As the country recuperates from the Covid-19 devastations, the crypto industry led by Bitcoin and stablecoins is expected to play a crucial role in uplifting the economic status of Venezuelan residents.

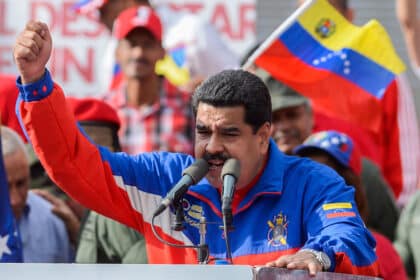

The President of the Bolivarian Republic of Venezuela Nicolás Maduro has ordered the restructuring of the National Superintendence of Crypto Assets and Related Activities (SUNACRIP). Through decree number 4,788, dated March 17, President Maduro has appointed a restructuring board of SUNACRIP chaired by Anabel Pereira Fernández, who replaces Joselit Ramírez.

Notably, Maduro has appointed Pavel Javier García Sandoval, Ramón Daniel Maniglia Darwich, Carlos Eloy Pirela Méndez, Larry Daniel Davoe Márquez, and Edgardo Alfonzo Toro Carreño as alternate directors of SUNACRIP to replace three principal conductors: Héctor Andrés Obregón Pérez, Luis Alberto Pérez González and Julio César Mora Sánchez.

While there has not been an official communication of the restructuring process, it is thought that Ramírez was ejected on corruption charges. As such, the economically distressed country has appointed fresh blood to steer its cryptocurrency agenda. Moreover, with high inflation of over 110 percent, digital assets are viewed as a vital hedge market against the inflationary fiat system.

President Maduro declared that “it is the duty of the State to take all measures at its disposal to protect the Venezuelan people from the negative effects of the multiform aggression that is taking place against the country and, especially, against its economy.”

Venezuela and Crypto Market Outlook

Venezuela has vast oil and minerals deposits that have corrupted the country’s leaders, law enforcement, and Justice system. As the country recuperates from the Covid-19 devastations, the cryptocurrency industry led by Bitcoin and stablecoins is expected to play a crucial role in uplifting the economic status of Venezuelan residents.

In a bid to circumnavigate the sanctions from international markets, including the United States, Venezuela has made a pact with the Colombian government to allow the free flow of economic activities. Nonetheless, the country anticipates a new government will be elected next year and help lift the existing sanctions.

Reportedly, approximately 20 per cent of the country’s population has interacted with Bitcoin or Web3 products in the past few years. More so due to the fact that the hyperinflation has put most Venezuelans on humanitarian aid.

According to a recent report, the United States has pledged more than $171 million in humanitarian assistance and development to boost Venezuelans impacted by the economic crisis. Notably, over 7 million people have fled the nation in recent years due to the dire financial situation.

“This new funding will help provide food, health care, emergency shelter, and access to legal and protection services,” US Ambassador to the United Nations Linda Thomas-Greenfield said virtually at the conference in Brussels.

Notably, the recent aid is expected to be divided among Venezuelans living in the country and those in Columbia and Ecuador.

Let’s talk crypto, Metaverse, NFTs, CeDeFi, and Stocks, and focus on multi-chain as the future of blockchain technology.

Let us all WIN!