The United States securities regulator has handed down nearly $4 million in fines to crypto exchange Coinme for allegedly offering unregistered securities and giving “misleading statements” on its crypto token UpToken (UP).

On April 28 the Securities and Exchange Commission (SEC) said it settled charges against Coinme, its subsidiary Up Global SEZC and the CEO of both firms, Neil Bergquist.

Up Global agreed to pay a $3.52 million penalty, for which Coinme was also liable. Separate penalties against Coinme and Bergquist of $250,000 and $150,000 respectively were also leveled, which both have agreed to pay.

In its order, the SEC alleged Coinme, Up Global and Bergquist’s Initial Coin Offering (ICO) of UP between October to December 2017 was an investment contract under the Howey test and were subsequently unregistered securities offerings.

The ICO raised around $3.6 million to expand the amount of Bitcoin (BTC) ATMs in Coinme’s fleet, with which it added 30 ATMs using ICO funding. UP holders received benefits such as discounted fees and a 1% cashback paid in UP when using the ATMs.

In January 2019, Coinme changed its offering and partnered with Coinstar to use its cash-counting kiosks to facilitate cash-to-crypto transactions rather than its own ATMs. By July 2019 Coinme shut down all of its own ATMs.

“There is currently no use for UpToken, and UpToken holders can no longer use UpToken to obtain the benefits that were described in the UpToken offering materials.”

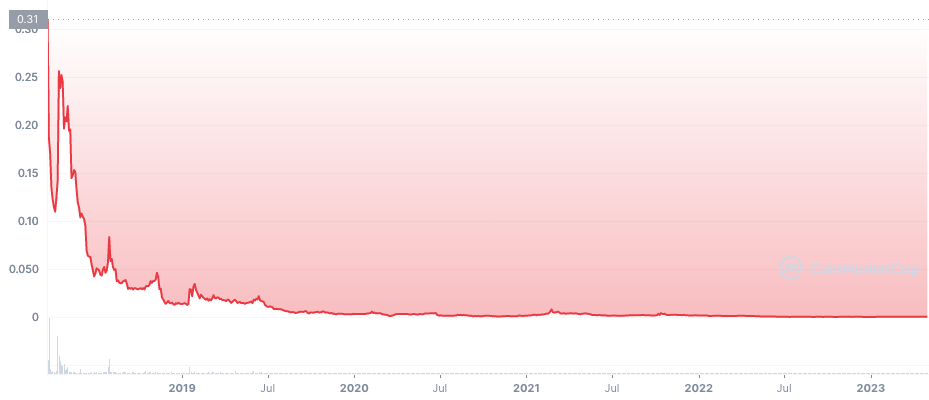

The price of UP has seen a significant drawdown since, with its market cap also falling to around $50,000 and 24-hour trading volumes topping just over $180.

Bergquist and Up Global also made “false and misleading statements” about the demand for UpToken and the amount raised in the offering, according to the SEC.

Up Global said Coinme’s purchasing of UP to fund its ATM rewards program would create constant demand for the token, but the SEC said:

“Bergquist and Up Global took steps before and throughout the ICO to obtain an UpToken supply that would substantially reduce Coinme’s need to purchase UpToken after the ICO for the ATM rewards program.”

The SEC claimed that Coinme sent 160 BTC, worth over $1 million at the time, to an Up Global wallet used to receive investor funds in the ICO. Up Global sent back around 14.5 million UP at a discount to Coinme, and the transaction “knowingly or recklessly” created the impression that a third party made a large purchase.

Related: Rep. McHenry announces hearings to address market structure around crypto

In another example, it was claimed Bergquist negotiated a 500 Bitcoin round-trip transaction of UP tokens with an unnamed Hong Kong company, with Coinme borrowing the funds to purchase further UP at a discount. The transaction was also used to create an impression of demand for the tokens.

The SEC said Bergquist didn’t admit or deny the regulator’s findings, agreed to settle the charges and was barred from acting as an executive of a public company for three years.

Cointelegraph contacted Coinme for comment but did not immediately receive a response.

Magazine: Crypto regulation — Does SEC Chair Gary Gensler have the final say?