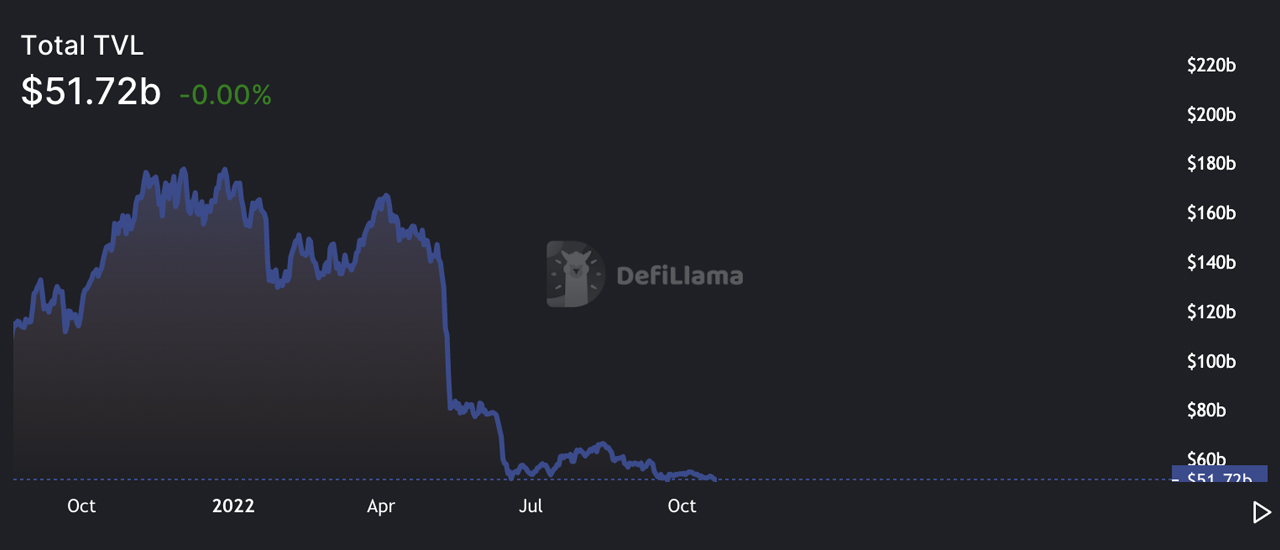

During the last 125 days or roughly four months, the total value locked (TVL) in decentralized finance (defi) has been range bound within the $50 billion to $65 billion region. The TVL in defi has shed significant value during the past six months as it dropped from $161 billion on April 1, down more than 67% lower to today’s $51.72 billion.

TVL Dropped More Than 67% in 6 Months, Defi Market Action Remains Vapid for 4 Months

Defi action has subsided a great deal in terms of the total value locked during the last six months. On Saturday, October 22, 2022, the TVL in defi is around $51.72 billion, with the collateralized debt position (CDP) protocol Makerdao commanding 14.76% of the entire TVL with $7.64 billion on Saturday morning (ET).

In addition to Makerdao, Lido, Curve, Aave, and Uniswap make up the top five largest TVLs today. The liquid staking protocol Lido is just below Makerdao with a TVL of around $6 billion and $5,839,046,587 of Lido’s TVL is staked ethereum (ETH).

Makerdao recorded a 30-day increase in value as the TVL jumped 4.82% higher last month. Sushiswap saw a notable increase, rising 41.27% during the last 30 days, and the yield protocol Aura jumped 38.70% over the last month.

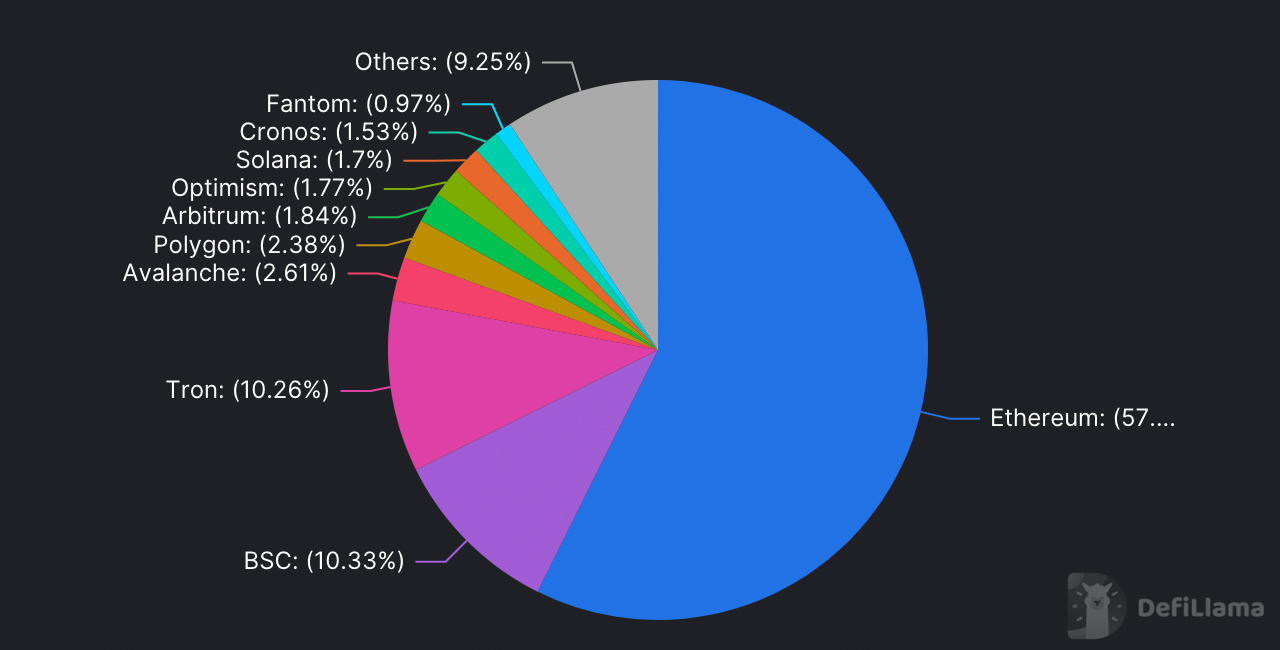

Out of all the blockchains today, Ethereum is the most dominant in terms of defi TVL with roughly 57% of the entire $51.72 billion locked in defi today. ETH has around $29.56 billion, while the second largest TVL by blockchain, Binance Smart Chain (BSC) has $5.32 billion or 10.33% of the aggregate value locked.

Besides ETH and BSC, Tron, Avalanche, Polygon, and Arbitrum follow behind, respectively, in terms of TVL by blockchain. Today, statistics show there are 607 decentralized exchange (dex) protocols with $21.57 billion locked.

There are 189 lending defi apps with $13.96 billion locked on Saturday and 57 CDP protocols command $10.37 billion. There’s also a total of 45 liquid staking applications that hold $7.91 billion in value today.

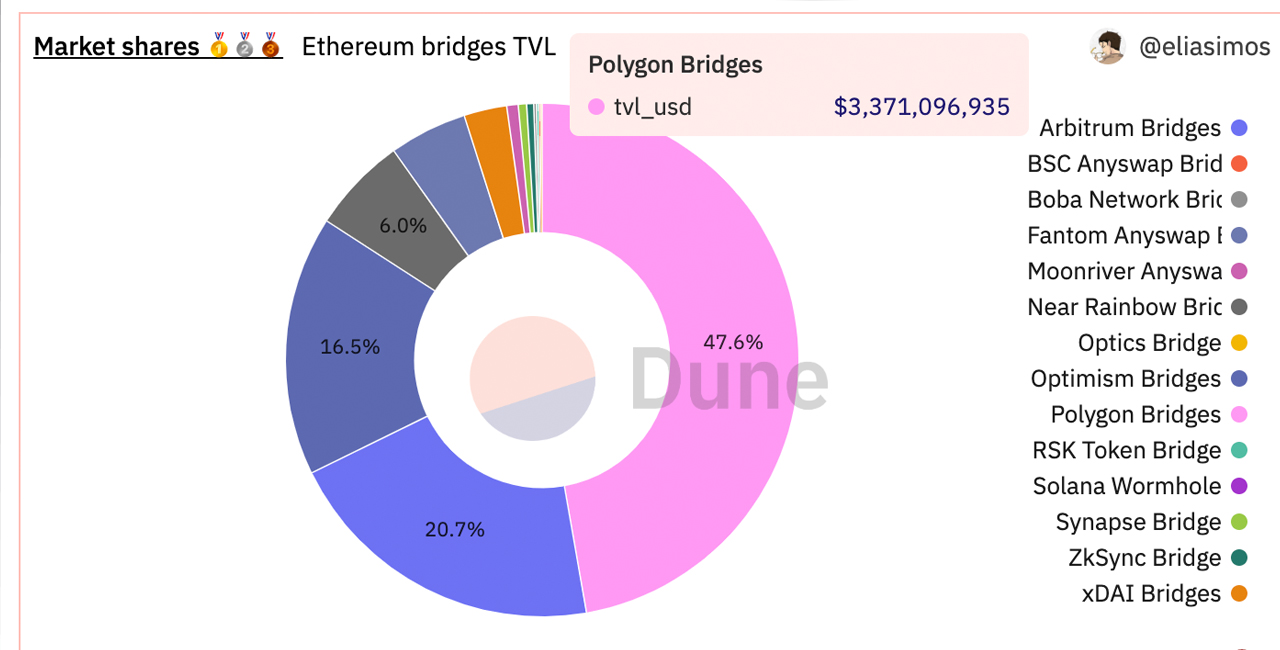

The value locked in cross-chain bridge platforms is also down 22% lower during the past 30 days. $7.80 billion is locked on decentralized cross-chain bridge platforms with 13,178 unique depositor addresses total.

Polygon is leading the bridge pack with roughly $3.37 billion TVL, but the TVL is down 6% during the past month. Arbitrum has around $1.44 billion which is down 2% lower than the month prior.

Polygon and Arbitrum bridges are followed by Optimism, Fantom, and the Near Rainbow bridge. The smart contract platform token market cap today is worth $281 billion and it has increased 1.4% during the last 24 hours.

The top five smart contract platform tokens today in terms of market capitalization include ethereum (ETH), bnb (BNB), cardano (ADA), solana (SOL), and polkadot (DOT). ADA, SOL, and DOT have seen losses between 3.4% and 6.8% over the last week. ETH and BNB have remained in the green during the last seven days, up between 0.3% to 0.8% this past week.

What do you think about the current state of decentralized finance and smart contract platform tokens? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.