As Silicon Valley Bank fails to reassure customers of its financial state, crypto-focused venture capital investors urge the firms to remove assets from the bank. Both stock and crypto markets are in the red, causing panic among traders.

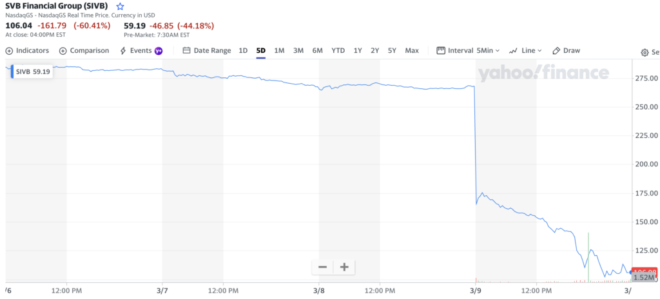

The announcement follows a dramatic decrease in the shares of SVB Financial Group, the bank’s parent business, which plunged by more than 60%. The loss came on the same day that the news was released.

Silicon Valley Bank announced a stock offering of $1.75 billion earlier this week, in addition to a separate purchase of $500 million common stock by private equity firm General Atlantic to shore up its balance sheet. This announcement caused investors to sell their shares, which led to the sell-off.

The shares of SVB Financial Group, the bank’s parent business, plunged by 60% immediately. Moreover, it has lost another 44% on March 10 pre-market trading.

Hedge funds urge investors to withdraw

According to a story published by Bloomberg, Peter Thiel’s Founders Fund has recommended to portfolio firms that they remove their cash from the failing Silicon Valley Bank.

Moreover, Pantera Capital, both a hedge fund and a venture investor, advises its portfolio companies to investigate the possibility of opening several accounts.

In addition to that, Bloomberg mentions five more venture capital investors in cryptocurrency have given similar advice to firms they have sponsored. Still, they have requested that their names not be used owing to the commercial sensitivities involved.

Will Sillicon Valley Bank collapse next?

With the failure of cryptocurrency-friendly Silvergate Bank earlier this week, SVB is having trouble at a time when cryptocurrency firms are already looking for other banking choices.

The proprietor of a web3 firm that asked to remain anonymous to talk openly disclosed that he had difficulty logging into his account. This problem has been brought to Twitter’s attention by several users.

SVB is the go-to bank for a significant number of venture-backed technology businesses located in the United States. According to its website, it has worked with more than 2,600 customers in the financial technology industry alone. Nevertheless, difficulties have arisen for the bank due to a downturn in the market for venture capital during the last year. According to a report from Bloomberg, SVB’s Chief Executive Officer Greg Becker advised customers to “remain calm” during a conference call earlier today.

Markets react to recent crashes

As of March 10, most cryptocurrencies were in the red, with bitcoin (BTC) down by 8% and ethereum (ETH) almost by 9%.

Huobi’s HT token was a top loser (-18% in 24 hours) for other reason. Earlier today it flash crashed losing 90% in price and soon recovered. Justin Sun, the founder of Huobi, explained that the crash may have resulted from leveraged liquidations caused by a “few users”, triggering a chain reaction of forced liquidations in the spot and contract HT markets.