Bitcoin (BTC) starts a new week in an uncertain place facing uncertain times — is $40,000 now resistance?

The largest cryptocurrency has just closed a fourth red weekly candle in a row, something that has not happened since June 2020.

As cold feet over the macro market outlook continues to be the norm, there seems little to comfort bulls as the week gets underway — and Bitcoin is not done selling off yet.

On the back of $4,000 in losses over the past four days alone, price targets now focus on retests of liquidity levels further toward $30,000.

It is not all doom and gloom — long-term hodlers and key participants such as miners are showing a more positive stance when it comes to Bitcoin as an investment.

With that in mind, Cointelegraph takes a look at the forces at work when it comes to shaping BTC price action in the coming days.

Asia woes overtake French election relief

The key external event for risk assets at the start of the week is the French election, this was won by incumbent Emmanuel Macron.

A sigh of relief for market players concerned about a surprise victory from far-right rival Marine Le Pen, Macron’s second term is expected to lift French stocks in particular on April 25’s open and the embattled euro along with them.

The European Union, much like the United States, faces a potent cocktail of inflation and plummeting bond markets, with the European Central Bank (ECB) nonetheless not yet taking decisive steps to raise interest rates or reduce its near $10 trillion balance sheet.

Bitcoin was unmoved at the Macron victory, and risk assets are already contending with an Asia downturn on April 25 as COVID-19 in China rattles sentiment.

The Hang Seng index in Hong Kong is down 3.5% on the day so far, while the Shanghai Composite has shed 4.2%.

With crypto en masse heavily correlated to stock market movements currently, a repeat performance by Europe and the United States would produce clear directional cues.

“The worry is the current policy support that the government has already put in place may not be effective because of the Covid policies as activities are subdued,” Jenny Zeng, co-head of Asia Pacific fixed income at global asset management firm AllianceBernstein, told Bloomberg.

Even before April 25’s losses, the past week was already painful for equities, as noted by markets commentator Holger Zschaepitz.

“Global stocks lost $3.3tn in mkt cap this wk as US equities — after peaking Thur morning — experienced steady fall lower as investors seem to reconsider why they have been buying risk assets in world filled w/so much uncertainty,” he told Twitter users on April 24:

“Global stocks worth $107.6tn, equal to 127% of GDP.”

A further post flagged the so-called Buffett Indicator — the ratio of total U.S. stock market valuation to GDP — still being in what he called “problematic” territory at over 100%.

Dollar strength is back with a vengeance

One component of the macro landscape firmly in bullish mode — to the chagrin of crypto traders — is the U.S. dollar.

The U.S. dollar currency index (DXY), after wobbling at two-year highs last week, now looks to be continuing its uptrend.

At 101.61 at the time of writing, DXY is challenging its performance from March 2020, when the Coronavirus crash sent assets worldwide tumbling.

Dollar strength has rarely been a boon for Bitcoin, and the inverse correlation, while criticized by some, appears to be firmly in control this month.

“Looks like the DXY dev announced a token burn or something,” popular trader Crypto Ed joked in response to the latest move.

For Preston Pysh, host of the Investor’s Podcast Network, something does not seem right.

“We got the BoJ implementing Yield Curve Control while the Yen is collapsing and we have the FED about to hike 50bps while the dollar is making new highs,” he warned on April 25″

“Something sure feels like it’s about to break…

Weekly chart prints fourth straight red candle

Bitcoin is looking anything but rosy on April 25. While the weekend managed to avoid significant volatility, the weekly close still disappointed, coming in at just under last week’s level.

This, nevertheless, means that there are now four red candles in a row on the weekly chart, something that Bitcoin has not seen since June 2020, data from Cointelegraph Markets Pro and TradingView shows.

The downtrend then continued overnight to see BTC/USD fall below $39,000, a position it maintains at the time of writing.

Traders are eyeing various chart features for clues as to where the pair is headed next, but bullish inklings are decidedly few and far between.

For popular trader and analyst Rekt Capital, it is the Ichimoku cloud looming overhead that would cause further losses for Bitcoin.

During Retest 1 #BTC fake-brokedown from the Cloud before reversing

During Retest 2 $BTC wicked sub-Cloud before reversing

Now retest 3 is in progress

BTC needs to reclaim Cloud as support

It’s crucial BTC doesn’t flip Cloud into resistance to avoid downside#Crypto #Bitcoin https://t.co/dDLtWwzuTn pic.twitter.com/NQfEbS3nAH

— Rekt Capital (@rektcapital) April 24, 2022

Popular analyst Cheds, author of Trading Wisdom, meanwhile, eyed a potential crossing under the 200-period moving average on the three-day chart.

This would be significant, he argued over the weekend, as the last time that this happened after a bull run was the bear market bottom of 2018.

“Not a prediction just an observation,” he cautioned.

On the topic of December 2018 and its $3,100 floor, Matthew Hyland, known as Parabolic Matt on Twitter, produced further comparisons between that period and the current BTC price action.

On longer timeframes, he said, holding $37,600 is now “crucial.”

#Bitcoin comparison of the 2018/2019 Bear Market Bottom compared to the current structure BTC has been in since January of this year

✅Similar Time Frame

✅Series of Lower Highs and Higher Lows

✅Creation of a higher high

✅Pullback after first higher highCrucial $37.6k Holds pic.twitter.com/kzQhvZUTMr

— Matthew Hyland (@MatthewHyland_) April 23, 2022

“Looking for that sweep down, at which point i will then be looking for signs of a relief rally to play off from,” fellow Twitter pundit Crypto Tony added on April 25 as part of his own analysis.

Hodlers put in a new record

The “choppy” nature of lower timeframe price action on Bitcoin makes it an uninspiring trade for anyone but the most experienced players.

As such, it is perhaps little surprise that the majority of hodlers are choosing to stay hands-off and do what they do best.

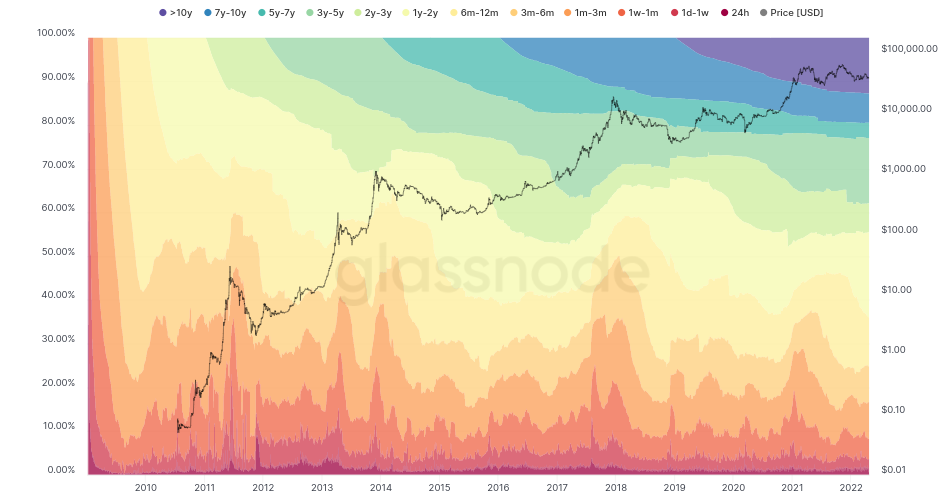

That is now reflected in on-chain data, which shows that the proportion of the Bitcoin supply that has stayed dormant for at least a year is now at all-time highs.

Citing figures from on-chain analytics firm Glassnode, economist Jan Wuestenfeld noted that this translates to the supply more broadly becoming “older.” Proportionally, more coins are being hodled for longer rather than spent.

According to Glassnode, the supply now dormant for a year or more has broken 64% for the first time on record.

The percentage of the #Bitcoin supply last active 1+ years ago just crossed 64% for the first time ever! The percentage of old coins continues to trend up. ↗️ pic.twitter.com/Zyj0hyqFti

— Jan Wüstenfeld (@JanWues) April 24, 2022

HODL Waves, a Glassnode indicator showing hodled coins of all ages confirms the trend. Since December 2021, the 1-2 year supply slice has increased more than any other — from under 10% then to nearly 15% as of this week.

The 3-5 year band of hodled coins also increased its presence in Q1.

Fundamentals still point to the moon

It is not just casual steadfast hodlers who are stubbornly refusing to reduce their BTC exposure despite the grim outlook.

Related: Top 5 cryptocurrencies to watch this week: BTC, DOT, XMR, APE, CAKE

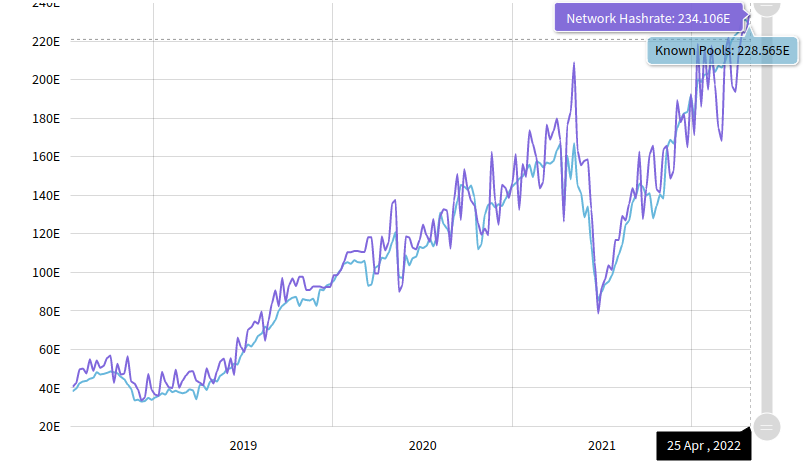

A look at Bitcoin’s network fundamentals shows that miners are also anything but bearish when it comes to investing.

A frequent story this year, but nonetheless an impressive one, given that price is moving in the opposite direction, Bitcoin’s network hash rate and difficulty are both due to make new all-time highs this week.

Depending on price performance, difficulty should adjust up by around 2.9% in two days’ time, setting a new record of 29.32 trillion in the process.

Underscoring the competition to participate in mining, difficulty joins hash rate — an estimate of the processing power dedicated to the blockchain — which is already at its highest ever.

Estimates vary by source, but raw data from MiningPoolStats underscores the “up only” trend when it comes to hash rate — a key trigger, some argue, for subsequent bullish price performance.

The trend of increasing hash rate is nothing new, having been long forecasted as investment continues to grow.

As Cointelegraph previously reported, as of early April, 20% of Bitcoin mining was being undertaken by publicly-listed companies.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.