In a frenzied bid to capitalize on the latest wave of meme coins, transaction fees on the Bitcoin network surged to $82 million on Saturday.

According to TheMinerMag, users were eager to mint tokens via the Rune protocol, which facilitates the creation of fungible tokens.

These digital assets’ appeal mirrors similar tokens’ success on other blockchains, like Ethereum’s PEPE and Solana’s WIF, which have performed exceptionally well this year.

According to Bloomberg, the Rune protocol, devised by developer Casey Rodarmor, also supports the creation of nonfungible tokens, further enhancing its utility. Rodarmor preferred the term “etching” over “minting” to more accurately describe the creation of a Rune.

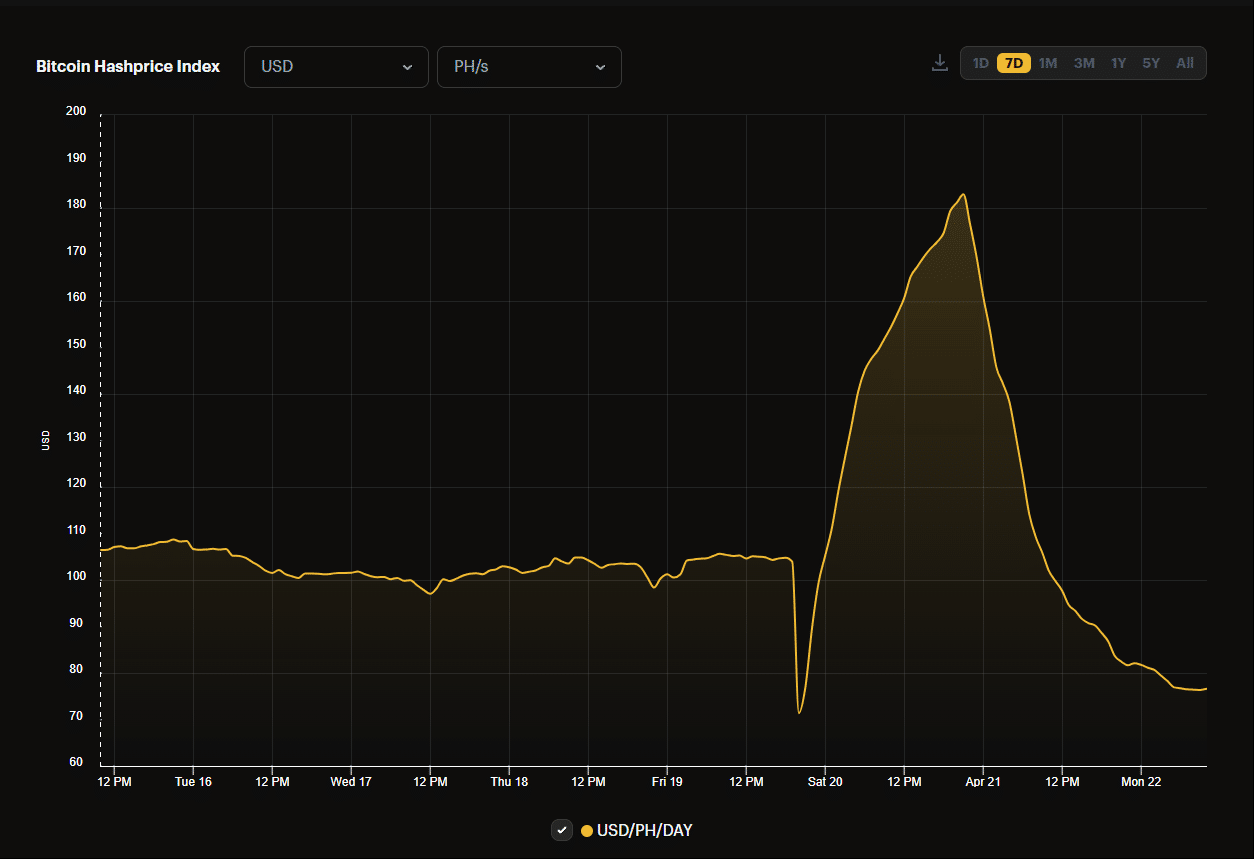

The surge in activity coincided with the latest Bitcoin (BTC) halving. The halving slashes miners’ main income, compelling them to rely more on transaction fees.

Despite the reduction in subsidies, the frenzy around Bitcoin meme coins significantly increased miners’ revenues, contributing about 75% of their total income. The total mining revenue was paid out in the form of 1,675 Bitcoin, amounting to approximately $109 million at current rates, reports Luxor Technology.

As the initial excitement diminishes, revenue from mining has started to wane from a two-year high, signaling potential challenges ahead for miners dependent on these fees.