In an analysis shared on X, popular crypto analyst Gum (@0xGumshoe) is projecting that Solana (SOL) could ascend to $500 by the conclusion of this bull run. This bullish forecast hinges heavily on the outcome of the US presidential election, slated for November 5th, and the potential policy changes that could follow.

Solana Price Prediction For This Bull Run

@0xGumshoe initiated his forecast with a bold declaration: “SOL TO $500. The upcoming US elections will affect SOL more than any other token. Here’s why I’ve changed my price target.” Delving into the potential scenarios, @0xGumshoe examined the implications of both possible election outcomes—whether Kamala Harris secures the presidency or Donald Trump returns to office. Each scenario presents distinct pathways for Solana’s trajectory.

Related Reading

In the event of a Kamala Harris victory, @0xGumshoe anticipates a mixed impact on Solana. He noted, “BTC and SOL have outperformed during Biden/Harris,” pointing especially to the performance of the past year under the current administration. The approval of the spot Bitcoin and Ethereum Exchange-Traded Funds (ETFs) during the Biden/Harris tenure is highlighted by the analyst as a positive factor that could continue to benefit Solana. Additionally, Harris’s supposed commitment to a “less aggressive stance towards crypto” regulation suggests a more favorable environment for the growth of Solana.

However, @0xGumshoe also cautioned about potential challenges under a Harris administration. He remarked, “Less regulatory clarity” and a potential new term for SEC Chair Gary Gensler could complicate things for Solana. Furthermore, the possibility of a spot Solana ETF facing rejection and an increase in Bitcoin dominance might overshadow altcoins.

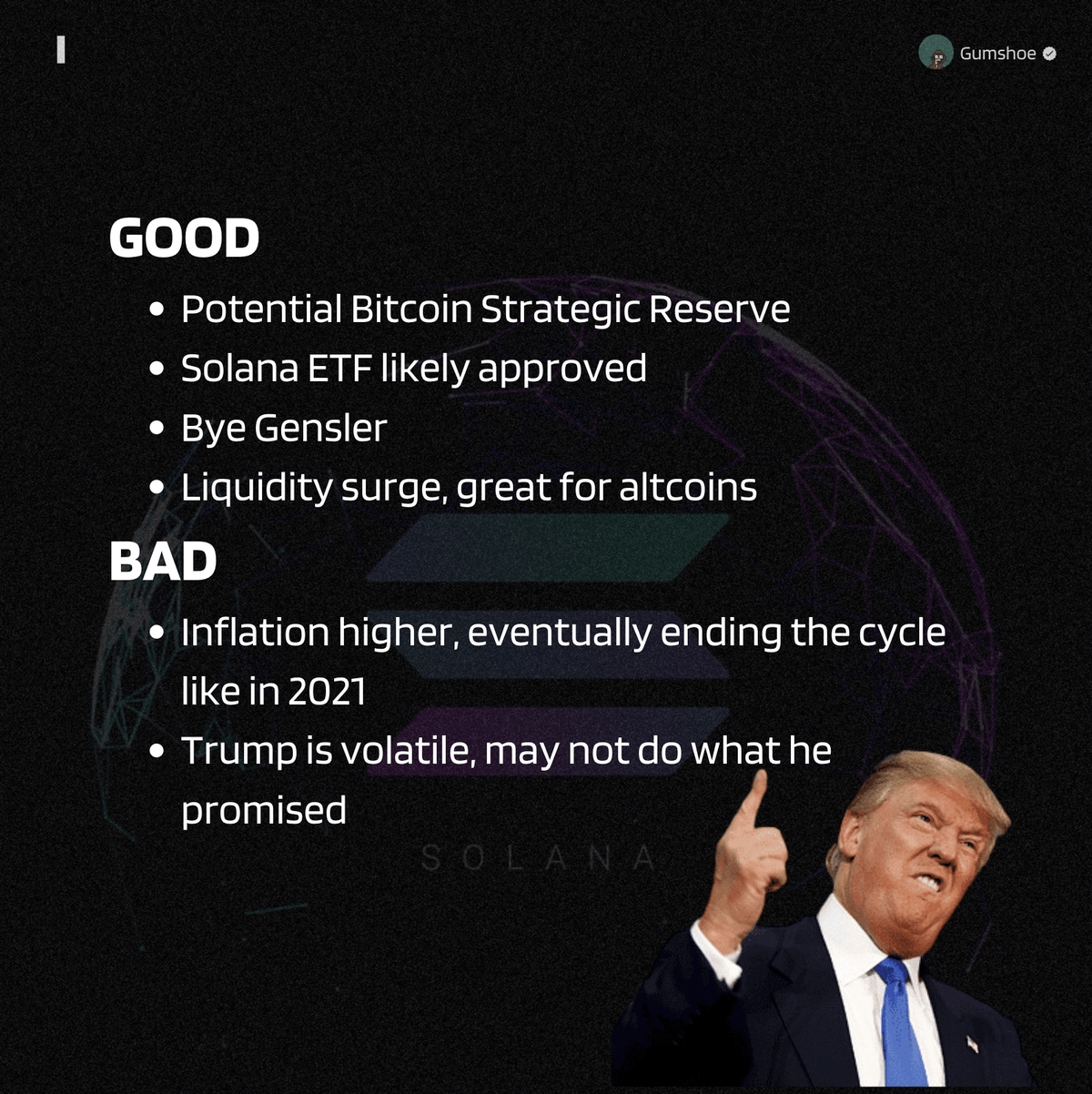

Conversely, @0xGumshoe presented a more bullish outlook if Donald Trump wins the election. He asserted, “A Trump win will send Solana to ATHs as the market realizes a SOL ETF will be coming.” The analyst emphasized that unlike Bitcoin and Ethereum, Grayscale is unlikely to offload significant amounts of Solana, which could help sustain its price. Additionally, the analyst points to the possibility of establishing a Bitcoin Strategic Reserve and the departure of SEC Chair Gary Gensler as bullish catalysts for SOL.

Related Reading

However, a Trump victory could also have downsides. @0xGumshoe acknowledged that “higher inflation could eventually end the cycle like in 2021.” Furthermore, he noted Trump’s inherent volatility, stating that the former president “may not do what he promised,” which introduces an element of unpredictability to the projections.

In light of these scenarios, @0xGumshoe revised his selling targets for Solana. Previously advocating for a $300 sell target, he now contemplates a higher threshold of $500, contingent upon a Trump win and an increase in macro liquidity. He explained, “If we pair up a Trump win and increase macro liquidity, I will instead sell over time for as long as I believe we hit $500.”

The rationale behind the $500 price target is anchored in Solana’s fully diluted valuation (FDV). @0xGumshoe articulated, “At that price, Solana would have a $291B FDV which would put it at the current ETH market cap.” He views this valuation as a significant benchmark, suggesting that Solana’s price could approach Ethereum’s market capitalization unless there is a substantial influx of investments through ETFs, which could propel the token beyond this threshold.

Under the Harris administration, @0xGumshoe’s price target for Solana remains at $300. @0xGumshoe concluded his analysis by advising caution, stating, “The elections alone are not enough to predict tops for Solana so take this with a grain of salt. Whatever happens, it is quite obvious that SOL will go far higher with Trump than Harris.”

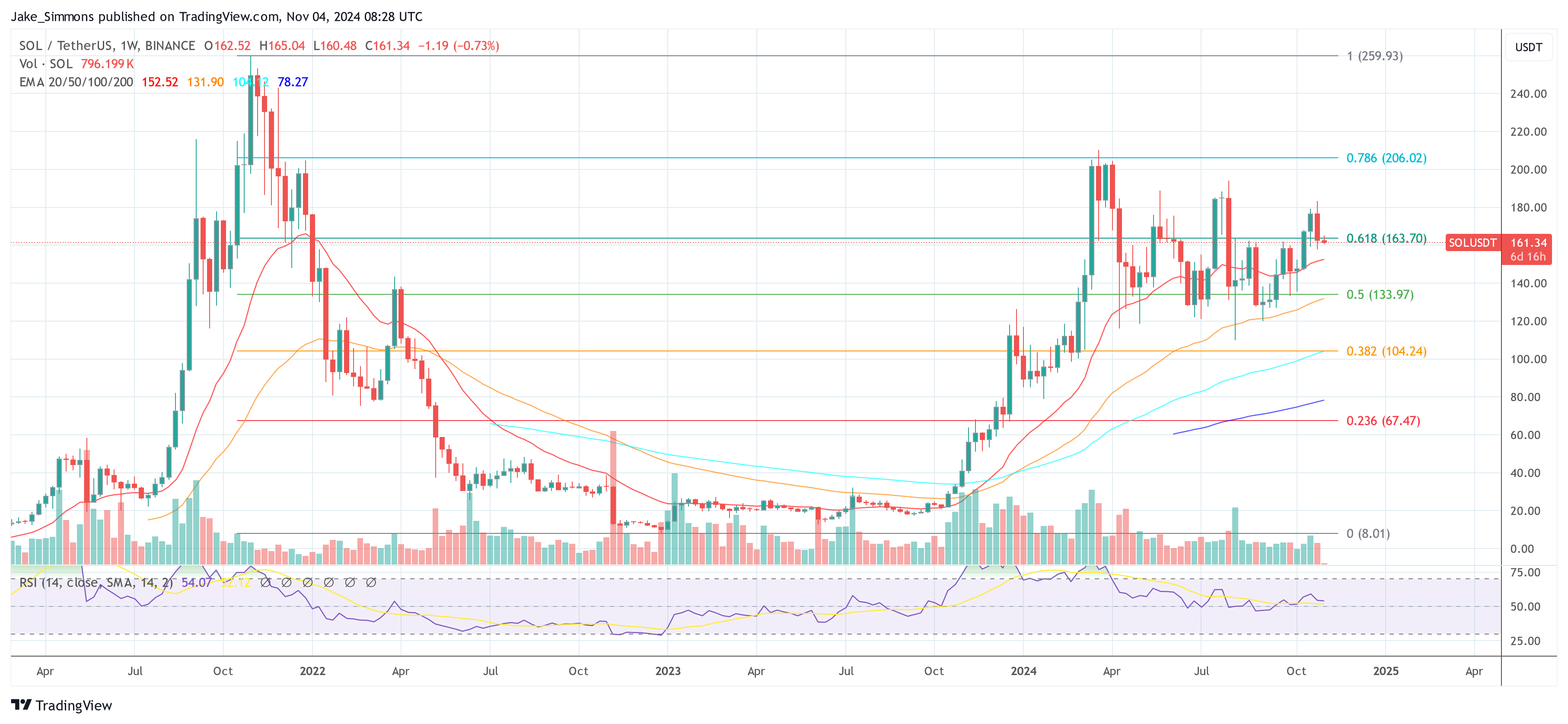

At press time, SOL traded at $161.

Featured image from Coinbase, chart from TradingView.com