Key Notes Analyst Bull Theory identifies recurring ’10am manipulation’ pattern with BTC consistently dropping after US market opens at 10:00 a.m. EST. Jane Street, a major high-frequency trading firm holding $2.5B in BlackRock’s Bitcoin ETF, emerges as the primary suspect behind moves. Bitcoin fell from $92,473 to $89,510, losing 3.2% in value before beginning gradual recovery following the established pattern. Bitcoin BTC $90 115 24h volatility: 0.9% Market cap: $1.80 T Vol. 24h: $69.66 B lost $2,000 in its price as the US market opened on Friday, Dec. 12, causing…

Tag: 132M

Bitcoin’s Sharp Descent Sparks $132M in Liquidations Amid Market Volatility

On Sunday, bitcoin’s price slid to an intraday low of $101,957 after reaching an earlier high of $105,424. This downturn set off the liquidation of more than $128 million in bitcoin long positions across crypto derivatives markets within a four-hour window. Bitcoin Plummets from $105K High As of 8 p.m. ET, the cryptocurrency market maintains […] Original

NFT sales drop to $132m, Pudgy Penguins loses steam

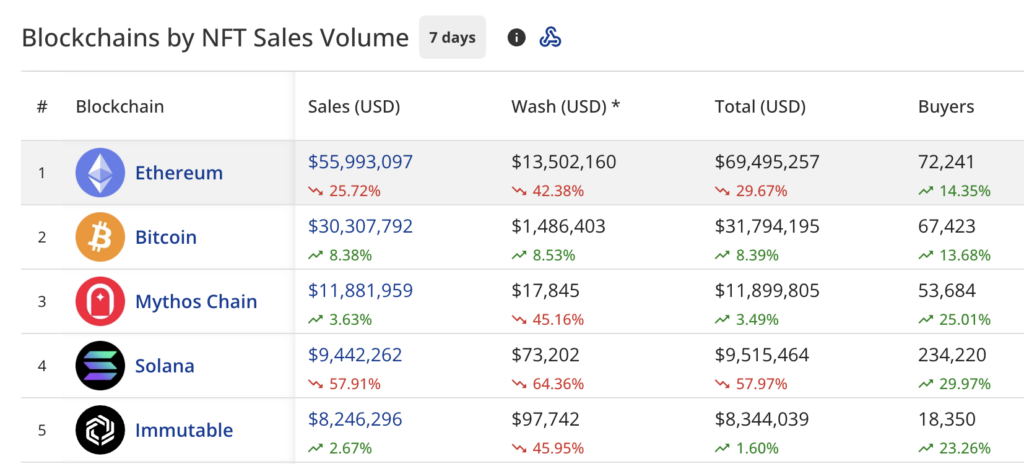

The NFT market cooling continues as the overall crypto market cap has grown to $3.6 trillion from last week’s $3.42 trillion, per CoinMarketCap data. CryptoSlam data shows that NFT sales have fallen 17.54% to $132.7 million this week. This is considerably lower than last week’s $152 million in sales. However, the market has seen greater participation from traders, pointing to sustained interest at lower price levels. Market activity shows mixed signals: NFT sales volume dropped to $132.7 million from last week’s $152.7 million The number of NFT buyers rose 25.54%…

Bitcoin Slips Below $59K as Crypto Market Faces $132M in Liquidations

On Sunday, bitcoin slipped below the $60,000 mark and dipped even further beneath the $59,000 range. The leading cryptocurrency touched an intraday low of $58,315, after previously hitting a high of $61,868 earlier in the day. Crypto Crash Course: Long Positions Take a Tumble in Sunday’s Wipeout Statistics show the broader crypto market saw a […] Original

FC Barcelona secures $132M investment for blockchain and NFT venture

Spanish football club FC Barcelona has secured a €120 million ($132 million) investment from Libero Football Finance AG and Nipa Capital B.V. for its Web3 initiative Barça Vision. According to the Aug. 11 announcement, FC Barcelona sold a 29.5% stake in Bridgeburg Invest, the holding company for Barça Vision, in exchange for the capital. “Barça Vision is the Club’s initiative to integrate all digital content around Web3 and blockchain including nonfungible tokens (NFTs) and metaverse, which are part of the Club’s strategy to build the digital Espai Barça,” developers wrote.…