a local top forms.”

You can read the full report here.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal