Video game retailer GameStop Corporation (GME) has finished a convertible debt offering that raised $1.5 billion, with some proceeds earmarked for buying Bitcoin. The offering was initially set to raise at least $1.3 billion, but purchasers opted for an additional $200 million aggregate principal amount of notes, GameStop said in an April 1 filing with the Securities and Exchange Commission. “The company expects to use the net proceeds from the offering for general corporate purposes, including the acquisition of Bitcoin in a manner consistent with the Company’s Investment Policy,” GameStop…

Tag: 1.5B

Kraken nears $1.5B deal allowing it to offer US crypto futures: Report

Crypto exchange Kraken is reportedly closing in on a $1.5 billion acquisition of trading platform NinjaTrader, a move that would expand Kraken’s customer base and enable it to offer crypto futures and derivatives in the US. The deal could be confirmed by the morning of March 20 in the US, The Wall Street Journal said in a March 19 report, citing people familiar with the matter. Kraken’s expanded offerings would be made possible through NinjaTrader’s registration as a Futures Commission Merchant. The move would help Kraken’s strategy to work across…

North Korea’s Lazarus Group Moves 400 ETH to Tornado Cash Following $1.5B Bybit Hack

North Korea-linked Lazarus Group transferred 400 ETH (worth $750,000) to Tornado Cash on March 12, 2025, likely laundering proceeds from the record $1.5 billion Bybit hack, blockchain researchers report. ZachXBT: Tornado Cash Demix Exposes North Korea’s $3.1M PEPE Token Purchase The Lazarus Group, a North Korean state-sponsored hacking collective, transferred 400 ETH to privacy tool […] Source CryptoX Portal

Crypto lost to exploits, scams hits $1.5B in February with Bybit hack: CertiK

Losses to crypto scams, exploits and hacks totaled nearly $1.53 billion in February, with the $1.4 billion Bybit hack accounting for the lion’s share of losses, said blockchain security firm CertiK. The Feb. 21 attack on Bybit by North Korea’s Lazarus Group was the largest crypto hack ever, more than doubling the $650 million Ronin bridge hack in March 2022, “which was also conducted by Lazarus,” CertiK said in a Feb. 28 X post. February’s lost crypto amount is a nearly 1,500% jump from the $98 million recorded by CertiK…

FBI Calls on Public to Help Stop North Korea’s $1.5B Bybit Crypto Laundering Now

The FBI urged immediate action to block transactions tied to North Korea’s $1.5 billion crypto heist, warning the hackers are swiftly laundering funds to evade recovery. FBI Urges Public and Private Sectors to Cut Off North Korea’s Stolen $1.5B in Crypto The Federal Bureau of Investigation (FBI) has confirmed that North Korea was behind the […] Source CryptoX Portal

Bybit’s Record $1.5B Hack & How Best Wallet Token Is Redefining Crypto Security

The famous crypto firm and exchange, Bybit, has been hit by possibly the biggest crypto theft in history. The Dubai-based company said that hackers managed to steal $1.5B worth of digital currency. The attack, which was apparently carried out by North Korea’s Lazarus Group, was a highly sophisticated one. Perpetrators were able to intercept a transaction taking place from the exchange’s cold wallet to the warm one. They manipulated the transaction’s signing interface and quickly diverted 401,000 $ETH to an unidentified address. Ironically, the breach affected Bybit’s cold wallet, which…

Mara bought $1.5b Bitcoin, plans to acquire more

Marathon Holdings restocked over $1.5 billion worth of Bitcoin using proceeds from its convertible note offering. Bitcoin (BTC) infrastructure firm Marathon Holdings acquired 15,574 BTC for an estimated $1.53 billion after raising nearly $2 billion through a 0% convertible note sale in November and December. Marathon shared a Securities and Exchange Commission Form 8-K filing on Dec. 19, revealing it bought its latest BTC tranche at an average price of $98,529 per Bitcoin. U.S. publicly traded companies use Form 8-K documents to disclose developments relevant to shareholders. Marathon Holdings now…

MicroStrategy registers new $1.5b Bitcoin buy

Michael Saylor-led MicroStrategy has increased its total Bitcoin holdings to 439,000, strengthening its position as the top corporate BTC holder. Another week, another Saylor buy. On Dec. 16, MicroStrategy executive chairman Michael Saylor disclosed the firm’s latest Bitcoin (BTC) purchase, worth $1.5 billion for 15,350 BTC at an average price of $100,386, according to a regulatory filing. MicroStrategy’s entire Bitcoin stash is now valued at over $45 billion, as BTC reached a new all-time high of $106,000. Approximately $18 billion of this value represents unrealized profits, with the company’s initial…

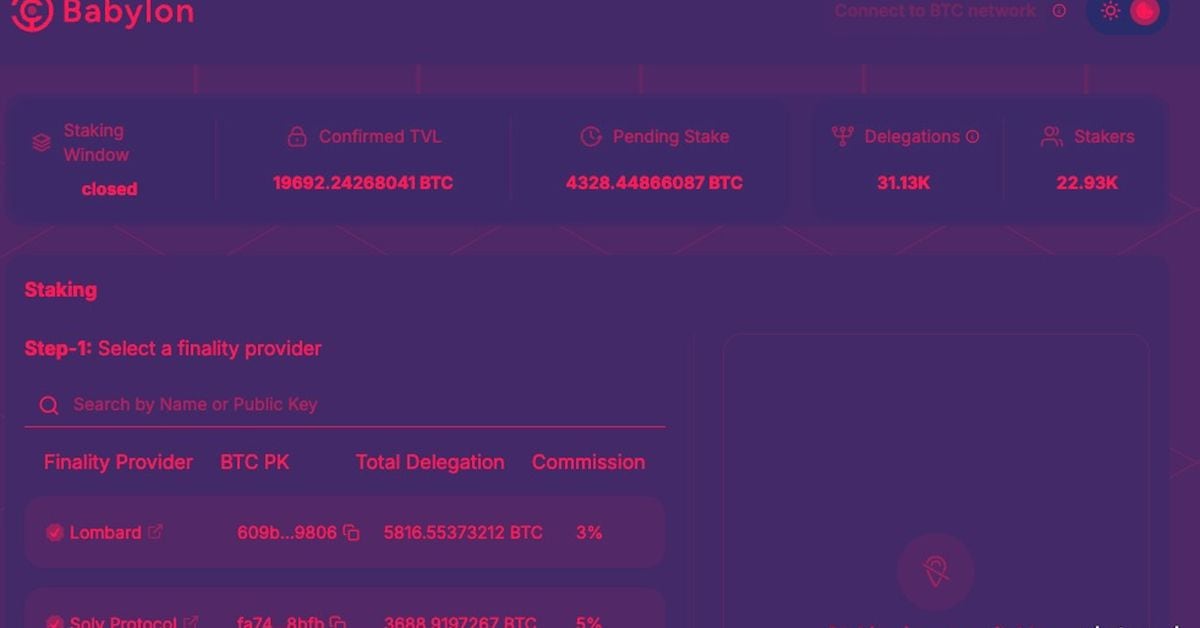

Bitcoin Protocol Babylon Pulls in $1.5B of Staking Deposits as Cap Lifted

Babylon, a Bitcoin staking platform billed as a new way of providing the original blockchain’s security to new protocols and decentralized applications, pulled in about $1.5 billion worth of bitcoin on Tuesday after briefly opening to additional deposits. Source

Bitcoin Exposed to Possible $1.5B in Future GBTC Sales, JPMorgan Says

Before being uplisted to an ETF from a trust, GBTC was one of one of the only ways for stock traders in the U.S. to gain exposure to the price movements of bitcoin without the need to purchase the actual cryptocurrency. That made it the largest regulated bitcoin fund in the world by AUM. The bank had previously estimated that up to $3 billion had been invested in GBTC in the secondary market during 2023 to exploit the trust’s discount to NAV. If this estimate is correct, and given that…