The U.S. Securities and Exchange Commission (SEC) has leveled charges against Brian Sewell, founder of the American Bitcoin Academy, over a fraudulent cryptocurrency scheme. In a Feb. 2 press release, the regulator claimed Brian Sewell’s scheme had siphoned approximately $1.2 million from students keen on learning about cryptocurrency investing. SEC CHARGES FOUNDER OF AMERICAN BITCOIN ACADEMY WITH FRAUD The SEC charged Brian Sewell, founder of American Bitcoin Academy, and his firm Rockwell Capital Management with fraud for allegedly targeting students to invest in a nonexistent crypto hedge fund. Sewell reportedly……

Tag: 1.2M

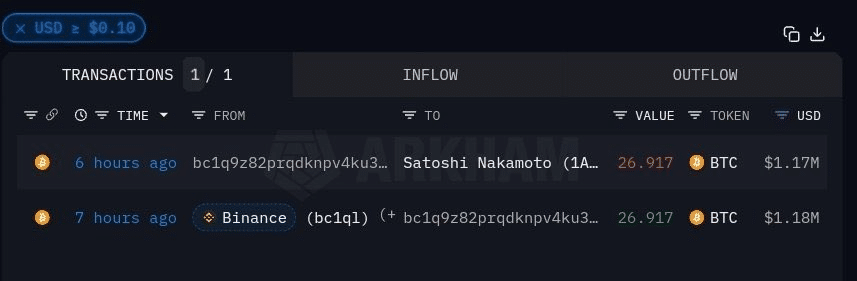

Bitcoin Creator Satoshi Nakamoto Receives $1.2M in BTC, Bewildering Crypto Enthusiasts

Jeremy Hogan, partner at law firm Hogan & Hogan, theorized that the transaction might be an attempt to reveal the identity of Bitcoin’s creator leveraging new U.S. tax rules. Taxpayers in the U.S need to report every crypto transaction over $10,000 to the Internal Revenue Service (IRS) starting this year. Source

Lazarus withdraws $1.2m Bitcoin from crypto tumbler

Notorious cybercriminal group Lazarus seems to be moving stolen Bitcoin after siphoning over $600 million from crypto protocols and users in 2023. The North Korean-funded hacker organization withdrew some 27.3 Bitcoin (BTC) worth an estimated $1.2 million from an unidentified crypto mixer. Per Arkham Intelligence data, Lazarus cashed out its ill-gotten BTC over two transactions on Jan. 8. A Lazarus wallet received 10 BTC valued at $440,000 and 17.3 BTC worth $762,000 from a contract address. Shortly thereafter, the receiving address transferred 3.3 BTC to another address holding just under…

North Korean Hacking Group Lazarus Withdraws $1.2M of Bitcoin From Coin Mixer

Generally speaking, a coin mixer, sometimes referred to as a tumbler, is a blockchain-based protocol that can be used to obscure the ownership of cryptocurrencies by mixing them with coins from other users before redistributing them – so no one can tell who got what. Typically, the transparency of blockchains makes it a straightforward exercise to track the crypto’s provenance and transfers. Original

Unidentified wallet sends $1.2m BTC to Satoshi Nakamoto

An unidentified individual initiated a transaction on Jan. 5, depositing 26.9 BTC, valued at approximately $1.19 million, into the Genesis wallet — the first wallet ever created on the Bitcoin (BTC) network by the pseudonymous entity known as Satoshi Nakamoto. This transaction occurred at 1.52 AM ET, two days after Bitcoin celebrated its 15th anniversary, and was noteworthy because it was impossible to retrieve. On-chain analytics platform Arkham Intelligence reported that before depositing the Bitcoins into the Genesis wallet, the mysterious wallet’s owner funded it through intricate transactions involving diverse…

CoinList agrees to $1.2M settlement over apparent US sanctions violations

CoinList, a United States-based cryptocurrency exchange, has agreed to a $1.2-million settlement with the Treasury’s Office of Foreign Assets Control (OFAC) following allegations the firm facilitated transactions in apparent sanctions violations. In a Dec. 13 notice, OFAC said CoinList had processed 989 transactions for users in Crimea — the peninsula formerly a part of Ukraine currently being occupied by Russia — from April 2020 to May 2022. According to OFAC, the apparent sanctions violations were “nonegregious” but “not voluntarily self-disclosed.” “[CoinList’s] screening procedures failed to capture users who represented themselves…

OFAC Accepts $1.2M Fine from Crypto Exchange CoinList to Settle Allegation of Russia Sanctions Violations

“This enforcement action further emphasizes the importance for virtual currency companies and those involved in emerging technologies to incorporate risk-based sanctions compliance into their business functions, especially when the companies seek to offer financial services to a global customer base,” OFAC said in a media release. Source BitcoincryptoexchangeExchanges CryptoX Portal

Cathie Wood’s Ark Invest Offloads $5.3M in Coinbase Holdings and Acquires $1.2M Worth of Robinhood Shares

Ark Invest seems to be rearranging its investment portfolio and has continued to sell huge amounts of Coinbase, while acquiring Robinhood shares. Cathie Wood’s investment firm, Ark Invest, made notable moves in its portfolio on Monday, marking a strategic shift in its crypto and fintech holdings. Ark Invest sold a substantial amount of its Coinbase Global Inc (NASDAQ: COIN) shares while increasing its position in Robinhood Markets Inc (NASDAQ: HOOD) and actively managing its exposure by also selling off its Grayscale Bitcoin Trust (GBTC) holdings. Ark Invest’s Coinbase Sell-Off amid…

BitFlyer USA Fined $1.2M by NYDFS for Not Meeting Cybersecurity Requirements

https://www.dfs.ny.gov/system/files/documents/2023/05/ea20230502_bitflyer_usa_inc.pdf Source

Contango Digital Assets Successfully Closes $1.2M Seed Round for Web3 Infrastructure

Blockchain-oriented VC firm Contango plans to use the seed round proceeds to facilitate increased Web3 adoption globally. Contango Digital Assets recently successfully concluded a $1.2 million seed round geared toward establishing Web3 infrastructure. To date, the leading blockchain venture capital firm has deployed more than $7 million globally to support Web3 startups. According to reports, Contango will double this sum in 2023 amid increased Web3 and blockchain mainstream adoption. The Contango Digital Assets seed round generated much excitement among participating investors. These investors included HNW Angel investors, Family Office, and…