On Monday, ALT5 Sigma, a fintech company specializing in blockchain infrastructure, unveiled plans to establish a crypto treasury focusing on the World Liberty Financial (WLFI) project—a venture backed by the Trump family. The announcement, however, was met with a swift and negative reaction from investors, resulting in a significant drop in the company’s stock price. First Crypto Treasury Focusing On World Liberty Financial ALT5 Sigma, which trades on Nasdaq under the ticker name “ATLS”, aims to raise $1.5 billion to become the first publicly traded company to hold WLFI, the…

Tag: 1.5B

Jack Dorsey’s Block Inc to Offer $1.5B in Senior Notes as Eyes Strategic Expansion

Key Notes Block Inc. plans to issue $1.5 billion in senior notes to qualified institutional buyers for corporate expansion needs. ARK Invest acquired 262,463 shares after the stock dropped 15% from its weekly peak, now holding 1.62% of total portfolio. The fintech company recently joined the S&P 500 index in July, replacing Hess Corp. with $45.44B market cap. Block Inc., a financial technology company founded by tech mogul Jack Dorsey, announced on Aug. 13 that it will seek to issue senior notes in the amount of $1.5 billion over two…

Trump Family’s DeFi Play Pulls ALT5 Sigma Into $1.5B WLFI Treasury Plan

ALT5 Sigma Corp. (ALTS) said it plans to load up on WLFI tokens in a $1.5 billion deal that will see the token of the Trump family’s crypto venture, World Liberty Financial, become a core treasury asset. The company said it will issue and sell 200 million shares, split between a direct offering and a private placement, to fund the purchase. The move will leave ALT5 holding 7.5% of the total WLFI supply, it said. World Liberty CEO Zach Witkoff will become chairman of ALT5’s board, Eric Trump will become…

Melania Token Hits $200M Valuation as Trump’s WLFI Launches $1.5B Treasury

Key Notes Official Melania Meme (MELANIA) price surged 14% this week, briefly hitting $0.22 and pushing its market cap above $190M. Rally fueled by WLFI’s USD1 loyalty rewards program announcement and $1.5B treasury fund plans. Trump-backed World Liberty Financial continues expanding with stablecoin, token, and lending product developments. . Melania Token’s market momentum intensified this week, climbing 14% to reach $0.22 on Saturday, August 9, and lifting its market capitalization above $190 million for the first time this month. The latest upswing has been driven by two major bullish developments…

World Liberty Financial Plans $1.5B Public Company to Hold WLFI Tokens

World Liberty Financial, the Trump family-backed crypto venture, is exploring the creation of a publicly traded company to hold its WLFI tokens, with a fundraising target of roughly $1.5 billion. The structure of the deal is still being finalized, but major investors in technology and crypto have been approached, and discussions are said to be progressing quickly, according to a Friday report from Bloomberg. The move would place World Liberty among a growing wave of digital-asset treasury companies, which are publicly traded firms holding crypto reserves. These companies have raised…

Ether Machine Targets NASDAQ with $1.5B to Boost ETH

Key Notes Ether Reserve is looking to merge with blank-check firm Dynamix Corporation to form Ether Machine. This new crypto firm will be listed on the Nasdaq stock exchange. Ultimately, the goal is to establish the largest yield-bearing Ethereum fund targeting institutional investors. Ether Machine, a team of crypto-native researchers and public market experts, is working on listing on the Nasdaq stock exchange through a merger with blank-check firm Dynamix Corporation. Still under formation, the company is on the verge of launching a 400,000 Ethereum ETH $3 758 24h volatility:…

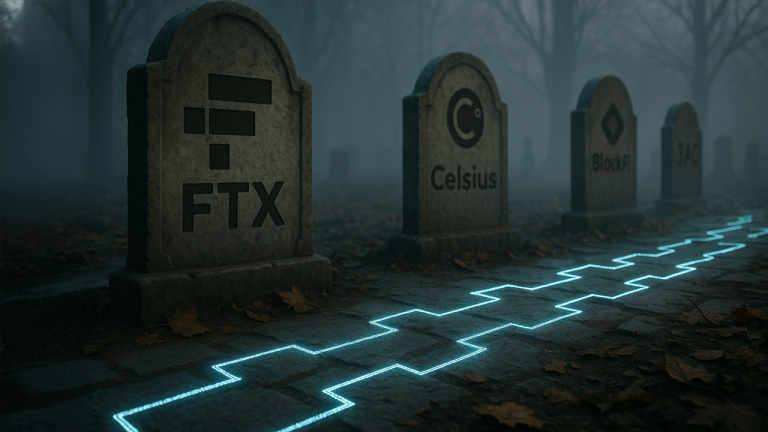

$1.5B in Crypto Still Sits in the Ruins of Firms Like FTX, Terraform, Celsius, and Blockfi

Over the past few years, a wave of digital asset firms collapsed for a mix of reasons—some dragged down by earlier disasters like the FTX and Terraform Labs fiascos. Here’s a closer look at a handful of wallets tied to those now-defunct ventures and a glimpse at what’s still sitting onchain. Collapsed Crypto Entities Still […] Source CryptoX Portal

Hong Kong’s Reitar Logtech Eyes $1.5B Bitcoin Purchase to Boost Reserves

In a regulatory filing submitted on Monday, Hong Kong’s Reitar Logtech Holdings Ltd. disclosed that it is negotiating a potential strategic acquisition of up to $1.5 billion worth of bitcoin to diversify its treasury reserves and fund global logistics technology expansion. Reitar Logtech Plans Treasury Diversification The Nasdaq-listed company (RITR) announced it is in advanced […] Original

GameStop’s $1.5B Bet on Bitcoin Pushes GME Stock Price

Key Notes GameStop raised $1.5 billion to add the digital gold to its balance sheet. The notes carry no regular interest and don’t accrue value over time. GameStop’s notes mature on April 1, 2030, unless converted or redeemed earlier. According to a filing with the US Securities and Exchange Commission (SEC), GameStop completed its $1.5 billion fundraising on April 1 via a private offering, exempt from SEC registration. The proceeds were invested in 0.00% convertible senior notes due on April 1, 2030. The notes were offered at $1,000 each. This…

GameStop completes $1.5B sale, eyeing Bitcoin acquisition

GameStop, the video game retailer, has completed a $1.5 billion offering of convertible senior notes, with plans to use the funds to buy Bitcoin for its treasury. The sale, completed on Apr. 1, 2025, raised $1.48 billion after fees, according to the company’s filing with the Securities and Exchange Commission. GameStop was initially aiming to raise $1.3 billion amid plans to add Bitcoin to its list of treasury assets. The sale surpassed expectations, with an extra $200 million in notes sold. The company stated the funds will be used for…