The past week has painted a vivid picture of shifting investor sentiment worldwide. While Bitcoin and the broader cryptocurrency market witnessed a significant outflow of funds from investment products like ETPs, ETFs and funds, Solana (SOL) emerged as a beacon of hope for altcoin enthusiasts.

A Dive Into The Numbers By Crypto Products

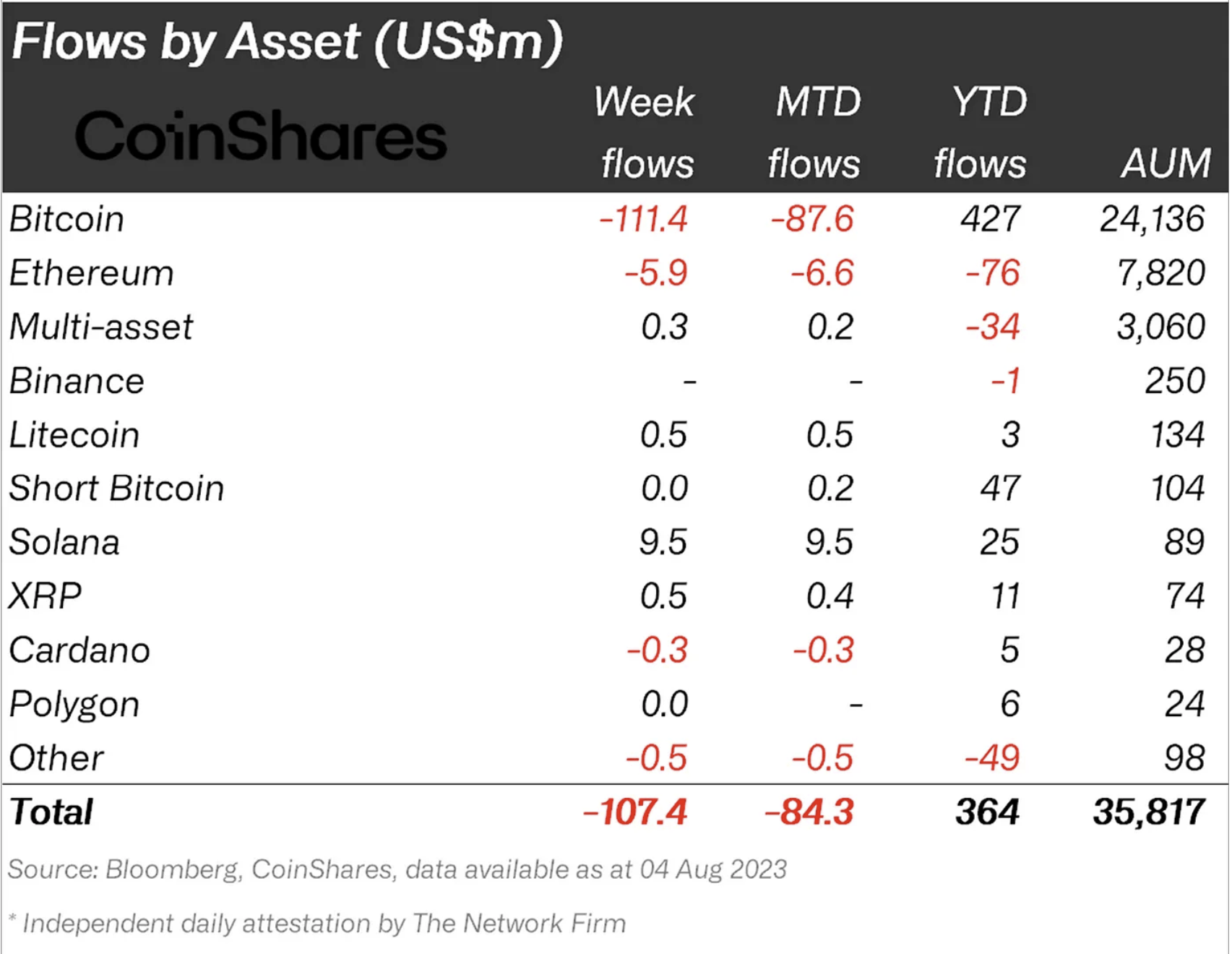

Digital asset investment products experienced a net outflow of $107 million this week, a figure that underscores the growing trend of profit-taking that has been evident in recent weeks. “Digital asset investment products saw outflows this week, totalling $107m with profit taking gathering pace in recent weeks,” James Butterfill noted in his recent report published in CoinShares’ blog.

Bitcoin, the de facto king of cryptocurrencies, bore the brunt of these outflows, seeing a staggering $111.4 million leave its coffers. This marks the “largest weekly outflows since March,” a time when US regulatory scrutiny began to intensify. Interestingly, for the first time in 14 weeks, the outflows into short bitcoin positions have also come to a halt.

Ethereum wasn’t spared either. The second-largest cryptocurrency by market capitalization saw outflows totalling $5.9 million, bringing the combined outflows for both Bitcoin and Ethereum to $117.3 million in just the past week.

Solana Is The Rising Star

Amidst this backdrop of outflows, Solana stood out, not just for its resilience, but for its impressive inflows. The altcoin witnessed the “largest inflows, totaling $9.5m, the largest single week of inflows since March 2022.” This surge in interest has propelled Solana’s Assets Under Management (AUM) to $89 million. With month-to-date inflows equalling $9.5 million and year-to-date inflows at $25 million, Solana is clearly on an upward trajectory.

To put this in perspective, Bitcoin has the largest AUM with $24,136 million, followed by Ethereum with $7,820 million and multi-asset investment products with $3,060 million. Litecoin ($134 million) and Bitcoin Short ($104) also have bigger AUM than Solana. However, Solana’s AUM has now surpassed that of established altcoins like XRP ($74 million), Cardano ($28 million), and Polygon ($24 million).

While Solana basked in the limelight, other altcoins had a mixed week. XRP and Litecoin registered modest inflows of $0.5 million and $0.46 million respectively. However, Uniswap and Cardano weren’t as fortunate, witnessing outflows of $0.8 million and $0.3 million respectively.

Regionally, the outflows were predominantly concentrated among two ETP providers in Germany and Canada, which saw outflows of $71 million and $29 million respectively.

SOL Price Analysis

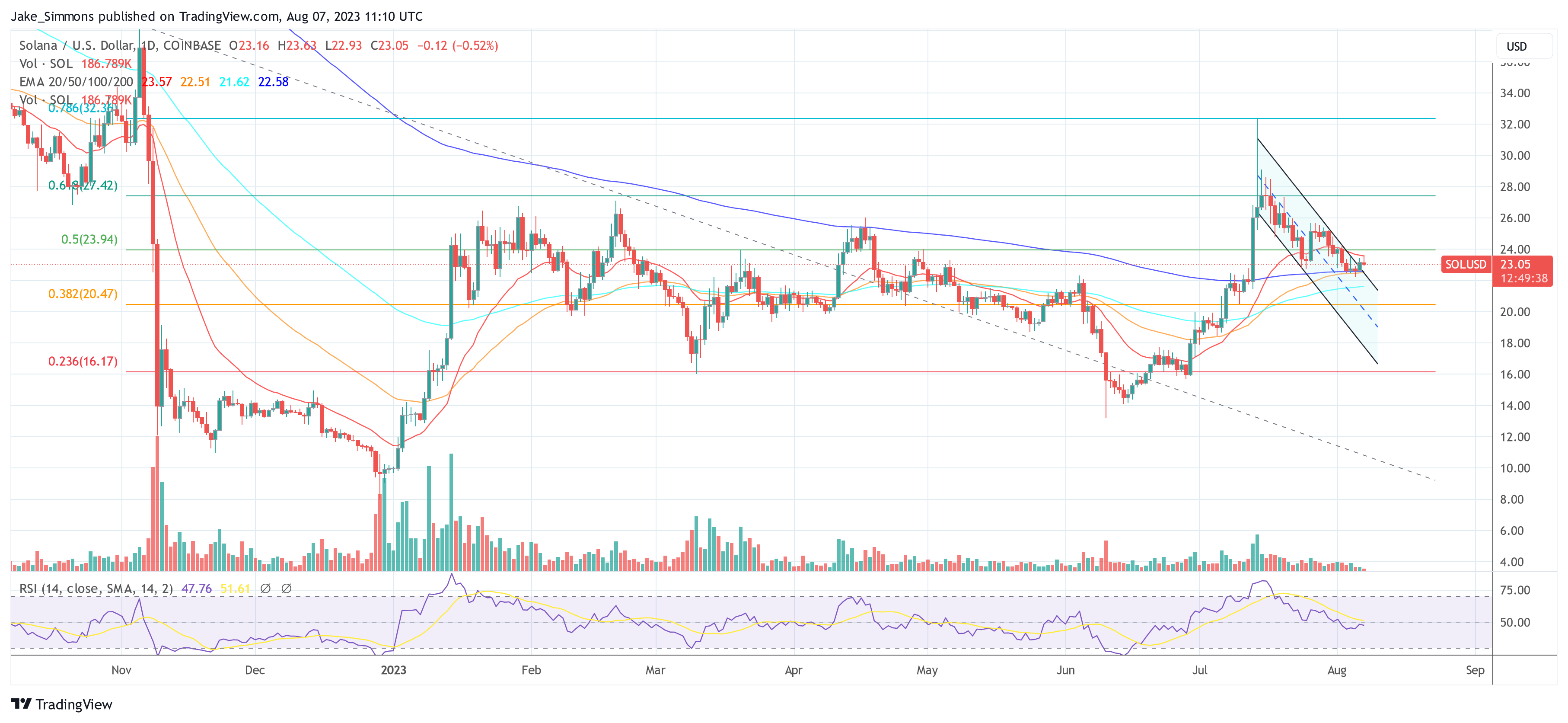

At press time, the Solana (SOL) price was trading at $23.05, above the 200-day EMA. If SOL manages to defend the 200-day EMA in the following days and confirm the breakout from the descending triangle, the chart looks very bullish. The next resistance level can be expected at the 50% Fibonacci retracement level ($24.00), before another move to the 61.8% Fibonacci level at $27.44 seems possible.

Featured image from iStock, chart from TradingView.com