Stablecoins are increasingly being used across Africa as a cheaper and faster remittance option, with remittances becoming “more important than aid” on the continent, according to Vera Songwe, a former UN under-secretary-general.

Speaking at a World Economic Forum panel in Davos, Switzerland on Thursday, Songwe said traditional money transfer services in Africa often cost about $6 for every $100 sent, making cross-border payments expensive and slow.

She said stablecoins are cutting fees and settlement times, allowing individuals and small businesses to move money in minutes rather than waiting days for cross-border payments to clear.

Songwe said inflation has exceeded 20% in “about 12 to 15 countries” across Africa since the COVID-19 pandemic, arguing that stablecoins provide a way to store value in currencies less exposed to inflation and serve as a financial safety net. She said:

650 million people don’t have access to a bank account in Africa. With a smartphone you have access to stablecoins, so you can save in a currency that is not exposed to fluctuations of inflation and making you poor.”

According to Songwe, stablecoin usage is highest in Egypt, Nigeria, Ethiopia and South Africa, countries marked by high inflation or strict capital controls. She added that most transactions are driven by small- and medium-size enterprises, an indication that stablecoins are functioning as a broad financial inclusion tool.

Songwe is the chair and founder of the Liquidity and Sustainability Facility and a nonresident senior fellow at the Brookings Institution. She previously served as a UN under-secretary-general and as executive secretary of the UN Economic Commission for Africa.

Related: Visa doubles down on stablecoins in Europe, Middle East, Africa with new partnership

African countries advance crypto legislation

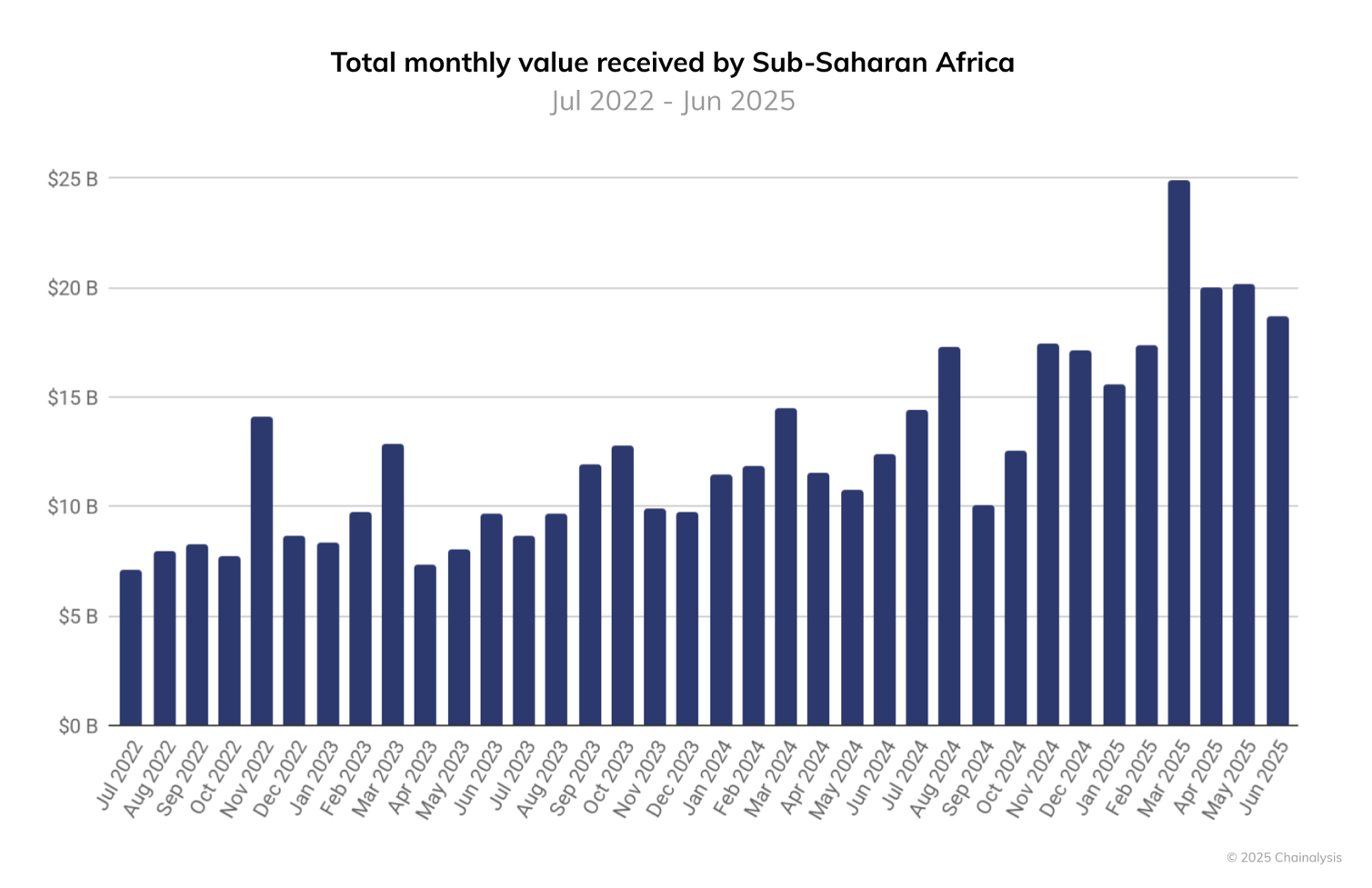

A Chainalysis report in September showed that Sub-Saharan Africa is among the world’s fastest growing regions for crypto adoption. The region received more than $205 billion in onchain value from July 2024 to June 2025, a roughly 52% increase year over year, ranking it third worldwide.

As crypto adoption accelerates across the continent, national responses are beginning to diverge, ranging from formal legalization and tax integration to more cautious, risk-focused oversight.

In December, Ghana legalized cryptocurrency trading after parliament passed the Virtual Asset Service Providers bill, establishing a formal regulatory framework for the industry. Bank of Ghana Governor Johnson Asiama said the law allows crypto activity while giving authorities tools to manage associated risks.

On Jan. 13, Nigeria implemented new rules requiring crypto service providers to link transactions to users’ tax identification numbers. The change is designed to bring cryptocurrency activity into the tax net through identity-based reporting, reducing the need for direct blockchain surveillance by regulators.

In South Africa, the national bank recently flagged crypto assets and stablecoins as an emerging financial stability risk as local adoption continues to grow.

Magazine: Here’s why crypto is moving to Dubai and Abu Dhabi