While Binance saw the acquisition of Gopax as a means of re-entering South Korea, it was also meant to be a turning point for the local trading platform.

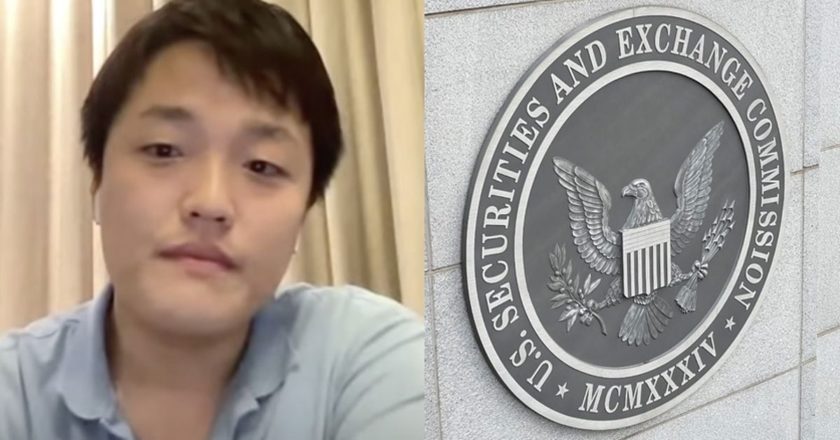

The SEC’s lawsuit against Binance has started affecting the company’s operations, particularly its acquisition of Gopax in South Korea. The US Securities and Exchange Commission filed a case against Binance for violating securities law. According to the filing with the federal court in Washington, Binance mishandled investors and also misled both investors and regulators. The Commission also alleged that the exchange broke the rules by letting Americans trade in an unsecured and unprotected environment.

The Director of the SEC’s Division of Enforcement, Gurbir S. Grewal, wrote in the filing that Zhao and the Binance entities “consciously chose” to flout the rules. He added that the company put its customers and investors at risk to maximize its profits. The SEC executive said Binance engaged in multiple unregistered offerings. Grewal continued, saying:

“While at the same time combining the functions of exchanges, brokers, dealers, and clearing agencies, the Binance platforms under Zhao’s control imposed outsized risks and conflicts of interest on investors.”

Binance Faces Challenge with Gopax Acquisition

Now, the legal case has become a hindrance to the business opportunity Binance has with Gopax. A South Korean report revealed that the Financial Service Committee (FSC), is reviewing the Gopax acquisition by Binance. In light of the SEC allegations, the nation’s financial watchdog has decided to monitor the case as it progresses. Notably, Binance bought a majority stake in Gopax in February. However, the regulator has postponed the report and acceptance of the business change notification filed by Gopax concerning the Binance deal. The local crypto trading platform filed an executive change report on the 7th of March.

Apart from the US SEC accusations, Binance is also under the radar of the US Commodity Futures Trading Commission (CFTC). The CFTC sued the exchange in March for violating trading and derivative trading regulations and evading registration obligations. In addition, the company has a case with the US Prosecutors’ Office and the US Internal Revenue Service for breaching anti-money laundering laws.

The FSC finds it difficult to accept the report due to the alleged accusations from the SEC and further requests to seize all assets belonging to the US arm of Binance. Noting that the SEC trend cannot be dismissed, an FSC official said that “it is cautious to say that the report is being reviewed internally.”

While Binance saw the acquisition of Gopax as a means of re-entering South Korea, it was also meant to be a turning point for the local trading platform. Following the collapse of the FTX crypto exchange in November 2022, Gopax halted withdrawals of principal and interest payments from its DeFi service GoFi. Thus, the Binance deal was supposed to reawaken the troubled exchange.

Ibukun is a crypto/finance writer interested in passing relevant information, using non-complex words to reach all kinds of audience.

Apart from writing, she likes to see movies, cook, and explore restaurants in the city of Lagos, where she resides.