On Nov. 11, 2022, FTX Trading Ltd. filed a voluntary petition for Chapter 11 bankruptcy protection in Delaware. The news followed a few days of speculation and evidence that had shown the digital currency exchange was likely insolvent. The company’s bankruptcy filing and information concerning Sam Bankman-Fried’s (SBF) quantitative cryptocurrency trading firm Alameda Research shed some more light on the situation. Moreover, crypto proponents have questioned why U.S. regulators let FTX fly under the radar.

Bankruptcy Filing Highlights FTX’s and Alameda’s Long List of ‘Portfolio Companies’

This past Friday, the general public and even FTX employees kept in the dark, were informed that FTX Trading Ltd. filed for Chapter 11 bankruptcy in the United States. The filing explains that it has more than 100,000 creditors and the firm’s estimated liabilities equate to $10 billion to $50 billion. The bankruptcy filing is signed by FTX’s new CEO John J. Ray III, an individual that worked on Enron’s bankruptcy proceedings.

The bankruptcy filing includes FTX Trading Ltd. and 134 affiliates of the debtor including Alameda Research, Atlantis Technology, Bitpesa, Blockfolio, Cedar Bay, DAAG Trading, Global Compass Dynamics, Hawaii Digital Assets, GG Trading Terminal, Ledger Holdings Inc., Liquid Financial, Western Concord Enterprises, FTX US Derivatives, FTX US Services, and FTX US Trading. The filing is authorized and signed by former FTX CEO Samuel Benjamin Bankman-Fried, otherwise known as SBF.

Alameda Called a ‘Financial Control Feedback Loop,’ Crypto Trading Reportedly Non-Existent

While the filing was registered on Nov. 11, SBF’s signature on the filing was dated Nov. 10, 2022. Out of the 134 affiliates, 11 share the Alameda name with Sam Bankman-Fried’s (SBF) quantitative cryptocurrency trading firm called Alameda Research. While Alameda claims to be a quantitative crypto trading company, it has been said that Alameda did nothing of the sort.

“Sam Bankman-Fried’s Alameda Research didn’t trade crypto so far as we can tell,” the investigative journalist and Twitter account @lordnefty wrote. “What did they do then? They ‘invested’ $8B across 448 venture-stage startups, most of which have ‘1-10’ employees and zero documentation. It only gets more crazy when you dig in to each and every one of the companies.” The journalist added:

A financial control feedback loop that ultimately ends with the all the money going to Sam Bankman-Fried controlled companies, companies with no owner or financial data, splash-page websites, etc.

While some claim Alameda didn’t really trade digital assets, it has also been said that Bankman-Fried and Alameda leveraged arbitrage schemes trading up to $25 million a day. The web portal crunchbase.com highlights the great number of portfolio companies associated with Alameda. Furthermore, on Nov. 2, 2022, Coindesk reporter Ian Allison published a story on Alameda’s balance sheet, which noted that the company held a massive amount of ftx (FTT) tokens in comparison to other assets held by the firm.

The report says Alameda’s CEO Caroline Ellison declined to comment. Alameda Research’s day-to-day affairs were run by Ellison, Nate Parke, Charlie Tsang, Christian Drappi, Aditya Baradwaj, Oliver Hamilton, and Sam Trabucco as an advisor. Ellison’s father is an MIT faculty member and an expert in economics, game theory, and technology adoption.

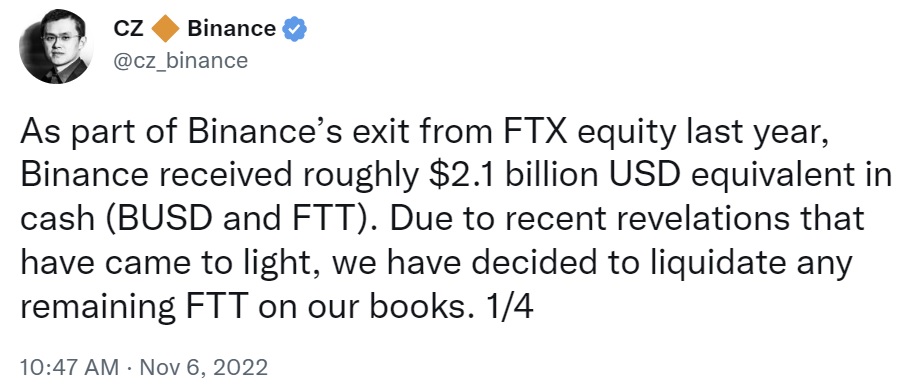

Following Coindesk’s Alameda balance sheet report, Binance CEO Changpeng Zhao (CZ) said his exchange would be dumping its FTT tokens.

Prior to CZ’s statements, on Oct. 31, 2022, Dirty Bubble Media (DBM) published a post that showed Alameda happened to be one of Celsius’ largest unsecured creditors and the crypto lender owes Alameda $12.8 million. The DBM report further highlights Celsius had another large unsecured creditor called “Pharos Fund SP.”

“This fund was, as far as we have found, not publicly known prior to the Celsius filing. It is managed by a firm called Lantern Ventures, which also has largely flown under the radar during its existence,” the DBM report explains. “According to a Bloomberg report, Lantern’s CEO, Tara Mac Auley, has claimed that she was a co-founder of Alameda Research. Mac Auley was also the CEO of a charity called the ‘Center For Effective Altruism.’ Sam Bankman-Fried is a member of that charity’s affiliate organization, ‘Giving What You Can.’”

LBRY Team Questions SEC’s Enforcement Motives, Crypto Community Members Think SBF Was a ‘Patsy’ Due to Extensive Political Connections

The issues associated with FTX and Alameda have caused a number of cryptocurrency proponents to ask why regulators like the U.S. Securities and Exchange Commission (SEC) did not catch FTX before it collapsed. Congressman Tom Emmer tweeted about allegations concerning the SEC chairman helping FTX obtain a regulatory monopoly. The LBRY Twitter account, operated by the blockchain project that lost a court case with the SEC, discussed the regulator’s harsh enforcement against LBRY, compared to the treatment FTX had seen.

“Increasingly looking like that while the SEC had a team of staff working to crush us, a tiny actor and one of the actual honest ones, FTX was stealing billions and [SEC chairman Gary Gensler] was taking the time to personally meet with them,” LBRY wrote. Bankman-Fried’s effective altruism background, the million-dollar donations to Democratic super PACs and U.S. president Joe Biden, his reported meeting with SEC chairman Gary Gensler, and other connections have caused people to believe SBF was a political “patsy” meant to roughshod crypto regulations into the industry.

What do you think about FTX’s Chapter 11 bankruptcy filing and the company’s subsidiary Alameda Research? What do you think about all the speculation tied to FTX’s and Alameda’s political connections? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.