Solana gained nearly 6% on Friday, rallying alongside Bitcoin, as the largest cryptocurrency regains $80,000 as support. However, the total value of assets locked in the Solana chain is down $5.26 billion from its peak, a nearly 50% drop. TVL represents demand and relevance for a chain, meaning Solana is negatively affected by the shifting market dynamics.

Solana-based meme coins considered the catalyst driving gains in SOL (SOL) this market cycle, are struggling to recover as traders turn fearful.

State of Solana

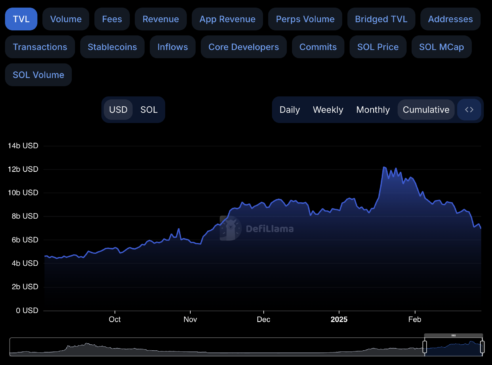

The total value of assets locked is a key metric used in DeFi to track investor confidence, a chain’s relevance, and demand among crypto traders. TVL tracked on DeFiLlama shows that Solana is slowly losing relevance in the ongoing crypto market cycle.

SOL TVL is down from its peak of $12.191 billion to $6.939 billion at the time of writing. This marks a nearly 50% drop in TVL of the chain. One of the leading catalysts behind the decline is the crash of meme coins on the SOL chain.

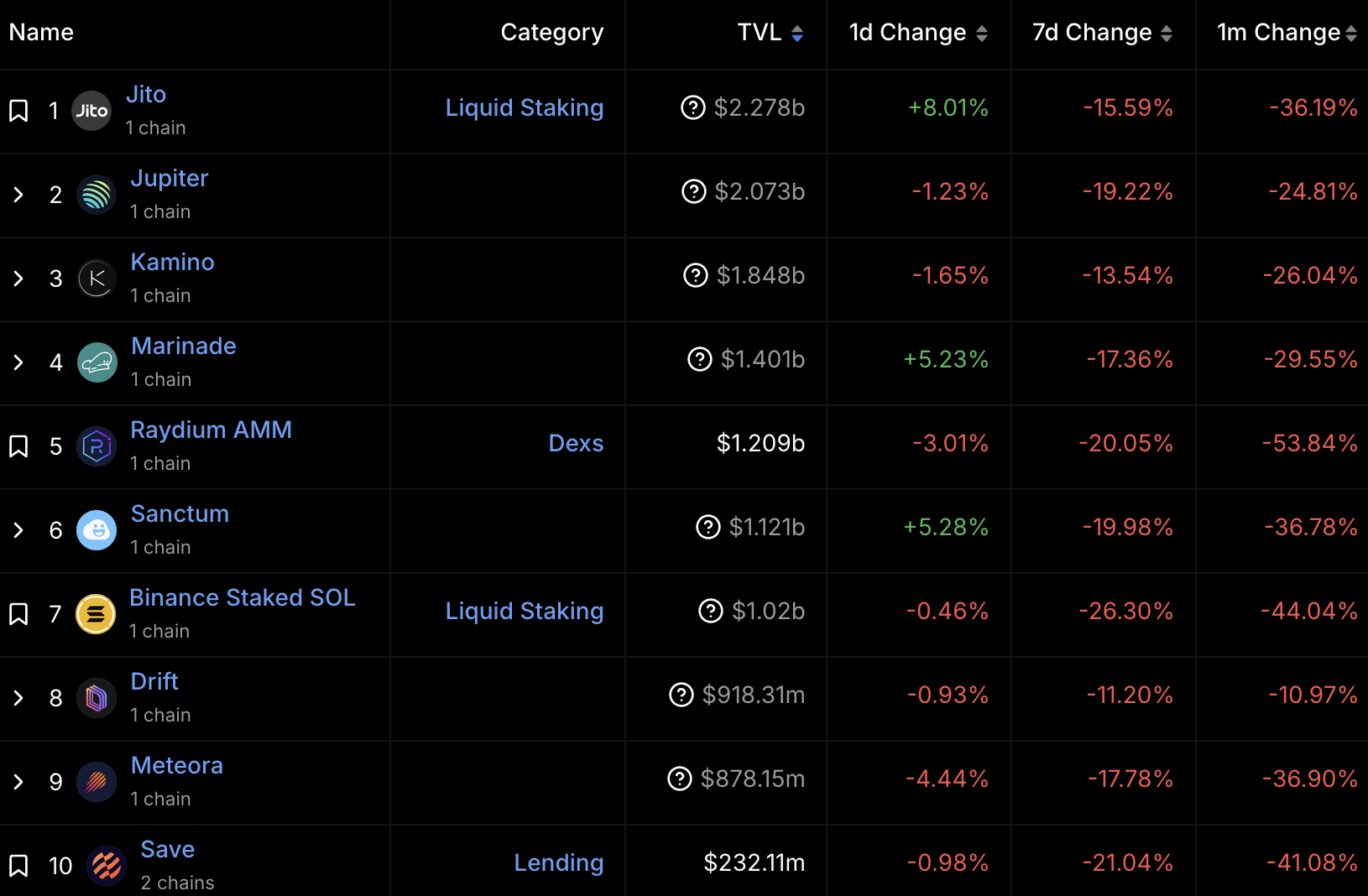

In the past month, the top 10 protocols on the Solana blockchain erased up to 40% in TVL. The top three catalysts influencing this change are Bitcoin’s flash crash, meme coin controversies surrounding MELANIA (MELANIA) token and LIBRA meme coin (LIBRA), price decline in Official Trump (TRUMP) token, and crypto traders turning risk-averse in response to U.S. macroeconomic developments.

The three market movers have contributed to capital outflows from the top 10 Solana protocols and leading meme coins on the SOL chain. DeFiLlama shows the 1-day, 7-day and 1-month change in TVL across Jito, Jupiter, Kamino, Marinade, Raydium, Sanctum, among other chains.

Solana meme coin market analysis

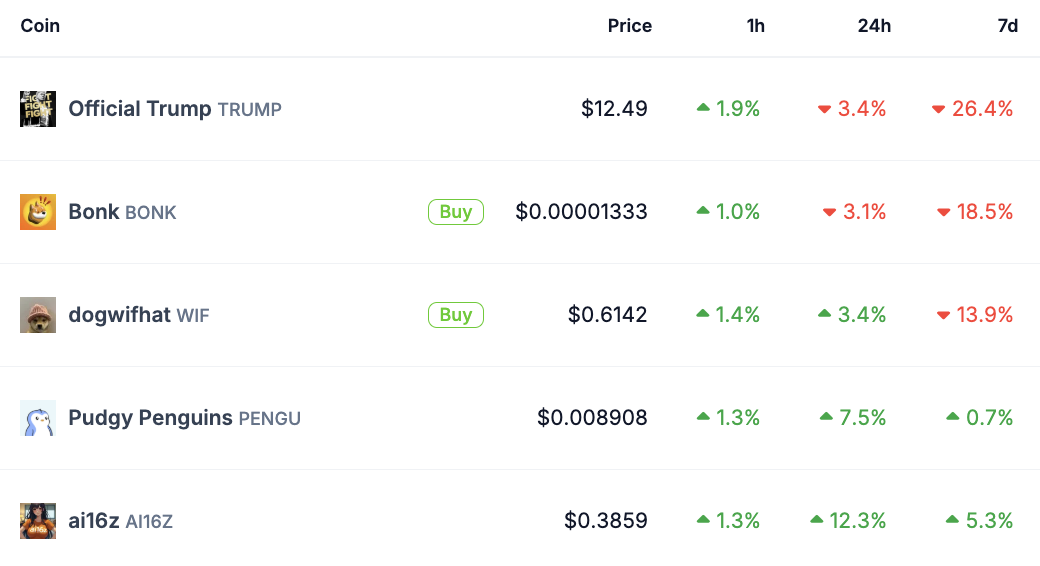

On CoinGecko, the Solana meme token category metrics show a slight recovery. Market cap of all tokens in the category has climbed to $8.949 billion. Two among the top five Solana-based memes have yielded negative returns in the past 24 hours, TRUMP and Bonk (BONK).

The other three, Dogwifhat (WIF), Pudgy Penguins (PENGU) and ai16z (AI16Z) have started their recovery in the past day. More than half of the Solana-based meme coins were corrected in double-digits in the last seven days.

The stats suggest there is a shift in market dynamics and both capital and attention of traders are shifting from the “meme coin” sector to other categories of crypto tokens.

Bitfinex analysts evaluated the recent events in the market and observed that the launch of a meme coin associated with the U.S. President, albeit one that led to significant losses and a liquidity drain across other meme coins on the Solana network, is a negative catalyst for the category.

Market movers and Solana catalysts

The world’s largest futures exchange, the CME Group announced the launch of Solana futures, a bullish development for the Ethereum competitor. The news comes after MetaMask’s roadmap release where the browser-based cryptocurrency wallet discusses the addition of native Solana support, in May 2025.

Solana is the first non-EVM chain supported by the browser wallet and it adds the functionality to buy, sell, swap and interact with dApps across the entire SOL ecosystem. All existing users of the chain will get access to the same features of MetaMask that Ethereum users enjoy alongside other chains supported by the wallet.

Bitcoin’s recovery and BTC regaining $80,000 support after a flash crash on Friday is one of the key drivers in the crypto market. Solana and Bitcoin enjoy a 0.83 correlation in the three-month timeframe. Bitcoin’s price changes therefore influence the Solana price trend.

Bitcoin’s re-test of support at $95,000 and a rally towards the $100,000 milestone are the two developments that could positively impact Solana price trend in the coming weeks, while the tokens are heavily correlated.

SOL on-chain analysis

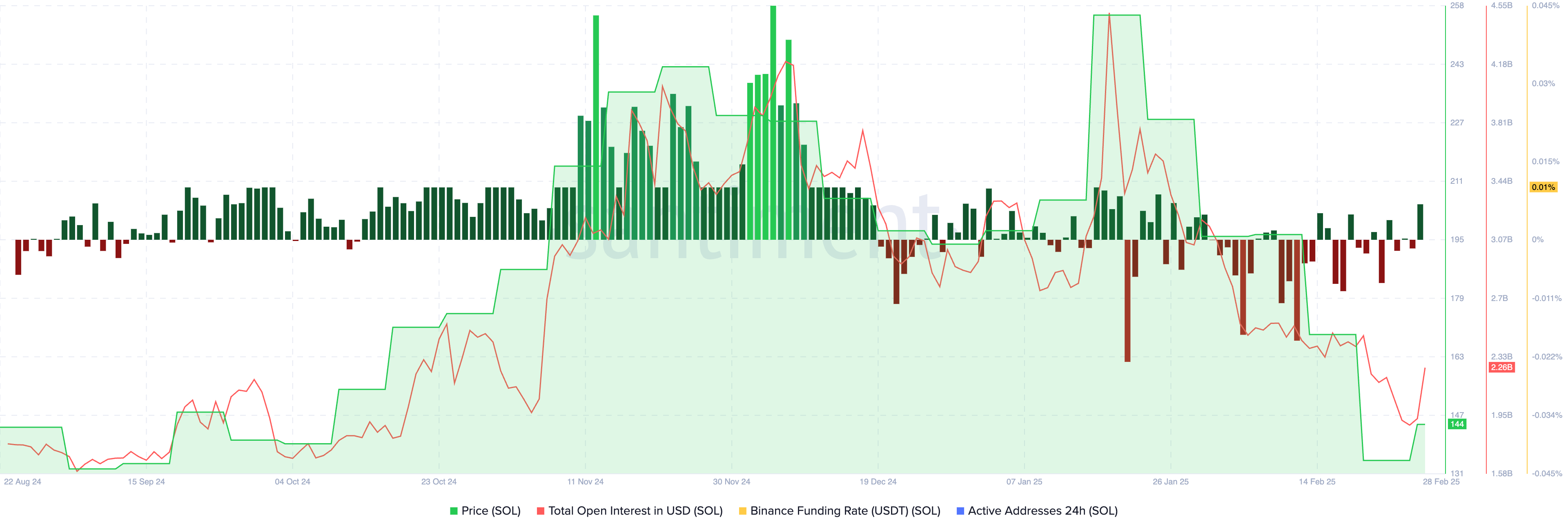

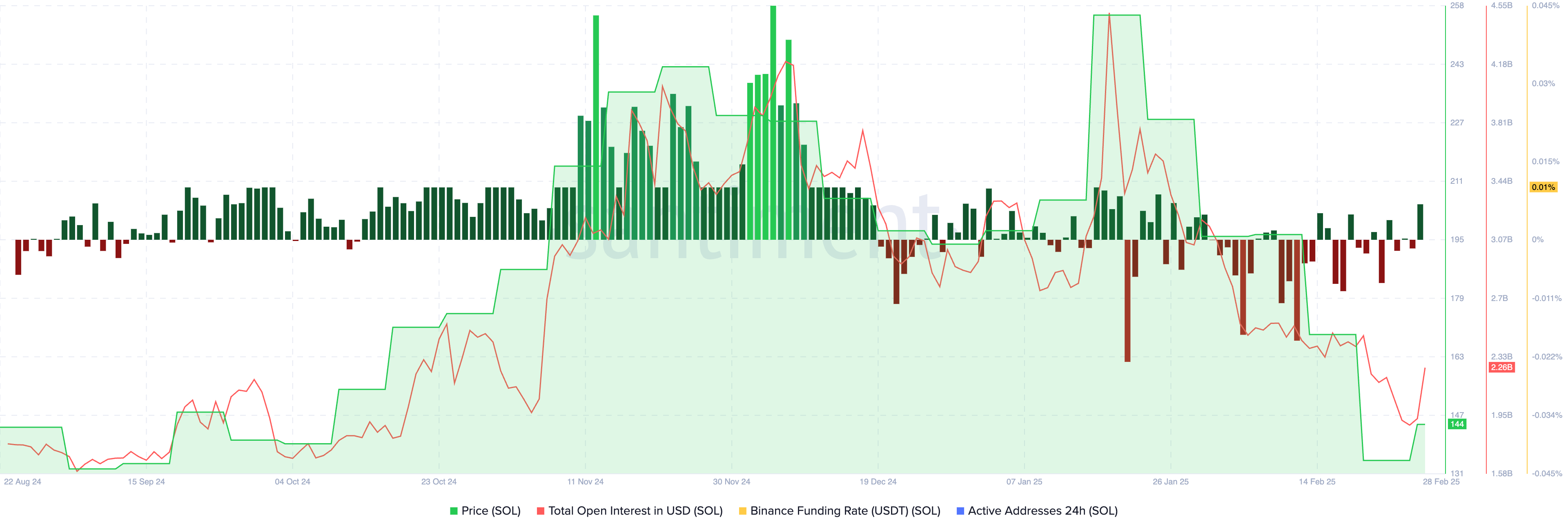

Solana’s on-chain metrics show signs of recovery in the token in the coming weeks. After several days of negative funding rate on Binance, Solana observes positive funding or a bullish bias among derivatives traders on Friday.

The total open interest, a metric that tracks the value of all open derivatives contracts in Solana, rises, climbs to over $2.26 billion on February 28. SOL price recovered after weeks of downward trend, up nearly 6% on the day.

The rising open interest and positive funding rate are supportive of a bullish thesis for Solana’s recovery in the medium to short-term.

Solana price forecast

Solana could break its multi-month downward trend with a daily candlestick close in the resistance zone between $147.09 and $166.42. These two levels mark the upper and lower boundary of a fair value gap, an inefficiency in the market. Once SOL breaks past the resistance zone, the next key level for traders is resistance at $180.

The $180 level has acted as support for nearly three months, making it a key level for SOL. A daily candlestick close above this level could prepare Solana for a retest of the $200 level, a key milestone for SOL.

Technical indicators on the daily timeframe, RSI, and MACD support the thesis. RSI reads 32 and is sloping upwards, above the “oversold” zone for Solana. MACD shows waning negative momentum underlying SOL price trend.

Ryan Lee, Chief Analyst at Bitget Research commented on Solana’s recent price action, the recent events like Bybit hack and Bitcoin ETF outflows. Ryan Lee shared the following comments with Crypto.news in an exclusive interview:

“Trump’s new tariffs on China, Canada, and Mexico have rocked the crypto market, driving Solana’s 40% TVL decline, worsened by the Bybit hack and over $2 billion in Bitcoin ETF outflows, reflecting weakened investor confidence and liquidity strain.

A bearish outlook suggests Solana faces stagnation if trade tensions escalate, inflation rises, or risk aversion intensifies. The trajectory hinges on Bitcoin’s price trend, China’s response, Federal Reserve actions, and whether Trump’s regulatory support counterbalances macroeconomic headwinds. Critical developments are expected within the next 30 days, making this period pivotal for market clarity.”

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.