White House crypto czar David Sacks said banks and crypto companies will ultimately merge into “one digital asset industry” once Congress passes the long-delayed market structure bill.

The comments came during an interview on CNBC’s Squawk Box on Wednesday at the World Economic Forum (WEF) in Davos, Switzerland, where Sacks was asked about the negotiations around the proposed CLARITY Act, a market structure bill that has stalled amid debate over whether stablecoin issuers should be permitted to offer yield.

Sacks said the yield debate has become the primary obstacle to advancing the legislation, but noted that lawmakers, banks and crypto companies must compromise to get a market structure bill to US President Donald Trump to sign into law.

He pointed to the GENIUS Act as an example, noting that the bill failed multiple times before ultimately becoming law, adding that banks should recognize that yield is already a feature within the legislation.

Sacks also urged the crypto industry to “see the bigger picture,” saying that he understands “yield is philosophically important to them, but so is getting an overall market structure bill,” Sacks said, adding:

After the bill passes, the Banks are going to get fully into the crypto industry. So we’re not going to have a separate banking industry and crypto, it’s going to be one digital asset industry. Over time, the banks like the idea of paying yield because they’re going to be in the stablecoin business.

Related: Central banks vs Bitcoin: Who deserves the public’s trust?

The ongoing debate over the CLARITY Act

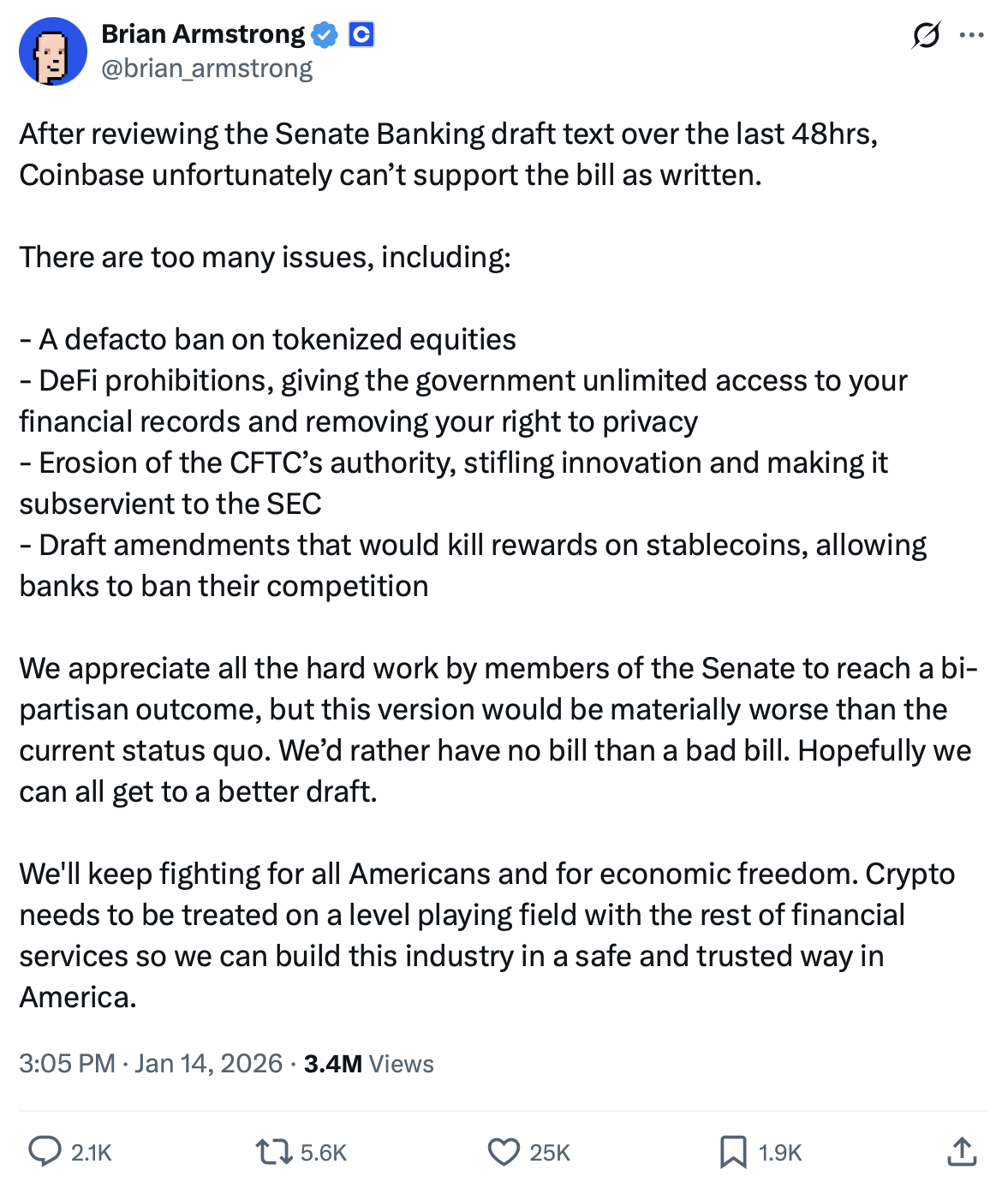

The dispute between traditional banks and crypto companies over whether stablecoins should be allowed to pay yield has simmered for months, but intensified last week when Coinbase publicly withdrew its support for the CLARITY Act.

Coinbase CEO Brian Armstrong said on X that there were “too many issues” with the current draft of the bill to support it, including eliminating stablecoin yields while insulating banks from competition.

Banks argue that allowing stablecoins to offer high yields could prompt a deposit flight from traditional bank accounts, potentially pulling trillions of dollars out of low-interest savings accounts.

While the US GENIUS Act, which became law in July 2025, prevented stablecoin yields from being offered by token issuers, third-parties such as Coinbase are still legally able to offer rewards.

On Tuesday, Armstrong told CNBC’s Squawk Box that since the bill has stalled in the Senate, “there’s an opportunity for us to come back and chat with the bank CEOs, and see what would create a win-win outcome here.”

Magazine: ‘If you want to be great, make enemies’: Solana economist Max Resnick