Ripple’s XRP sales continued to drop in the second half of 2019, with sales of the token reaching a historic low in Q4.

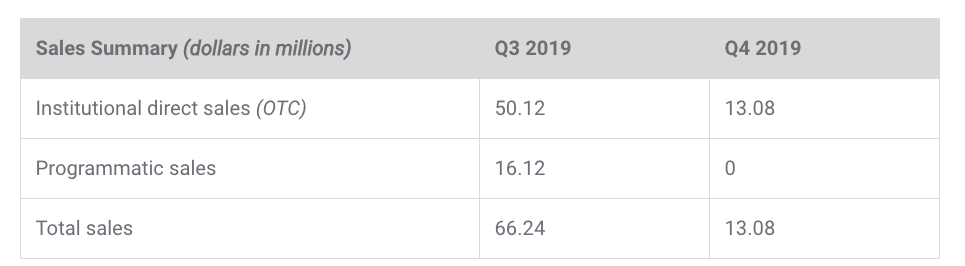

According to a Jan. 22 blog post by Ripple — the firm behind the third largest crypto asset by market cap — total XRP sales in Q4 2019 accounted for $13.08 million, down more than 80% from the $66.24 million reported in Q3 2019.

Ripple got rid of programmatic sales

The massive decline in XRP sales in 2019 does not appear to be unexpected though. Specifically, quarterly XRP sales were consecutively dropping in 2019 as Ripple initiated the pause of programmatic sales in mid-2019. Announcing the plans in June, Ripple was expecting that XRP sales would would fall significantly:

“In the short term, this means Ripple’s sales of XRP in Q2 2019 will be substantively lower (as a percentage of reported volume) than in the previous quarter—with our stated target of 20bps for programmatic sales of XRP volume, as reported by CoinMarketCap, likely dropping to less than 10bps. Longer term, by being more demanding about our expected standards for market structure and reporting, we hope to begin raising the bar industry-wide.”

As Ripple started to reduce the amount of programmatic sales in Q3, the company subsequently saw a notable decline of total XRP sales.

In Q2 2019, Ripple’s programmatic sales accounted for nearly 60% of XRP sales that quarter, at $144 million out of the $251 million total. In Q3, programmatic sales comprised 25% of total token sales, weighing in at over $66 million.

Finally, Q4 2019 appears to be the first quarter when Ripple has finally got rid of programmatic sales altogether, focusing solely on over-the-counter (OTC) sales. As such, total XRP sales in Q4 2019 only included OTC sales or institutional direct sales.

XRP sales in Q3 and Q4 2019. Source: Ripple

What are programmatic sales and why did Ripple decide to pause them?

While Ripple does not explicitly define the term of a programmatic sale on its website, the company notes that such sales are associated with passive trade execution. The company purportedly decided to temporarily pause its programmatic sales as part of their effort to address the issue of misreported trading volumes on cryptocurrency markets. Ripple wrote in July 2019:

“Ripple’s programmatic XRP sales have been done with the goal of minimizing market impact. The company did this through limiting XRP programmatic sales to what it considers a small percentage of traded volume, which was executed across multiple exchanges. Ripple relies on programmatic sales partners who mainly execute trades passively; their trading volumes do not vary based on changes in the price of XRP, but they do increase as overall XRP trading volumes increase.”

As part of the initiative, Ripple also shifted to a “more conservative volume benchmark” for XRP sales, moving away from CoinMarketCap to CryptoCompare Top Tier.

Cointelegraph has reached out to Ripple for commenting on its decision to eliminate programmatic sales, but has not received a response as of press time. This story will be updated should they respond.

Ripple called 2019 its strongest year of growth

The XRP price was also decreasing in 2019, dropping 42% from $0.364 on Jan. 1, 2019 to $0.183 in December, marking a two-year low.

The situation has been intensified by growing concerns over the unclear regulatory status of XRP after Ripple faced a class-action lawsuit alleging that it held an unregistered sale of securities.

On Jan. 13, the chairman of Commodity Futures Trading Commission said that the status of XRP is still unclear, while expressing confidence that Bitcoin (BTC) and Ether (ETH) are commodities. On top of that, the Coinbase-backed Crypto Ratings Council, a group of major United States’ cryptocurrency firms seeking regulatory clarity, believes that XRP is likely to be a security, based on its rankings for digital assets.

At press time, XRP is trading at $0.219, down nearly 4% over the past 24 hours, following a major downward trend on markets.