Bitcoin slid to just above $100,000 late Monday before a slight rebound to $101,000, as a wave of forced liquidations and renewed macro jitters erased billions in speculative positions across crypto markets. More than $2 billion in futures contracts were liquidated in the past 24 hours, per CoinGlass, with long traders accounting for nearly 80% of the losses at $1.6 billion. Crypto liquidation heatmap. (CoinGlass) Liquidations occur when traders using borrowed funds are forced to close their positions because their margin falls below required levels. On crypto futures exchanges, this…

Tag: 1.6B

Ethereum Co-Founder Moved $6M of ETH; Whales Bought $1.6B In 2 Days

Ethereum co-founder Jeffrey Wilcke could be looking to sell some of his Ether holdings after sending around 1,500 ETH to crypto exchange Kraken on Thursday. Wilcke sent 1,500 Ether (ETH), worth around $6 million, to the crypto exchange, according to onchain analytics platform Lookonchain. It came as the price of Ether dropped from $4,000 to around $3,900. Source: Lookonchain Moving cryptocurrency to an exchange deposit address does not guarantee it is being sold. In August, Wilcke had deposited $9.22 million worth of ETH to Kraken. He had previously sent $262…

FTX Recovery Trust Unlocks $1.6B for Creditors This Month

The FTX Recovery Trust, the entity overseeing the distribution of funds from the bankrupt crypto exchange, announced a third tranche of distributions to creditors, worth about $1.6 billion. According to a Friday announcement, the distribution is scheduled for Sept. 30, and creditors should receive the funds in their accounts within three business days of the payment date. The third distribution includes a 6% payout for Dotcom Customer claims, a 40% distribution for US Customer Entitlement Claims and a 24% distribution for General Unsecured Claims and Digital Asset Loan Claims. Convenience…

$1.6B Bitcoin Whale Shifts Another $113M BTC Into $240M ETH Long

A recently emerged Bitcoin whale, or big investor, continued to acquire Ether, transferring another $113 million worth of Bitcoin after seven years of dormancy. The Bitcoin whale sold $76 million worth of Bitcoin (BTC) and opened a $295 million perpetual futures long position on Ether (ETH), Cryptox reported earlier Thursday. The mysterious whale closed part of his perpetual futures positions and deposited another 1,000 BTC worth $113 million on the decentralized exchange Hyperliquid, most of which was sold to enter the long spot Ether position. The whale held 55,700 spot…

Crypto hacks top $1.6B in Q1 2025 — PeckShield

Hackers stole more than $1.63 billion in cryptocurrency during the first quarter of 2025, with the Bybit exploit accounting for more than 92% of total losses, according to blockchain security firm PeckShield. PeckShield reported that over $87 million in crypto was lost to hacks in January, while February saw a dramatic spike to $1.53 billion, largely due to the Bybit attack. That incident was one of the largest crypto thefts to date. In addition to the Bybit hack, other attacks in February caused $126 million in losses. This included a…

Spot Bitcoin ETFs saw over $1.6b in outflows in the first half of March

U.S. spot Bitcoin exchange-traded funds recorded over $1.6 billion in net outflows during the first two weeks of March amid escalating U.S. trade tensions and broader market uncertainty. According to data from SoSoValue, the 12 spot Bitcoin (BTC) ETFs saw weekly outflows of $799.39 million and $870.39 million in the first two weeks of March, adding up to a total outflow of $1.67 billion over the period. These outflows marked the fifth straight week of net withdrawals, wiping out over $5.4 billion from these ETFs. In contrast, these Bitcoin ETFs…

As Bitcoin Eyes $80K, Futures Premium Soars and $1.6B Locked in Options Bet Points to Big Moves

As Bitcoin Eyes $80K, Futures Premium Soars and $1.6B Locked in Options Bet Points to Big Moves Original

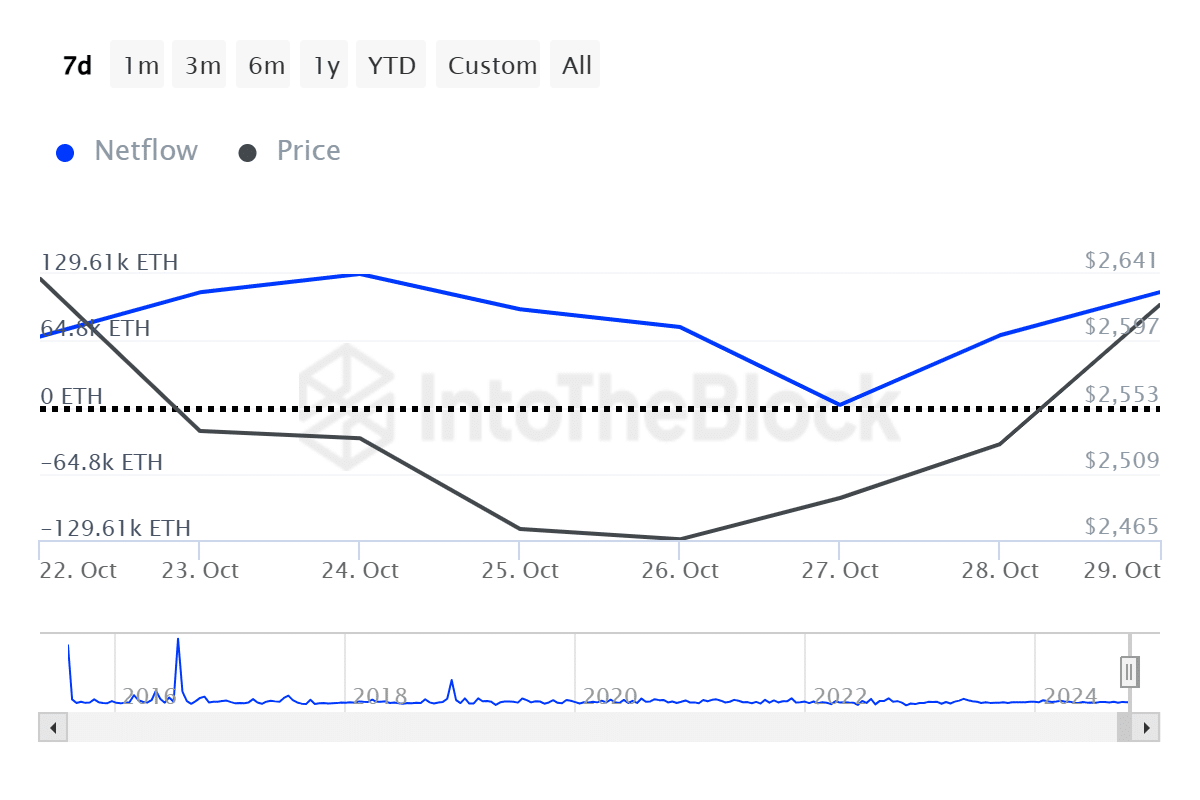

Whales accumulated $1.6b in ETH in 7 days, exchange outflows surge

Ethereum whales have been accumulating the asset as the Oct. 23 price drop brought a buying opportunity. According to data provided by IntoTheBlock, large Ethereum (ETH) addresses saw a net inflow of over 598,000 ETH over the past week—worth $1.6 billion at the current price. The accumulation gained traction after the ETH price plunged from its local high of $2,765 between Oct. 21 and 23. ETH large holder net flows | Source: IntoTheBlock Ethereum gained 4% in the last seven days and is trading at $2,685 at the time of…

Bitcoin ETFs See $1.6B Inflows This Week – Is BTC Reaching A New ATH Soon?

Este artículo también está disponible en español. Bitcoin is holding strong above $67,000 after setting a new local high of around $68,300, fueling excitement among investors. This bullish momentum is driven by price action and supported by key market data signaling a potential uptrend continuation. Related Reading Daan, a top crypto analyst, shared crucial insights showing that Bitcoin ETFs have been buying heavily for the past four days. This surge in institutional demand is a positive signal for the market, as it could further propel Bitcoin toward new all-time highs.…

Spot Bitcoin ETFs see four straight days of inflows, surpassing $1.6b, Ether ETFs rebound

Spot Bitcoin ETFs in the U.S. marked their fourth straight day of net inflows, while spot Ether ETFs reversed course, moving back into net positive flows. Data from SoSoValue shows that the 12 spot Bitcoin ETFs recorded net inflows of $458.54 million on Oct. 16, marking the fourth consecutive day of positive inflows. Over this period, the funds have accumulated more than $1.63 billion. BlackRock’s IBIT, the largest Bitcoin ETF by assets under management, continues to dominate, posting the highest net inflow for the second straight day. On Oct. 16,…