Solana achieved a remarkable comeback after the collapse of Sam Bankman-Fried’s FTX and Alameda Research in 2022, which was a key backer of the budding smart contract platform. The chain emerged as the go-to ecosystem for retail crypto users and a hotbed of this cycle’s memecoin craze, hosting for example the popular pump.fun protocol. Resurging decentralized finance (DeFi) activity also benefitted the network, making Solana’s on-chain trading ecosystem the third-most-profitable sector in crypto, a recent Coinbase report noted. The solana token was a standout among altcoins over the past year’s…

Tag: 100B

USDT Issuer Tether Reports $2.5B Profit in Q3, Holds Over $100B Exposure to U.S. Treasuries

Tether Investments, the group’s venture arm that manages Tether’s growing foray into energy, mining and artificial intelligence, had a net equity value of $7.7 billion, up from $6.2 billion in the previous quarter. It also disclosed owning 7,100 bitcoin (BTC) worth nearly $500 million, the company said in a blog post. Source

Decentralized Finance TVL Recovers to $100B After July Lows

Between June 19 and July 19, within a 30-day period, the total value locked (TVL) in decentralized finance (defi) dropped below the $100 billion mark, hitting a low of $86.3 billion on July 7, 2024. Over the past three days, however, the TVL has managed to stay above the $100 billion threshold. Lido Leads Defi […] Source CryptoX Portal

Value Locked in Defi Nears $100B Range Again After $11.89B Increase in 35 Days

Over the past 35 days, the total value locked in decentralized finance (defi) protocols has expanded by $11.89 billion, recovering from a low of just over $83 billion on April 13. Although it has not yet reached the $100 billion mark, the value locked in defi is approaching that milestone after hovering just below it. […] Source CryptoX Portal

FXS Price Poised For Uptrend As Frax Finance Unveils Roadmap To Reach $100B TVL

Frax Finance, a decentralized finance (DeFi) protocol, recently unveiled its Singularity Roadmap. It aims to propel the total value locked (TVL) of its layer 2 blockchain, Fraxtal, to $100 billion by the end of 2026. This notable surge would represent a 760,000% increase from the current TVL levels, which stand at $13 million. Frax Finance Singularity Roadmap According to the protocol’s announcement, Fraxtal, the substrate that powers the Frax ecosystem, serves as Frax Finance’s operating system. With the launch of Fraxtal and achieving an effective 100% Collateralization Ratio (CR), Frax…

Frax Finance Targets $100B TVL in Singularity Roadmap

The road map proposed launching 23 layer 3s within a year and new assets like frxNEAR, frxTIA and frxMETIS. The existing assets, FRAX, sFRAX, frxETH, and the new ones will be issued on Fraxtal going forward, the proposal floated by founder Sam Kazemian and other contributors added. Source

Binance’s user asset holdings exceed $100b

Cryptocurrency exchange Binance reported the total value of user assets crossed the $100 billion mark in the first week of March. According to a March 18 blog post, Binance surpassed the $100 billion milestone for the first time since it began disclosing user holdings through its proof-of-reserves (PoR) system in November 2022. The Binance team explained that the prices of digital assets have been increasing noticeably and sustainably in recent weeks, a trend that has undoubtedly contributed significantly to increasing the value of user assets managed by Binance. “As strong…

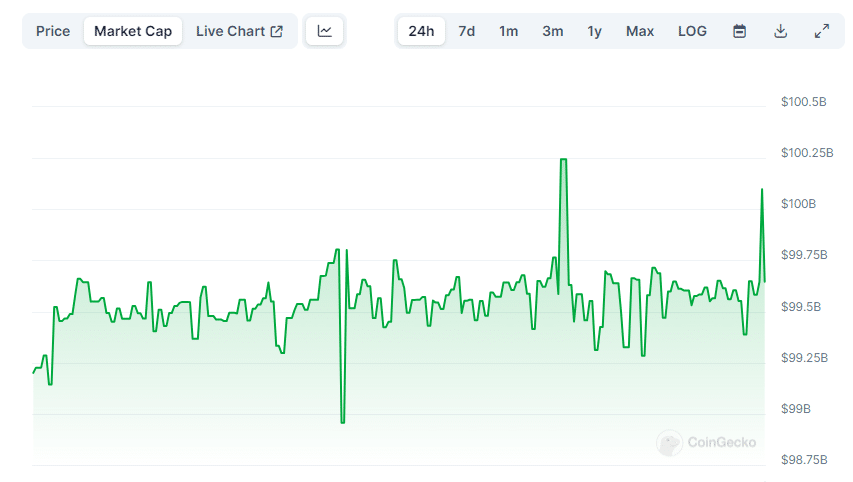

Tether’s USDT Stablecoin Touches $100B Market Cap, Benefiting from Crypto Trading Frenzy

The company has, however, received a fair amount of scrutiny over the years for its opaque reserve management, having at one point risky backing assets like Chinese commercial paper and credit to now-bankrupt crypto lender Celsius, and a lack of independent audits – a deeper financial analysis than attestations. It now says it is backed mainly by more secure investments such as U.S. Treasury bills, repurchase agreements and deposits in money market funds. Source

Tether’s USDT surpasses $100b mark, sets new stablecoin record

Tether’s USDT stablecoin market cap exceeded the $100 billion mark today, setting a significant benchmark. As the first stablecoin to achieve this scale, USDT’s distribution has increased by over 9% from the beginning of the year, driven by a surge in demand for Bitcoin, which reached $66,000 today for the first time since November 2021. Tether’s position as the most frequently traded cryptocurrency worldwide has been cemented as part of the milestone. The peak in circulation reached $100.2 billion around 8:10 a.m. GMT on Monday, as per CoinGecko, though it…

Stablecoin Sector Sees $3.26 Billion Growth Spurt; Tether Nears $100B Milestone, USDE Supply Swells by 374%

The stablecoin sector experienced a $3.26 billion expansion within the last eight days, climbing from $140.82 billion to $144.08 billion by Sunday, March 3, 2024. During February, increases in supply were observed in four of the top five stablecoins by market cap, with FDUSD’s supply growth leading amongst the five. Stablecoin Economy Rises 2.31% in […] Source CryptoX Portal