Update (May 12, 1:25 pm UTC): This article has been updated to reflect that Strategy lifted its 2025 Bitcoin yield target from 15% to 25% in early May.

Michael Saylor’s Strategy purchased a fresh batch of Bitcoin as the cryptocurrency pushed above $100,000 last week.

Strategy acquired 13,390 Bitcoin (BTC) for $1.34 billion between May 5 and May 11, the firm announced in its filing with the US Securities and Exchange Commission published on May 12.

The acquisition has increased Strategy’s total Bitcoin holdings by 2.4% to a total of 568,840 BTC, acquired for about $39.4 billion at an average price of $69,287 per coin.

The newly announced purchases were made at an average price of $99,856 per BTC, with Bitcoin reclaiming the psychological mark of $100,000 on May 8.

Strategy achieves its previous Bitcoin yield target

Following the acquisition, Strategy met its previous 2025 Bitcoin yield target, co-founder Michael Saylor said in a May 12 post on X.

The purchase brought Strategy’s BTC yield — an indicator representing the percentage change of the ratio between its BTC holdings and assumed diluted shares — to 15.5%, Saylor said in a statement on X.

As previously mentioned, Strategy was previously seeking to maintain the Bitcoin yield target at 15% for the entire 2025 after posting a 74% BTC yield last year. The firm has lifted the yield target to 25% in May 2025.

Peter Schiff voices a gloomy prediction

Despite Strategy breaking through its 15% Bitcoin yield target, some critics have remained skeptical of the company’s aggressive BTC buying agenda.

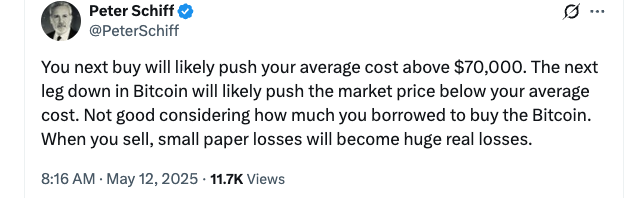

Major Bitcoin critic Peter Schiff jumped in on Saylor’s purchase announcement on X, predicting some negative scenarios potentially arising from the consistent growth of the average BTC cost in Strategy’s purchases.

Related: Metaplanet now holds more Bitcoin than El Salvador

“You [your] next buy will likely push your average cost above $70,000,” Schiff said in response to an X post from Saylor, forecasting that the next drop in the BTC price will “likely push the market price below your average cost.”

“Not good considering how much you borrowed to buy the Bitcoin. When you sell, small paper losses will become huge real losses,” Schiff added.

Schiff’s criticism comes just days after Strategy announced plans to double its capital raise to $42 billion in equity and $42 billion in fixed-income offerings to purchase more Bitcoin, according to a May 1 statement.

While Schiff is known for his inaccurate Bitcoin predictions, some major crypto firms have also reportedly chosen to distance themselves from Strategy’s aggressive Bitcoin accumulation model.

According to a report by Bloomberg, cryptocurrency exchange Coinbase repeatedly considered a Bitcoin investment strategy similar to Saylor’s Strategy, but decided against it each time.

Magazine: Adam Back says Bitcoin price cycle ’10x bigger’ but will still decisively break above $100K