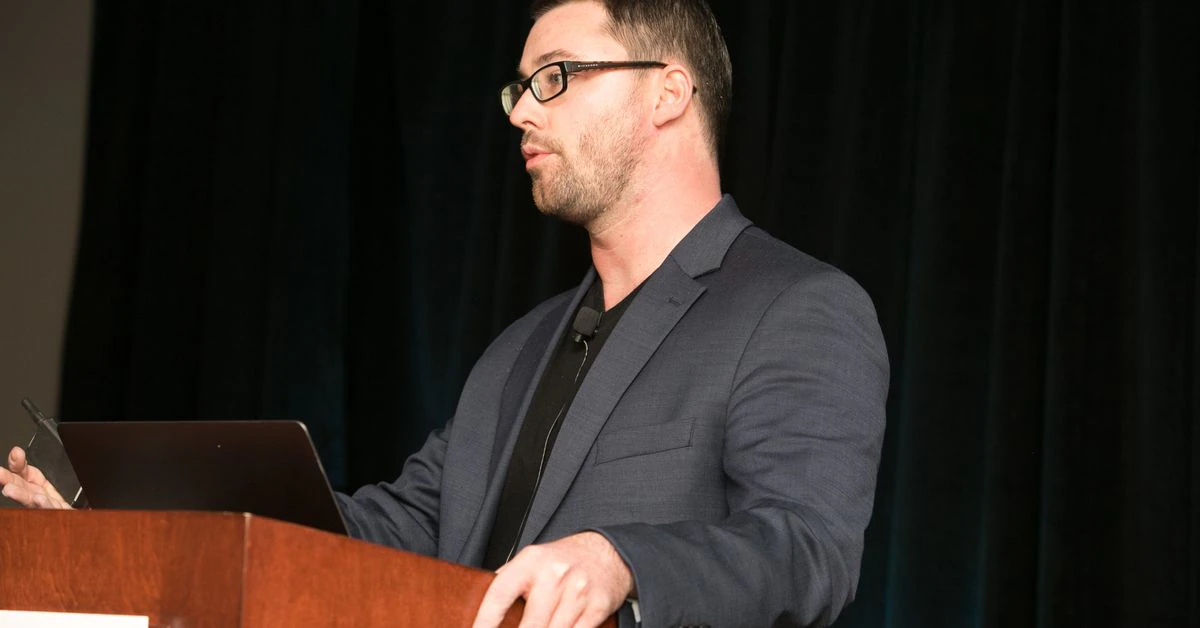

Sam Hamilton, Creative Director at Decentraland, told CoinDesk that while they report 8,000 users on average per day, this accounts for any individual who passively interacts with the metaverse. He noted that while they saw peak attendees in March, the number of “tourists and spectators” has since cooled down. Source

Tag: 13b

Jack Dorsey’s Block hits $1.3B in Q1 profits, $43M in BTC trading revenue

Block, the pro-Bitcoin (BTC) umbrella company that hosts Cash App, Square and Afterpay, continues its growth in 2022. According to its Shareholder letter, in the first quarter of 2022, gross profits are “up 34% year over year.” In total, the group netted $1.29 billion in gross profits. However, operating costs were also up “$1.52 billion in the first quarter of 2022, up 70% year over year.” The group explains that the acquisition of Afterpay, a buy now pay later service, could explain the increasing costs. In total net Block’s revenues…

Talos raises $105M to become the latest crypto unicorn valued at $1.3B

PayPal-backed cryptocurrency firm Talos is becoming the latest unicorn in the industry, reaching a $1.25 billion valuation following new funding. Talos has raised $105 million in Series B funding round led by a major global growth equity firm, General Atlantic, according to an announcement released on May 10. The funding will help Talos extend its institutional-grade digital asset platform as well as accelerate the firm’s expansion into the Asia-Pacific region and Europe. The raise featured major firms in both the traditional finance and the crypto industry, including Ken Fox’s private…

Ethereum Foundation Holds $1.3B in Ether, $300M in Non-Crypto Investments

Almost $1.29 billion was held in ether, the world’s second-largest cryptocurrency by market capitalization. That represented over 0.297% of the total ether supply as of March 31. Some $11 million was held in other cryptocurrencies. The treasury also included about $300 million in non-crypto investments. The foundation did not return requests for details on the makeup of these assets at writing time. “We also increase our non-crypto savings in response to rising ETH prices,” the foundation said in the report. “(This) provides a greater safety margin for our core budget…

Pantera to close Blockchain Fund soon after raising $1.3B — double the target

Crypto hedge fund giant Pantera Capital is set to close a blockchain fund next month that is backed by around $1.3 billion worth of capital. The Pantera Blockchain Fund was announced in May last year, with plans to raise $600 million to invest in early-stage tokens, venture equity, Web3 firms and tokens with strong liquidity. It has since surpassed that target significantly, with the firm revealing last month that the fund had topped $1 billion. The latest $1.3 billion figure was noted during an April 12 investor conference call regarding…

Pantera Capital Set to Close $1.3B Blockchain Fund, With Follow-Up Vehicle Already in the Works

The Select Fund was Pantera’s fifth, joining the Bitcoin Fund, Early-Stage Token Fund, Liquid Token Fund and Blockchain Fund. Select is “smaller, more targeted and therefore more concentrated than a typical growth fund,” said Pantera. The deadline for limited partners to get in on the Select Fund is May 1. Source

Simple math says Russia could collect up to $13B in crypto tax each year

The Russian government is expected to collect up to 1 trillion rubles ($13 billion) in crypto tax each year, as per an estimation by the authorities. The Bell, a local Russian publication, reportedly got its hands on the government analytic note that estimated the yearly tax revenue. According to the letter’s authors, Russians hold 12% or nearly $214 billion in crypto. The number of users on foreign exchanges is estimated to be about 10 million, added with the significant number of over-the-counter (OTC) crypto trades. The government agency believes even the most…

Crypto IRA Platform iTrustCapital Raises $125M at $1.3B Valuation

CryptoX is a multi-platform publisher of news and information. CryptoXtrade has earned a reputation as the leading provider of cryptocurrency news and cryptomarket analysis, bitcoin and other cryptocurrencies, blockchain technology, finance and investments. CryptoXtrade have become a known leader in the cryptocurrency information market. We work only with trusted information sources providing latest financial and technological innovations that improves the quality of life of CryptoX readers by focusing on Cryptocurrency and Blockchain. CryptoX Portal

Crypto-focused software firm Lukka raises $110M, reaches $1.3B valuation

Cryptocurrency accounting and data company Lukka said it had raised $110 million in a new funding round led by hedge fund giant Marshall Wace. In a Friday announcement, Lukka said it had completed a $110 million Series E funding round led by Marshall Wace, with participation from Soros Fund Management — a fund created by billionaire investor George Soros — Liberty City Ventures, S&P Global, and accounting advisor CPA.com. Lukka said it planned to use the funds for “aggressive growth and global expansion strategy” with its current customer base dealing…

Blockchain Data Startup Lukka Reaches $1.3B Valuation

Crypto asset software company Lukka has closed a Series E funding round of $110 million that pushed its valuation up over $1.3 billion. The round was led by global alternative asset manager Marshall Wace. The funds will go toward accelerating Lukka’s global expansion strategy. Source