Bitcoin’s price action has turned somewhat sluggish after its unprecedented climb to a new all-time high of $122,838 on July 14. The rapid push to that level was preceded by a week of frenzied trading and heavy inflows, with BTC breaking through multiple resistance zones in quick succession. However, once that peak was hit, a series of volatile intraday movements followed to give a pullback to $116,000 and Bitcoin is now back to trading between the $117,000 and $118,500 price zone.

Related Reading

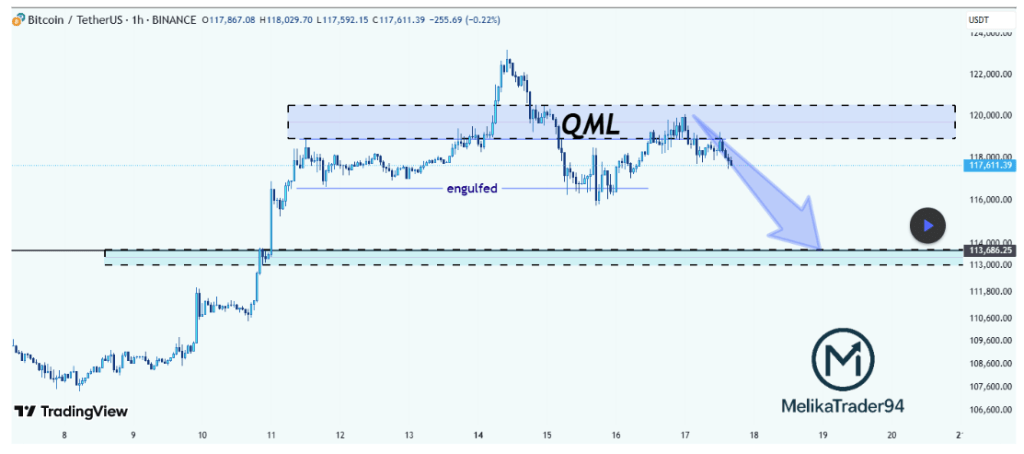

A notable bearish call came from crypto analyst Melikatrader94, who posted a technical breakdown on the TradingView platform that might send Bitcoin down to $113,000.

QML Zone Rejection Points To Downtrend Toward $113,600

According to the hourly candlestick chart shared by Melikatrader94, Bitcoin is currently exhibiting a Quasimodo Level (QML) structure. The Quasimodo Level (QML) structure is characterized by three peaks in a bearish scenario or three troughs in a bullish scenario, with the middle one being the most prominent, identifying the price. The post predicted that Bitcoin’s entry into the $119,000–$121,000 zone would draw sellers, and this was indeed the case.

The quick rejection after its all-time high confirms a bearish shift in structure, and now the momentum is tilted to the downside. This rejection came after a significant price move that engulfed a previous structural support level.

“BTC rejected from QML zone and the selloff confirms bears are active,” the analyst noted.

The bearish outlook remains valid as long as Bitcoin stays below the QML zone, with the next critical support level situated at $113,600. This area could serve as a potential point for either a bounce or short-term consolidation if the price continues downward. However, a pullback is likely to occur around $116,000 before Bitcoin falls to $113,600.

Altcoins Under Threat As BTC Price Weakens

The potential Bitcoin crash to the $113,000 region could have serious implications for many altcoins that are already starting to post massive gains. However, these altcoins, which often follow Bitcoin’s lead, are already showing signs of nervousness as BTC struggles to maintain upward momentum.

Among the notable movers, XRP finally broke its eight-year-old resistance to hit a new all-time high of $3.65. However, the rally appears to be stalling, with the token now showing early signs of a correction around the $3.45 zone. Ethereum, which also surged on the back of Bitcoin’s push to $122,000, climbed above $3,600 for the first time in months but has since settled into a consolidation phase just below $3,500.

Related Reading

Should the leading cryptocurrency break below $116,000 in the coming days, it may cause a cascade of outflows from altcoins and lead to increased selling pressure across the board. However, we could see these major altcoins finally detach from Bitcoin’s movement. This would lead to an altcoin season where major altcoins outperform Bitcoin for some time.

Featured image from Pixabay, chart from TradingView