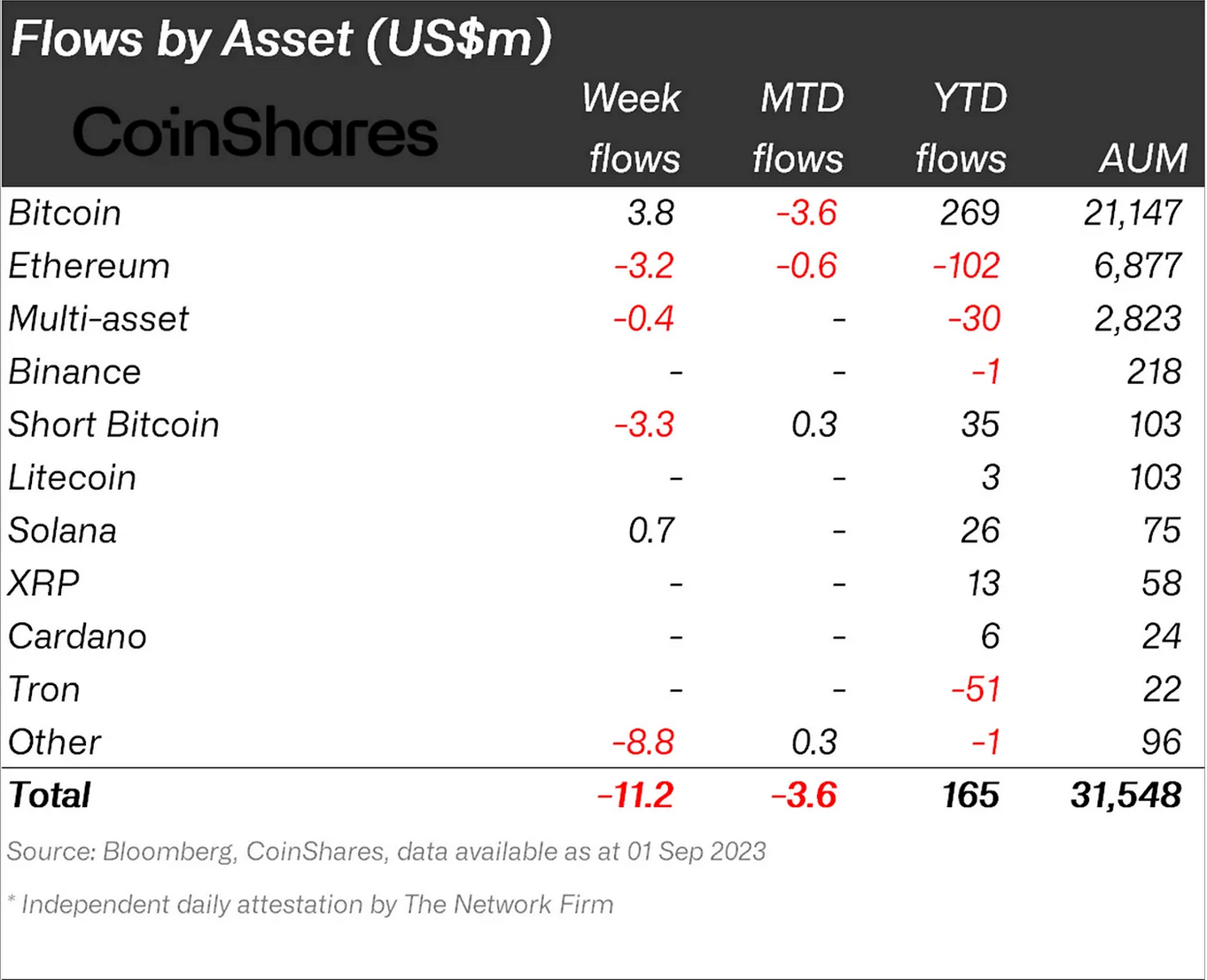

Solana (SOL) investment products clocked $26 million worth of inflows since the start of 2023, outpacing all other altcoins, including Ether (ETH), suggesting it’s the “most loved altcoin amongst investors” according to CoinShares.

In a Sept. 4 Digital Asset Fund Flows weekly report, CoinShares’ head of research, James Butterfill, noted that trading volumes for crypto investment products for the week ending Sept. 1 were 90% above the year-to-date average — with crypto product outflows dropping to $11.2 million.

It marks a seven-week run of negative sentiment that’s seen $342 million leave crypto products over that time but YTD, investment products remain net inflow positive at $165 million.

The outflows haven’t affected Solana products however, which saw weekly inflows of $700,000 — the ninth straight week in a row with inflows of $14.1 million over that time and YTD inflows of $26 million.

Bitcoin (BTC) products were the only other asset to see weekly inflows, totaling $3.8 million, while Short BTC, Polygon (MATIC) and ETH products all recorded weekly outflows.

Solana’s inflows come amid a streak of recent positive developments related to the network.

On Sept. 1, MakerDAO co-founder Rune Christensen submitted a proposal to build the project’s upcoming native chain off a fork of Solana’s codebase despite its long-held ties to Ethereum.

Related: Bitcoin ETF applications: Who is filing and when the SEC may decide

On Aug. 23 it was reported that Shopify added the Solana-based payment network Solana Pay to its payment options — starting with the stablecoin USD Coin (USDC).

The Solana network has also seen some performance and reliability improvements, with only one outage in 2023 so far.

SOL’s price is up around 95.5% YTD but has traded mostly sideways around $20 to $25 since mid-January. It was trading at around $19.5 as of 12 am UTC Sept. 5, according to Cointelegraph data.

However, SOL is down 92.5% from its November 2021 all-time high of nearly $260.

Magazine: BitCulture: Fine art on Solana, AI music, podcast + book reviews