Solana price has reclaimed the $100 territory on Jan. 18, but vital on-chain metrics are flashing signals of a prolonged rally toward $120.

Following the Bitcoin spot ETF approval verdict, Bitcoin dominance has waned as investors redirect capital towards the altcoin markets. In effect, Layer-1 projects, including Solana (SOL), Ethereum (ETH), and Cardano (ADA) have witnessed increased demand this week.

Solana network usage has hit a 2024 peak

Solana bulls have fiercely defended the $90 support level amid intense volatility in the cryptocurrency markets. At the time of writing on Jan. 18, SOL price is trading north of $103.

Vital on-chain data shows that Solana has substantially increased its fundamental growth metrics this week.

TokenTerminal’s active user count data tracks a blockchain network’s participation rate by aggregating the daily number of unique addresses that carry out valid transactions within a given period.

Solana’s daily active user count reached 429,162 addresses on Jan. 17, its highest in 2024. Notably, the last time Solana network activity reached these heights was Dec. 25, when the SOL price briefly crossed $126.

A closer look at the purple trend line in the chart above shows how Solana’s daily active user count has risen since Jan. 15.

An increase in daily active users on a layer-1 network like Solana is considered a strong bullish signal. Firstly, it indicates that SOL’s recent growth performance is driven by fundamental demand for products and services hosted on the Solana network rather than mere price speculation among swing traders.

More importantly, such a prolonged increase in network participation rate often evolves into a price rally as the new participants require the native token to deploy transactions.

If this thesis holds, SOL traders can anticipate a breakout towards the $120 area in the days ahead.

Solana node validators are pulling record profits

Furthermore, there has been a significant rise in fees paid to Solana proof of stake validators. This invariably affirms that Solana is currently experiencing a significant boost in network usage.

The chart below shows that Solana stakes received a total of $314,789 in fees on Jan. 14. But after three consecutive days of rising network demand, the fees soared to $519,885 at the close of Jan. 17.

The chart above clearly explains how rising network activity has seen fees accruing to SOL proof-of-stake validators increase significantly. Notably, stakers could now be incentivized to stake more SOL coins to capitalize on the rising fees.

If this scenario continues, that temporary reduction in Solana circulating supply will likely amplify the SOL price rally.

SOL price prediction: Can Solana price to reclaim $120?

From an on-chain standpoint, Solana price price uptick this week appears to be driven by the rising network usage. With these vital indicators still trending upward, SOL price looks poised to stage a rebound toward $120.

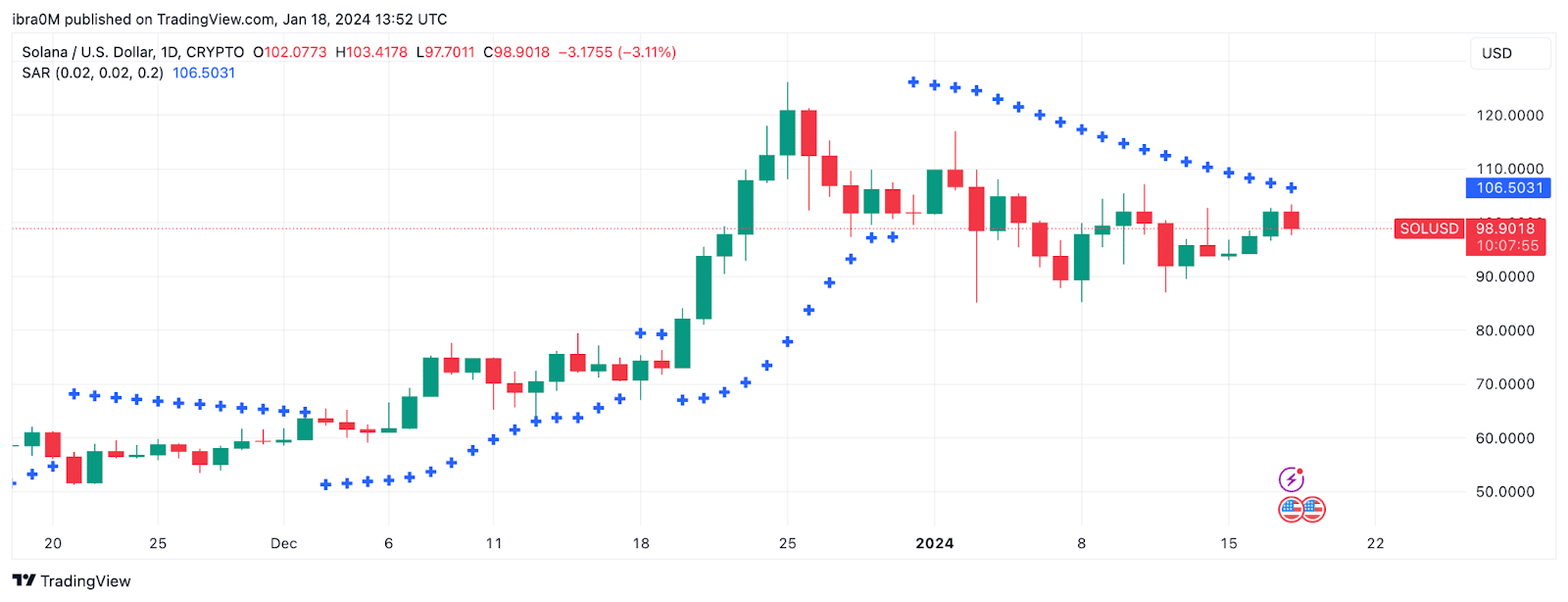

The parabolic stop and reverse (SAR) indicator affirms this bullish stance. This technical indicator examines historical trading patterns to identify potential reversal points in an asset’s short-term price trend.

As depicted below, the parabolic SAR dots for Solana currently point toward $106, well above the current SOL price of $98. When Parabolic dots point to a price level above the current market price, it suggests a growing bullish momentum.

If the bulls can garner sufficient momentum to break past that initial resistance at $106, a move toward $120 could be on the cards.

On the downside, the bears could negate this optimistic Solana price prediction if they force a downswing below $90. However, given the psychological significance of the price level, the bulls will likely make frantic efforts to cover their positions.

But with the network demand still rising, SOL price will likely avoid such a large downswing in the short term.