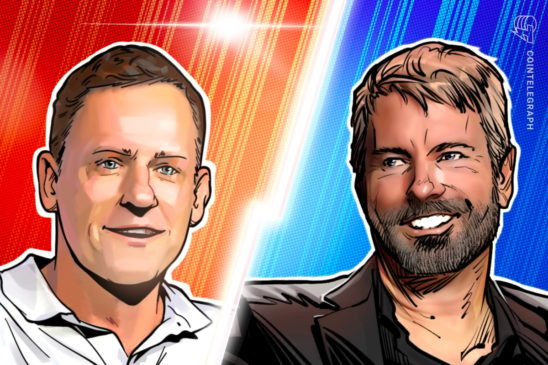

Tech billionaires Peter Thiel and Michael Saylor are establishing crypto company treasuries, but some financial observers note that their strategies could pose significant risk.

Both Thiel and Saylor have poured substantial capital into cryptocurrencies through their respective firms and investment vehicles: Saylor, with his software firm Strategy’s frequent Bitcoin (BTC) buys, and Thiel, through venture capital investments in crypto firms, and his exchange, Bullish, which went public earlier in August.

Each is not only seeking to expand his holdings but also how the cryptocurrency industry is shaped and regulated. But there are still significant differences in their respective strategies and outlooks regarding crypto, and companies that decided to form crypto treasuries could be inviting a “death spiral” when prices crash.

Thiel and Saylor have differing crypto investment strategies

Michael Saylor, co-founder and chairman of software company Strategy (formerly MicroStrategy), has created waves in the financial world through what has been dubbed an “infinite money glitch.”

The “glitch” refers to Strategy’s approach to buying Bitcoin, wherein it issues stock or equity-linked securities to buy Bitcoin and then holds the asset on its balance sheet.

Normally, issuing more equity would devalue the stock’s price, but large Bitcoin purchases increase BTC’s price, subsequently increasing Strategy’s valuation and allowing it to issue more debt.

And the cycle continues.

The strategy has been so successful for Strategy that it has gained a host of imitators. The term “Bitcoin treasury company” is growing increasingly common in the financial world, with 174 public companies reportedly holding Bitcoin, according to BitcoinTreasurys.net.

Saylor’s crypto strategy concentrates solely on Bitcoin, namely, accumulating the largest portion of the cryptocurrency as possible, and contains a nearly metaphysical characterization of the asset.

In 2020, he wrote that Bitcoin “is a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth, exponentially growing ever smarter, faster, and stronger behind a wall of encrypted energy.”

In a speech at the Bitcoin Policy Institute in March, Saylor said Bitcoin was a “Newtonian network,” the control of which was necessary for the US to maintain global power.

He further suggested that an aggressive Bitcoin accumulation strategy from the US government could erase the national debt and suggested in other interviews that a national Bitcoin reserve is “manifest destiny for the United States.”

Thiel’s strategy, while less groundbreaking, is more diverse. In February 2025, Founders Fund, a VC firm co-founded by Peter Thiel in 2005, which backed firms like SpaceX, Palantir and Facebook, invested $100 million in Bitcoin and another $100 million in Ether (ETH).

Which crypto investment strategy will prove more effective in the long run:

A) Michael Saylor’s Bitcoin-only approach

B) Peter Thiel’s diversified strategyShare your thoughts in the comments 👇👇👇

— Cointelegraph (@Cointelegraph) August 26, 2025

The Founders Fund owns 7.5% of ETHZilla, a biotech firm that transformed into an Ether investment vehicle, as well as a 9.1% share in BitMine Immersion Technologies, which Founders Fund helped raise $250 million in ETH.

Thiel has also backed a cryptocurrency exchange, Bullish, that went public on Aug. 19, receiving a $1.15-billion valuation settled across several stablecoins, including USDC (USDC) and PayPal USD (PYUSD).

He is clearly invested in the crypto space and is optimistic about its growth, but Thiel has also shown some more measured skepticism, particularly regarding Bitcoin. Far from Saylor’s “swarm of cyber hornets serving the goddess of wisdom,” Thiel previously wondered whether the asset isn’t at least “in part a Chinese financial weapon against the US.”

“It threatens fiat money, but it especially threatens the US dollar, and China wants to do things to weaken it so China is long Bitcoin, and from a geopolitical perspective, the US should be asking some tougher questions about exactly how that works.”

In short, Thiel’s approach offers a more cautious and diversified exposure to cryptocurrencies, while Saylor takes an aggressive, direct exposure, all-in-on-Bitcoin strategy.

Bitcoin treasury companies on the rise: Is it a bubble?

The crypto industry may soon find out which strategy will win. In recent weeks, the Bitcoin treasury model championed by Saylor has been losing steam.

The model’s thesis of “raise capital, convert to Bitcoin and wait for appreciation” may be fairly straightforward, but it leaves the company vulnerable to the notorious volatility of Bitcoin markets.

If the price of BTC dips too close to the Bitcoin-per-share metric, or net asset value (NAV), of a company’s stock, that stock loses the valuation buffer that was supposed to lift its stock price.

This can lead to a supposed “death spiral” in which, as a company’s market cap shrinks, so does its access to capital. Without anyone to buy the company’s equity or any lenders, the firm cannot expand its holdings or refinance existing debt. Should a loan mature or a margin call come, forced liquidations will follow.

Strategy’s NAV currently clocks in at 1.4 times its share price. It was nearly double the share price in February, when Carnegie Mellon University finance professor Bryan Routledge told Fortune, “There’s no rational explanation for that difference.”

Strategy investors, therefore, face risk not only from fluctuations in Bitcoin’s price but from “whatever is driving this difference between the net asset value and the price of the shares … That extra component is an extra source of risk.”

In recent weeks, the Strategy stock price has slumped along with BTC, but Saylor’s BTC-buying runs continue unabated. The company bought 3,081 BTC for $356.9 million over the week ending Aug. 24.

Market conditions may be relatively steady for now, and policy from the White House remains firmly pro-crypto. But crypto winters always come, and when they do, the market will see which strategy survives.

Magazine: The one thing these 6 global crypto hubs all have in common…